Are you capable of transforming an unremarkable object into a thing of beauty? If so, you might find serious success as a crafter. Makinghandicrafts ...

Women tend to be bigger candle buyers than men, and homeowners buy more than renters.

We earn commissions if you shop through the links below. Read more

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on October 29, 2021

Updated on July 1, 2024

Investment range

$1,040 - $1,680

Revenue potential

$60,000 - $180,000 p.a.

Time to build

0 - 3 months

Profit potential

$30,000 - $72,000 p.a.

Industry trend

Growing

Commitment

Flexible

Here are the most important things to consider when you are opening a candle business:

You May Also Wonder:

How long do homemade candles last?

Homemade candles typically last for 12-15 months if stored in a cool, dry place. They burn approximately one hour for each inch of their length. The burn time can vary based on the materials and wicks used.

How do you ship candles?

Since candles can be fragile, it is best to package them in durable boxes and fill the interior with tissue paper or bubble wrap to cushion them during transit. For certain candles and climates, you may want to include frozen gel packets within the box to prevent any melting. See this guide from Paper Mart for some more tips and tricks on candle shipping.

Are scented and other specialty candles safe?

Yes, scented and unscented candles – using the appropriate materials – are safe for use. Both synthesized and natural scents have been widely tested and deemed safe. Wicks and wax sold by candle makers and suppliers are also safe, as they must be approved by the relevant regulatory agencies. For more info on candle safety, consult this comprehensive FAQ from the National Candle Association.

Do you need insurance to sell candles?

No, insurance is not required to sell candles in the US. However, many candle makers buy liability insurance to help shield against any potential legal action. Ultimately, candles deal with fire, so there always liability concerns for sellers. The Armatage Candle Company provides a useful guide on candle maker insurance.

Is candle making a profitable business?

Candle making can be a profitable business, but success depends on various factors such as market demand, product quality, pricing, marketing, and effective business management. If you sell online, you’ll have to spend some money on digital marketing to get traffic to your site.

Is a candle business hard?

Starting and running a candle business can have its challenges, including sourcing quality materials, developing unique scents and designs, managing inventory and production, marketing and competition, and maintaining consistent quality.

What type of candles sell best?

Some popular candle categories include scented candles, soy candles, natural or organic candles, decorative or artisanal candles, and seasonal or themed candles.

Can I use essential oils in candles?

Yes, you can use essential oils in candles to add natural fragrance. It’s important to choose oils suitable for candle making and to adhere to guidelines for safe use. Typically, essential oils should make up about 5-10% of the total wax weight.

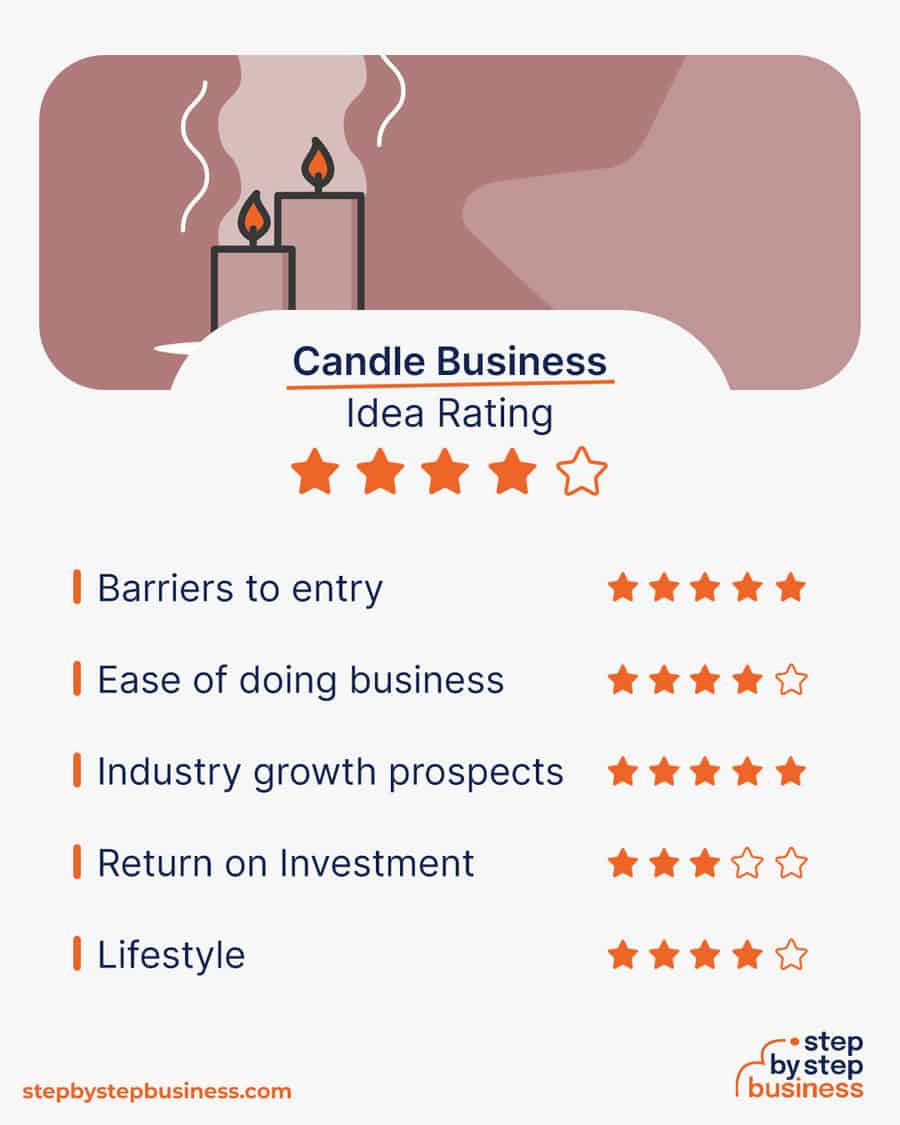

Every business has its pros and cons, and it’s a good idea to weigh these factors to decide if starting a candle business is a good fit.

Increased demand for home decor products has helped expand and broaden the candle-making market in recent years. Today’s custom-made marketplace offers innovative scents, multiple colors, organic ingredients, and a wide variety of shapes and sizes. One inventive maker even sells a candle shaped like a hand, with wicks on the end of each finger! The price? A cool $65.((https://www.uncommongoods.com/product/light-my-fingers-candle))

These days, pumpkin candles do well in the fall, peppermint in winter, and citrus in the summer. The candle industry has grown alongside the spa and yoga studio market.

Trends

Challenges

The startup costs for a candle business depend almost entirely on your starting inventory, which is the largest cost. In general, to get you started in a modest capacity, startup costs will range from about $1,000 to nearly $1,700.

You will need several different items to launch your candle business, including special equipment you’ll need to purchase. Websites like Candle Science, Candles and Supplies, and CandleWic offer a comprehensive selection of candle-making equipment. Here is a list to get you started:

| Start-up Costs | Ballpark Range | Average |

|---|---|---|

| Equipment | $90–$110 | $100 |

| Initial inventory and supplies | $360–$440 | $400 |

| Labels and shipping costs | $80–$100 | $90 |

| Licenses and permits | $110–$130 | $120 |

| Insurance | $200–$400 | $300 |

| Website | $100–$300 | $200 |

| Signage | $100–$200 | $150 |

| Total | $1,040–$1,680 | $1,360 |

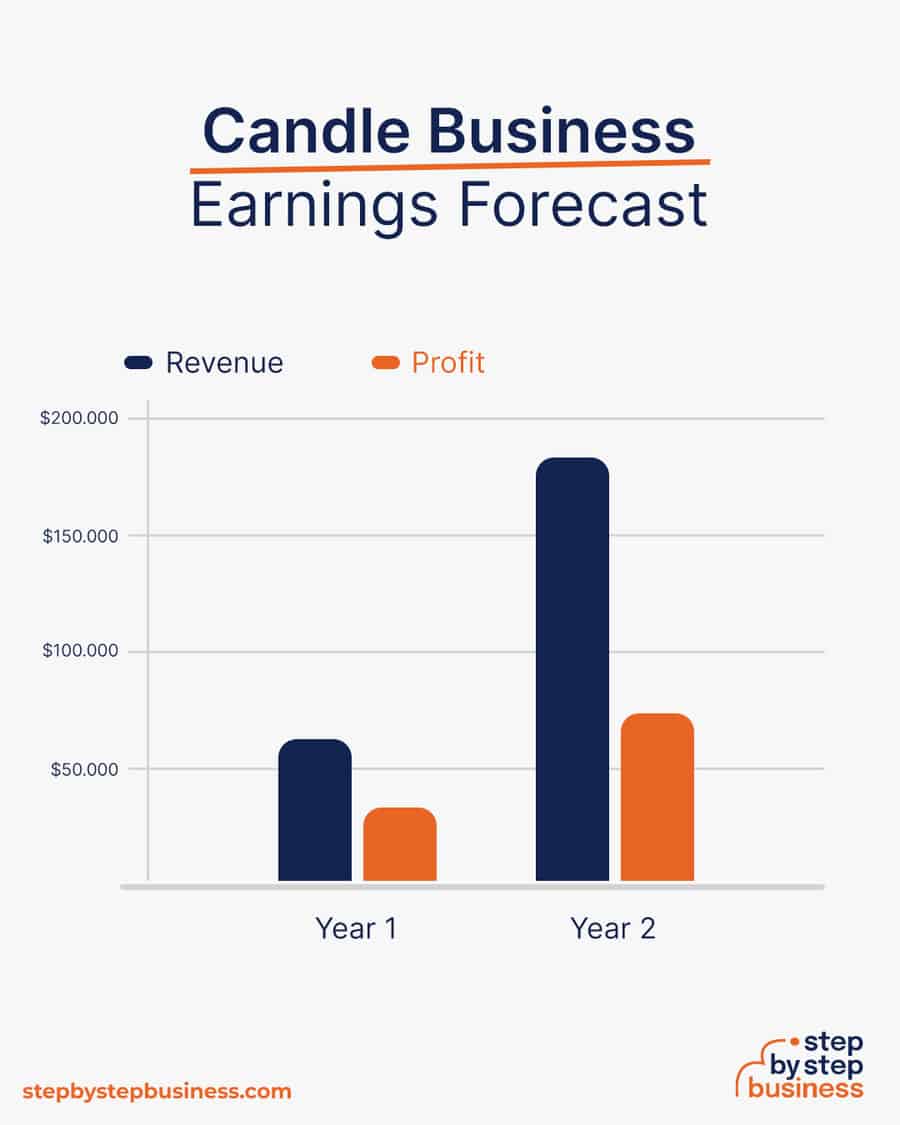

Candles can be made for a relatively low cost and sold at a high margin, from 30% all the way to 75% in net margin. The total potential earnings for a candle business depend on your level of production. For example, if you’re selling candles at $10 each and they cost you $5 to make, then you make $5 for each sale and your gross profit margin is 50%.

In your first year or two, you could work from home and sell 500 candles a month, bringing in $60,000 in annual revenue. This would mean $30,000 in profit, assuming that 50% margin. As your brand gains recognition, sales could climb to 1,500 candles a month. At this stage, you’d rent a storefront and hire staff, reducing your profit margin to around 40%. With an annual revenue of $180,000, you’d make a tidy profit of $72,000.

Candleers, a candle-making advisory, estimates that the average candle maker earns $50,000 per year, with the bottom 10% making less than $25,000 and the top 10% checking in at more than $100,000. Simply put, annual earnings will depend on how many candles you are selling and at what price point you are selling them.

Ultimately, your candle business’ earnings will be heavily dependent on the cost of inventory and the cost of making the candles. Your per candle price should be determined by your costs and how much you hope to earn from each sale. Candle-making has relatively low fixed costs, so this ratio will be among the most important aspects of your business.

To find the right price, research the prices of your closest competition.

Now that you know what’s involved in starting a candle business, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

The first thing an aspiring candle business owner should do is assess their skills and knowledge about candles in relation to the larger market. You can find good opportunities with some simple research into the most popular candles and their makers. Try to answer questions like: What are the most popular candle websites and what are their bestselling products? Which price points are most appealing? At which cost could you produce the same candles, and what materials would you need to do so?

Your business brand will be determined as a result of your research and the market opportunity you choose to target with your candle creations. You might go in for wildly shaped or exotically scented niche-market candles, or go for a mass market product. The choice is entirely up to you!

Make a list of all of the candles you might like to make. Some of the popular candle types, each appealing to different segments of buyers, include but are not limited to:

Each candle could require different ingredients and a different process of creation. You should consider which type of candles you’d like to define your brand. This will determine your material needs, production schedule, and marketing.

Most homemade candles you’ll find online are priced in the $15 to $30 range. Specialty candles that provide a special scent or artistic design will of course be more expensive than straightforward candles of traditional shape and size.

You should price your candles based on your costs and your profit expectations informed by market norms. It’s best to do a good deal of market research before settling on your price points.

Once you know your costs, you can use our profit margin calculator to determine your markup and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

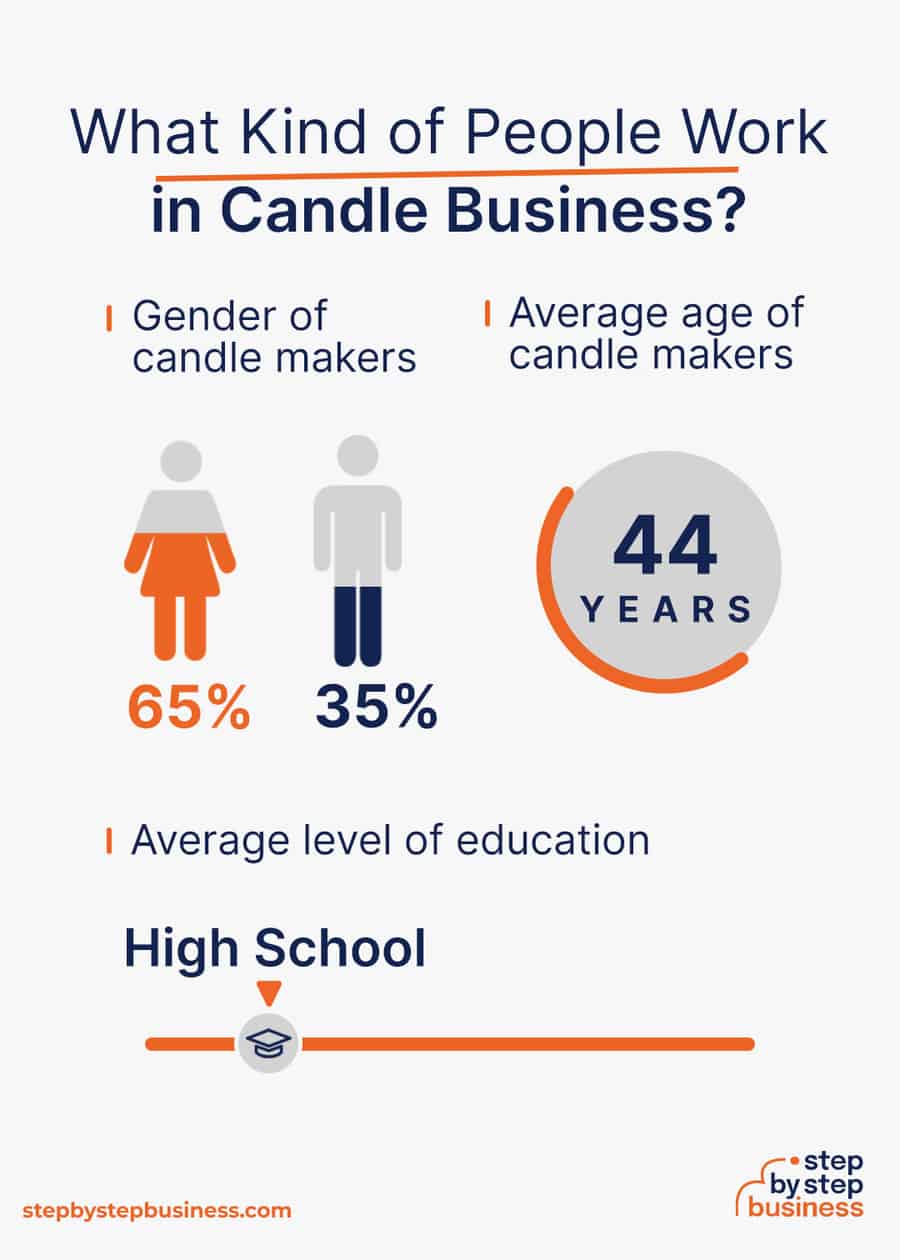

Different candle types will be popular for different market segments, and at different times of the year. As noted above, citrus and fruit-scented candles will be popular in the warmer months, while mint-scented candles will do better in winter.

Women tend to be bigger candle buyers than men, and homeowners buy more than renters.

Spas and yoga centers, restaurants, retailers, and other small businesses that rely on candles to create a certain ambiance will also be in your target market.

Depending on the type of candle you produce, some will meet the desires of a specific customer – such as eco-friendly, vegan candles, or highly decorative candles. And keep in mind, the more original and exotic your niche, the more you may be able to charge!

In the early stages, you may want to run your business from home to keep costs low. But as your business grows, you’ll likely need to hire workers for various roles and may need to rent out a storefront. You can find commercial space to rent in your area on sites such as Craigslist, Crexi, and Instant Offices.

When choosing a commercial space, you may want to follow these rules of thumb:

Here are some ideas for brainstorming your business name:

Discover over 410 unique candle business name ideas here. If you want your business name to include specific keywords, you can also use our candle business name generator. Just type in a few keywords, hit Generate, and you’ll have dozens of suggestions at your fingertips.

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. Once you pick your company name and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Here are the key components of a business plan:

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Registering your business is an absolutely crucial step — a prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s done, you have your own business!

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you are planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to candle making.

If you’re willing to move, you could really maximize your business! Keep in mind that it’s relatively easy to transfer your business to another state.

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your candle business will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization, and answer any questions you might have.

Choose Your State

The final step before you’re able to pay taxes is getting an Employer Identification Number or EIN. You can file for your EIN online, by mail, or by fax. Visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate on a calendar year (January–December), or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist, and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you are completing them correctly.

Securing financing is your next step and there are plenty of ways to raise capital:

Bank and SBA loans are probably the best options, other than friends and family, for funding a candle business. You might also try crowdfunding if you have an innovative concept.

Starting a candle business requires obtaining a number of licenses and permits from local, state, and federal governments.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration (OSHA), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package. They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account.

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your candle business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use industry-specific software, such as Craftybase to track material and product stock, log expenses, and update pricing. You can also use NetSuite Commerce to manage your online and in-store transactions.

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using website builders. This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech savvy, you can hire a web designer or developer to create a custom website for your business.

However, people are unlikely to find your website unless you follow Search Engine Optimization (SEO) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Here are some powerful marketing strategies for your future business:

Unique selling propositions, or USPs, are the characteristics of a product or service that set it apart from the competition. Customers today are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your candle business meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your candle business could be:

You may not like to network or use personal connections for business gain but your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a candle business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been making candles for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in candles. You’ll probably generate new customers or find companies with which you could establish a partnership. Online businesses might also consider affiliate marketing as a way to build relationships with potential partners and boost business.

You may not need any employees if you are starting out small from a home-based office. But as your business grows, you will likely need workers to fill various job roles. The potential employees for a candle business include:

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed, Glassdoor, or ZipRecruiter. Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Scented candles are widely thought to melt stress, induce or improve sleep, provide therapeutic care, and more. That’s why candle making is a nearly $3 billion market in the US and remains one of the top business ideas globally. Now that you have all the information you need to start a candle business, it’s time to take the first step in your entrepreneurial journey.

If you do proper research to better understand what your target market needs and craft a brilliant marketing strategy, you can light your way to success and start making a great profit!

Published on June 30, 2022

Are you capable of transforming an unremarkable object into a thing of beauty? If so, you might find serious success as a crafter. Makinghandicrafts ...

Read Now

Published on June 30, 2022

Want to express your creativity and be your own boss? There are many creative business ideas out there that can help you check both boxes, and makeg ...

Read Now

No thanks, I don't want to stay up to date on industry trends and news.

Comments