Seeking low-cost, high-profit business ideas for 2024, we’ve gathered insights from CEOs and founders who have a track record of turninginnova ...

For a candy making business, you can target B2B and B2C prospects.

We earn commissions if you shop through the links below. Read more

Written by: Howard Tillerman

Howard Tillerman is the Chief Marketing Officer for Step By Step Business and an award-winning marketing professional.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on October 13, 2021

Investment range

$2,000 -$8,000

Revenue potential

$30,000 - $480,000 p.a.

Time to build

0 - 3 months

Profit potential

$24,000 - $96,000 p.a.

Industry trend

Steady

Commitment

Flexible

Here are the most important aspects to consider when starting a candy business:

Start by determining if starting a candy making is a good idea in the first place. At this point, you’ll want to know the following:

Gauging the downsides of a candy business will enable you to know the challenges you’re likely to encounter. Evaluating the upsides of the business will provide the motivation you need to start.

Below are the pros and cons of making candy:

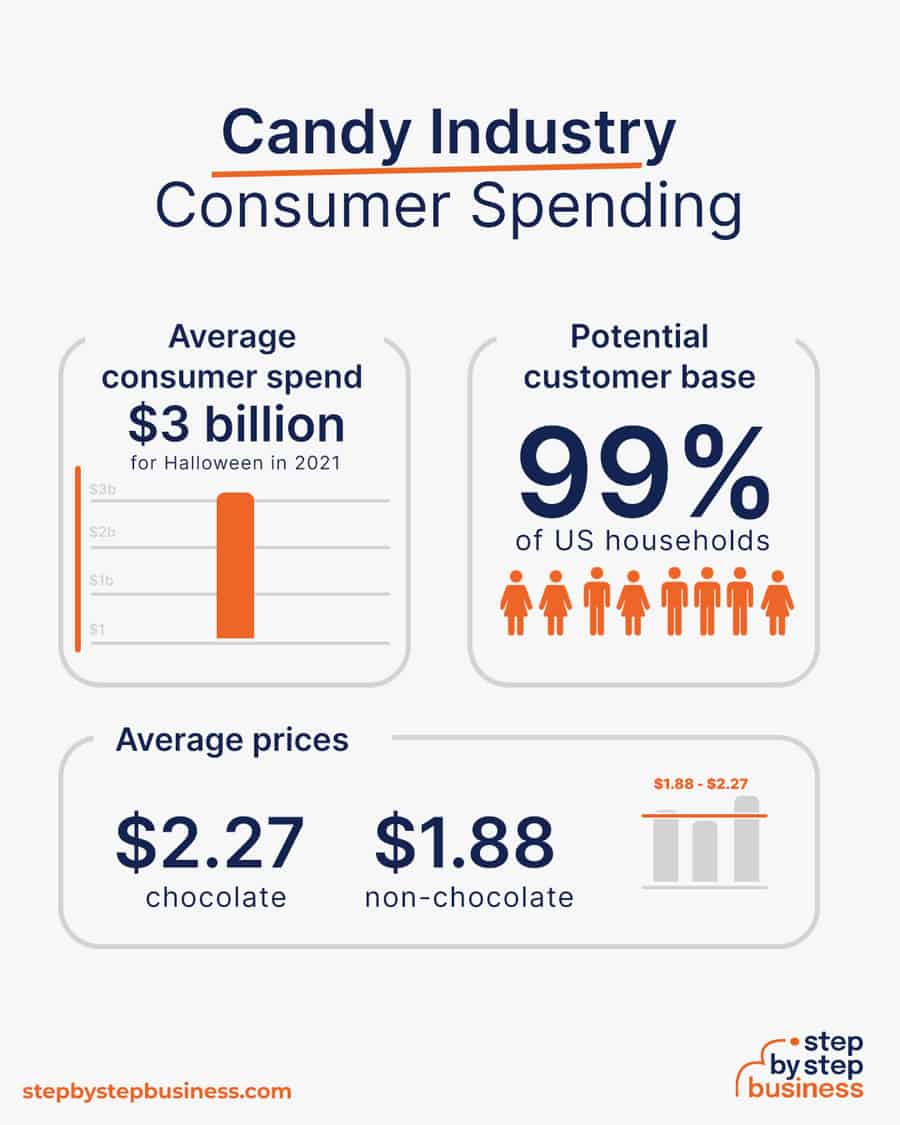

The National Trade Federation says 73% of the US population was expected to participate in Halloween activities in 2023, and 68% planned on handing out candy.((https://nrf.com/media-center/press-releases/halloween-spending-reach-record-122-billion-participation-exceeds-pre))

Trends

Challenges

It costs $2,000 to $8,000 to start a candy business. However, most startups in this industry spend about $5,000.

Most of the initial capital goes toward marketing, creating your online footprint, and buying equipment.

On the lower end, the capital is enough to enable you to create a basic website and launch a local marketing campaign to generate leads. On the higher end, you can create a full-blown ecommerce website and launch an online and local marketing campaign.

You don’t need a lot of equipment to start a candy business. However, you must have basic office equipment like chairs, a laptop, a table, and a telephone. Also, you will need the following equipment for candy production.

| Start-up Costs | Ballpark Range | Average |

|---|---|---|

| Licenses and permits | $300–$1,200 | $750 |

| Insurance | $125–$300 | $213 |

| Marketing and advertising | $500–$3,000 | $1,750 |

| Website | $200–$1,500 | $850 |

| Software | $200–$400 | $300 |

| Equipment | $500–$1,300 | $900 |

| Raw materials | $100–$200 | $150 |

| Miscellaneous | $75–$100 | $87 |

| Total | $2,000–$8,000 | $5,000 |

Candy was sold for $2.27 each for chocolate and $1.88 each for non-chocolate in 2019, or an average of $2 per unit. We’ll take these prices as the basis for our calculations.

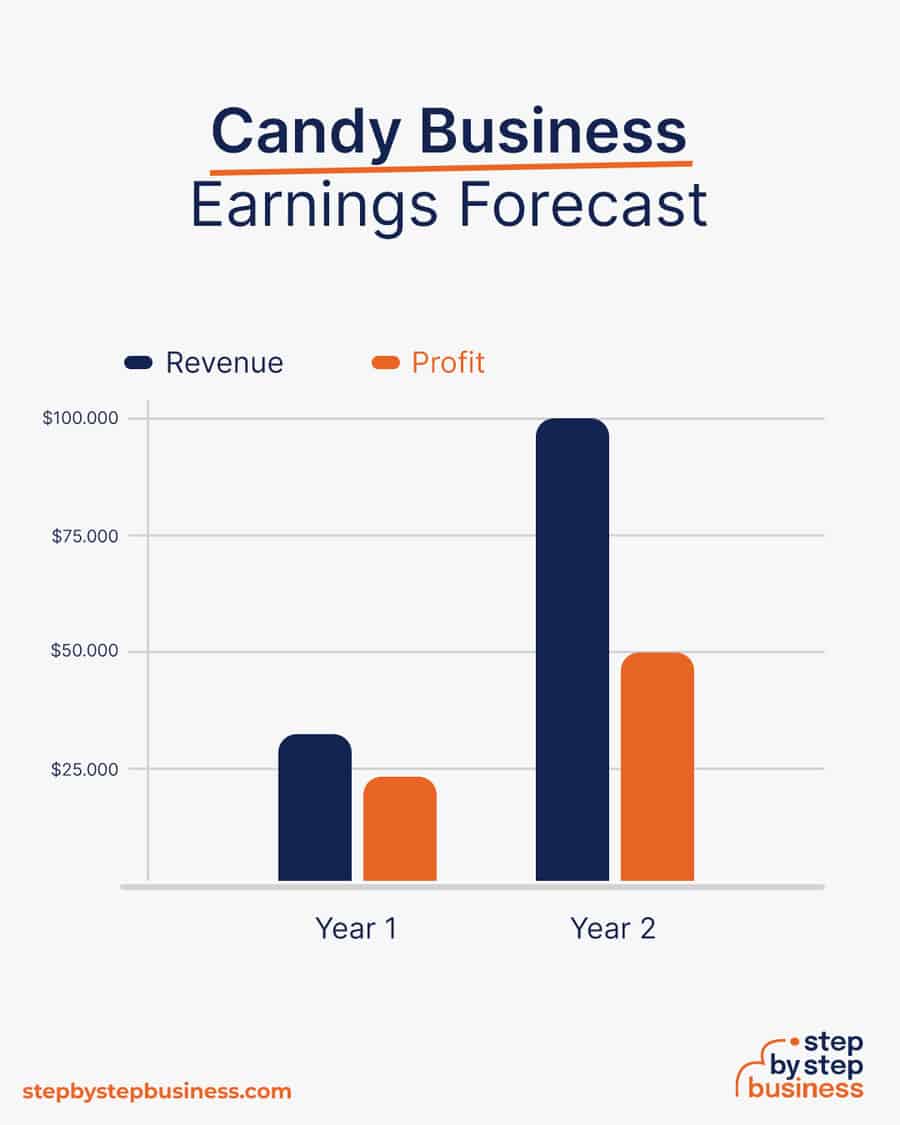

If you’re a sole proprietor, you could work from home in your first year or two. Assuming you make 15,000 chocolate and non-chocolate candies in a year, you could bring in $30,000 in annual revenue and $24,000 in profit, assuming an 80% margin.

As your brand gains recognition, your production could climb to 50,000 units a year. At this stage, you’d rent a commercial space and hire a couple of staff, reducing your profit margin to around 50%. With an annual revenue of $100,000, you’d make a tidy profit of $50,000.

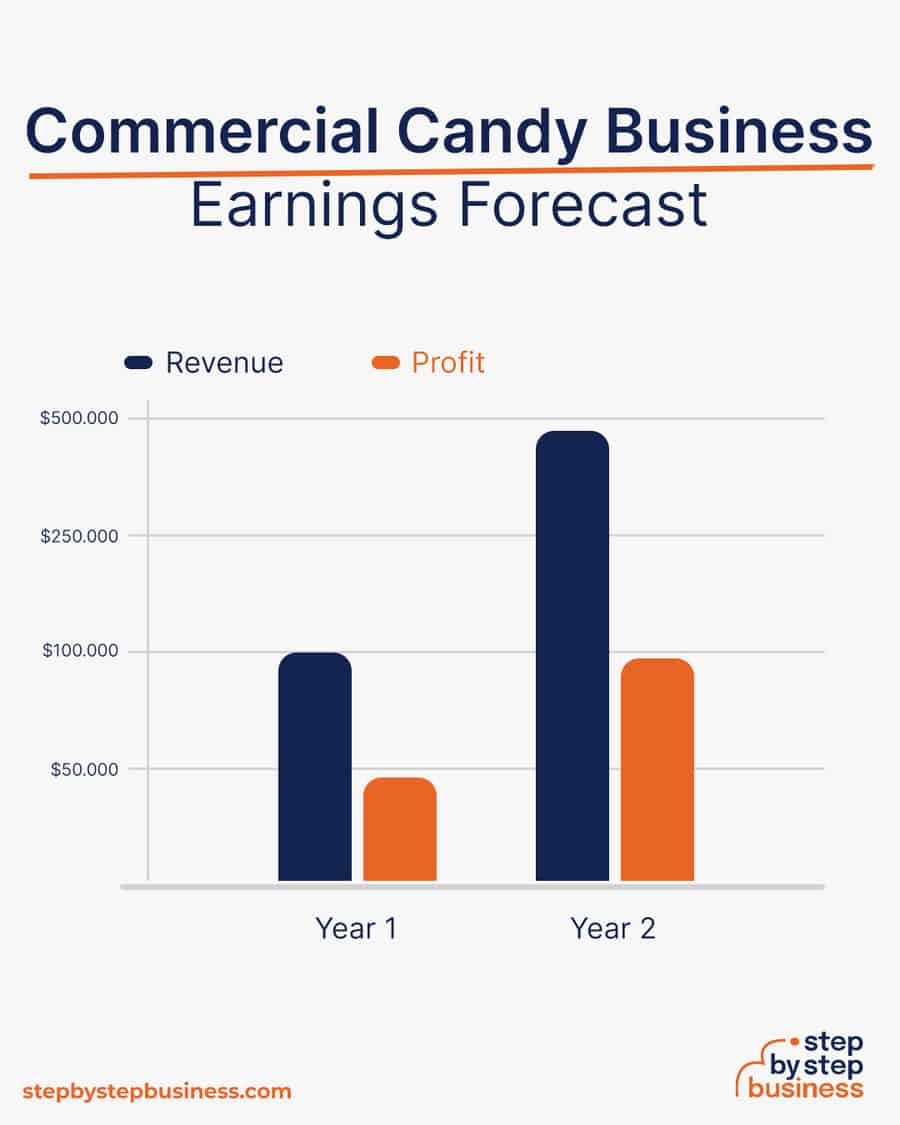

If you start your business from a commercial facility with three employees, you could make 60,000 chocolate and non-chocolate candies in your first year or two. You could sell these at wholesale and retail prices, with a profit margin of around 40%. With annual revenue of roughly $100,000, you could make a profit of nearly $50,000.

As your brand gains recognition, you could ramp up production to 20,000 units per month, or 240,000 units a year. At this stage, you’d rent a bigger commercial space and hire more staff, reducing your profit margin to around 20%. With an annual revenue of almost $480,000, you’d make a tidy profit of $96,000.

The biggest barriers to entry for a candy-making business are the strict legal and regulatory requirements at the state and federal levels.

You’ll need to get a food permit from your state and have your packaging approved by the FDA.

Also, you must register your production facility as required by the FDA. On top of that, you’ll need to obtain several permits and licenses. You can read more about these requirements on the FDA’s website.

Other barriers to entry include:

Now that you know what’s involved in starting a candy business, it’s a good idea to hone your concept in preparation to enter a competitive market.

The insights can help you create an offering that suits your market segment needs and place you on the right path to winning your first paying customer.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

You can identify a business opportunity to sell candies in your area by narrowing down on local market research. You can understand local consumers by studying their buying behavior and interest in candy.

You will be selling your candies to supermarkets, local convenience stores, and specialty food stores. You shall, therefore, visit these places and gather their input.

While you’re at it, research the best-selling candies to understand what makes them stand out. Also, find out about your competition to help you figure out what you’re up against.

Other strategies you can use to identify an opportunity include analyzing big companies and their products and drawing a parallel between two major competitors to understand what they share and how you can be different.

Candies come in a variety of textures, from soft to chewy, brittle, and hard. They are also available in different sizes.

Deciding the type of candies you want to sell is essential because, by extension, it enables you to define your target market.

Some popular candy options in the United States include caramels, brittle, chocolate, gumdrops, jelly tots, hard candies, licorice, lollipops, sours, chewing gums, Skittles, toffee, and cotton candy.

Candy prices vary depending on the size and type. The average price of chocolate candy was $2.8 in 2023, and the candy overall cost about $2.5 per unit.

Pinpointing your target market enables you to concentrate on the market segment that’s likely to purchase your candies. It also allows you to allocate your marketing budget to prospects with the highest profit potential.

For a candy making business, you can target B2B and B2C prospects.

B2B customers include convenience stores, hypermarkets, supermarkets, specialty food stores, bakeries, candy distributors, and online candy stores. B2C prospects are your neighbors and other local residents. Further, you can partner with wedding planners, event organizers, florists, and bridal shops to hook you up with customers who may want to buy candy to be eaten during celebrations and festivals.

In the early stages, you may want to run your business from home to keep costs low. But as your business grows, you’ll likely need to hire workers for various roles and may need to rent out a physical storefront. You can find commercial space to rent in your area on sites such as Craigslist, Crexi, and Instant Offices.

When choosing a commercial space, you may want to follow these rules of thumb:

Here are some ideas for brainstorming your business name:

Discover over 380 unique candy business name ideas here. If you want your business name to include specific keywords, you can also use our candy business name generator. Just type in a few keywords, hit Generate, and you’ll have dozens of suggestions at your fingertips.

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool below. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that set your business apart. Once you pick your company name and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Here are the key components of a business plan:

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you are planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to candy making.

If you’re willing to move, you could really maximize your business! Keep in mind that it’s relatively easy to transfer your business to another state.

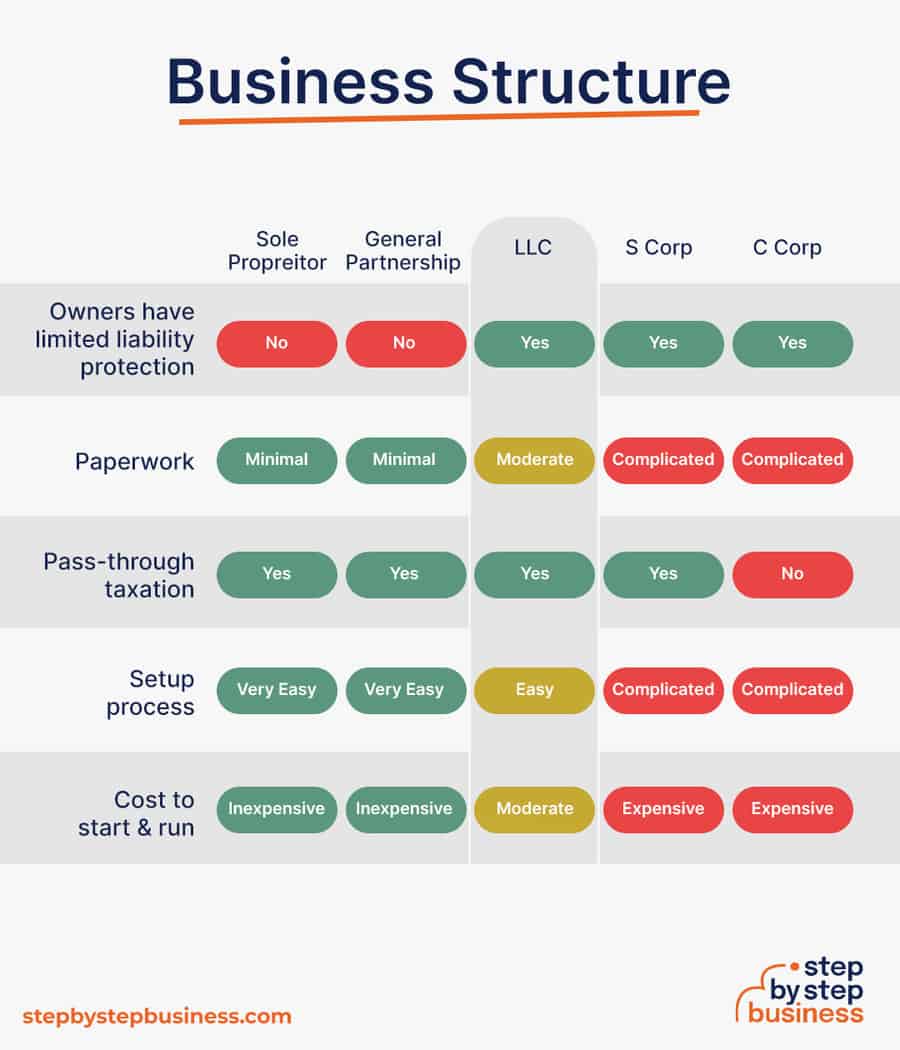

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your candy business will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization, and answer any questions you might have.

Choose Your State

The final step before you’re able to pay taxes is getting an Employer Identification Number or EIN. You can file for your EIN online, by mail, or by fax. Visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship, you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist, and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you are completing them correctly.

Securing financing is your next step and there are plenty of ways to raise capital:

Bank and SBA loans are probably the best options, other than friends and family, for funding a candy business. You might also try crowdfunding if you have an innovative concept.

Starting a candy business requires obtaining a number of licenses and permits from local, state, and federal governments.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration (OSHA), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

Your business will be subject to FDA regulations.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package. They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account.

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your candy shop as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may need to invest in Enterprise Resource Planning (ERP) software, such as CSB System, Aptean, BatchMaster, and Deacom to manage your records and distribution, track expenses, schedule production, and more.

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using website builders. This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech savvy, you can hire a web designer or developer to create a custom website for your business.

However, people are unlikely to find your website unless you follow Search Engine Optimization (SEO) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Here are some powerful marketing strategies for your future business:

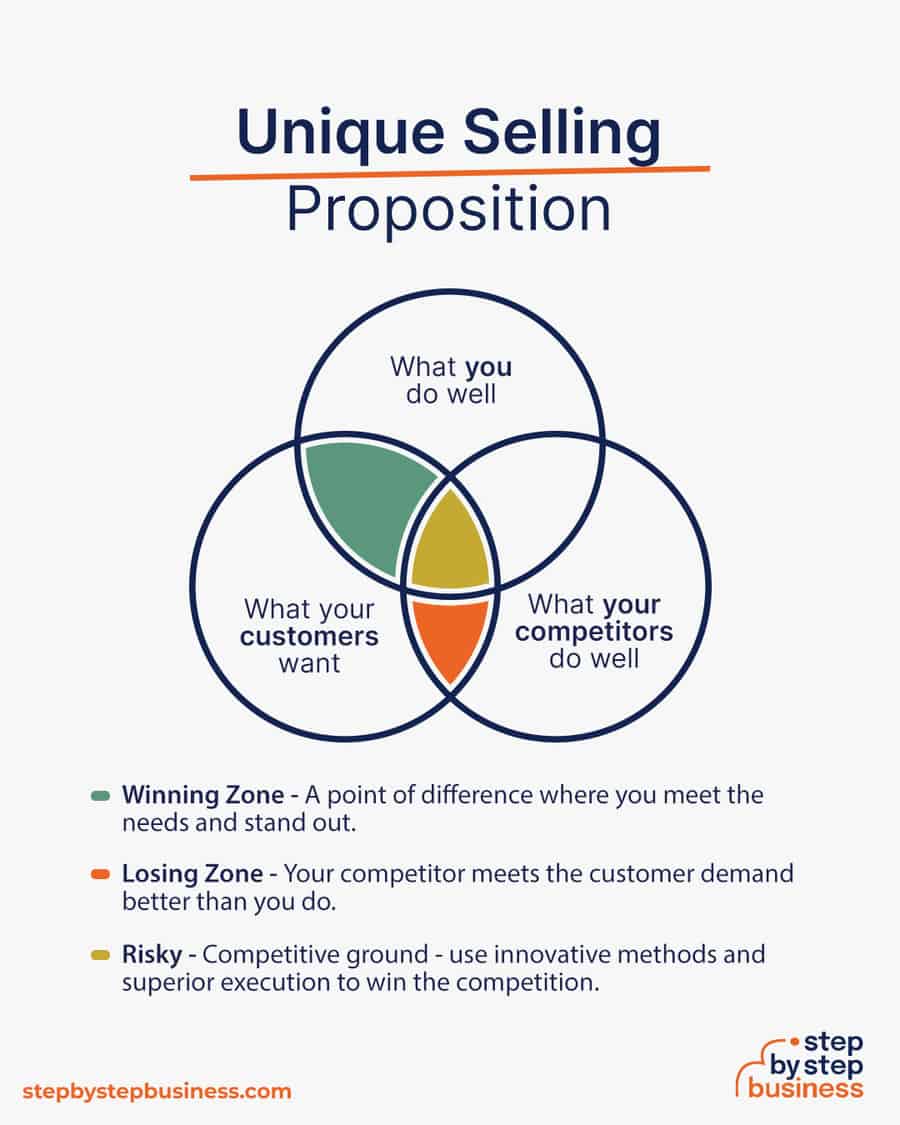

Unique selling propositions, or USPs, are the characteristics of a product or service that set it apart from the competition. Today, customers are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your products meet their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your candy business could be:

You may not like to network or use personal connections for business gain, but your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a candy making business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in a candy factory for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in candies. You’ll probably generate new customers or find companies with which you could establish a partnership. Online businesses might also consider affiliate marketing as a way to build relationships with potential partners and boost business.

You can run your candy business alone during the early startup days. However, as your operations intensify, you’ll need to hire employees, including:

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed, Glassdoor, or ZipRecruiter. Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Once you start production, you can try to attract prospective B2B clients and retail customers by giving out free samples of your products. Or, you can give free samples ahead of festivities such as Halloween and Easter.

Remember to maintain a strong online presence, especially on social media. You can slash marketing costs by promoting your products through your social media posts. It’s a good idea to post regularly and to always include a great photo or engaging video clip that will trigger impulse purchases.

It’s all systems go! Your candy making business is now ready to start generating some revenue.

Yes, primarily due to the high demand for candy. According to statistics, Americans spent about $25 per year on candies a couple of decades ago. Now, they spend $25 for Halloween alone! That’s exceptional demand right there!

To create a unique brand identity for your candy business, identify your target audience and differentiate your products. Develop a clear brand voice and visuals, and use social media to connect with customers. Collaborate with influencers, host events, and partner with other brands. Prioritize high-quality products and excellent customer service to build loyalty and enhance your brand.

Selling homemade candy isn’t illegal in the United States. However, you must comply with the state and federal licenses and permits requirements. Check with your state for specific regulations. Also, you’ll need to abide by FDA’s requirements for food businesses.

No, it’s not illegal to resell candy. You’re at liberty to do whatever you want with your candy once you’ve bought it from a retailer or wholesaler. However, rebranding or relabeling candy is illegal unless you have the manufacturer’s consent.

Yes, they do. Candy shops generate revenue by buying stock from manufacturers at a competitive price and reselling it to consumers at a profit. What’s more, candy shops adopt a relatively simple business model. As a result, they don’t incur high labor or production costs, further improving their bottom line.

Published on August 26, 2022

Seeking low-cost, high-profit business ideas for 2024, we’ve gathered insights from CEOs and founders who have a track record of turninginnova ...

Read Now

Published on June 30, 2022

People are always eating and drinking, so starting a food business is always a potentially wise career choice. But to succeed you’ll need astr ...

Read Now

No thanks, I don't want to stay up to date on industry trends and news.

Comments