Here are the most important factors to consider when starting a bank:

- Licensing — You will need many licenses and approvals to start a bank. The primary one is the Banking License. Next, you will need to apply for regulatory approval from a central bank. In addition, banks must comply with AML and KYC regulations to prevent financial crimes.

- ATMs and Branches — If your bank plans to open branches or install ATMs, depending on local laws, additional permissions may be required for each location.

- Capital — Regulators will require that you maintain certain levels of capital to cover potential losses. These requirements can be quite high and are meant to ensure the bank’s stability and solvency.

- Insurance — In many jurisdictions, banks are required to insure deposits up to a certain amount. This insurance protects depositors in the event of a bank failure.

- Location — Find a location that’s in a busy commercial area or business district.

- Security — Invest in high-quality physical security such as alarm systems, surveillance cameras, secure vaults, and secure doors. In addition, consider robust cybersecurity measures to protect sensitive data such as encryption, storage solutions, and strict access controls.

- Register your business — Banks are typically corporations — they cannot be formed as LLCs by law.

- Legal business aspects — Register for taxes, open a business bank account, and get an EIN.

Interactive Checklist at your fingertips—begin your bank today!

Download Now

Step 1. Is Starting a Bank the Right Move for You?

Pros and Cons

Starting a bank has pros and cons to consider before deciding if it’s right for you.

Pros

- Provide value — Crucial financial services for your community

- Large market — Most people rely on banks

- Good money — Banks are big money makers

Cons

- Large investment — Millions in starting capital required

- Highly regulated — Banking is the most regulated industry in the US

Bank Industry Trends

Industry Size and Growth

Trends and Challenges

Trends

- Digital banking is the way of the future, with major banks competing to have the best apps, websites, and digital services, like instant payments.

- Technologies such as Robotic Process Automation and machine learning are helping banks replace manual workflows with cost-efficient, lightning-fast operations.

Challenges

- For small banks, keeping up with technology to compete with major banks can be expensive.

- Regulations on banks — already the country’s most regulated industry — are continuing to tighten, creating new expenses and operational challenges.

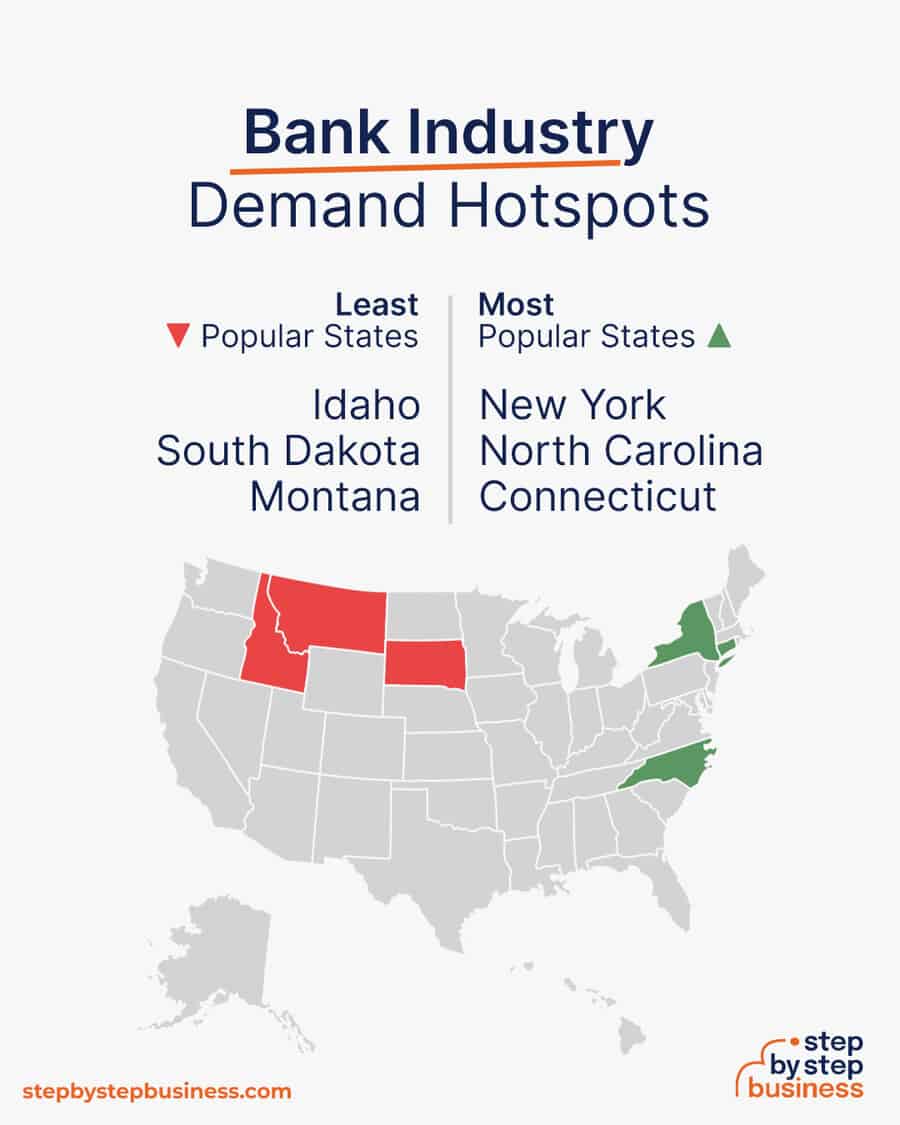

Demand Hotspots

- Most popular states — The most popular states for bank managers are New York, California, and Washington.

- Least popular states — The least popular states for bank managers are Nebraska, Wyoming, and North Dakota.((https://www.zippia.com/bank-manager-jobs/best-states/))

What Kind of People Work in Banks?

- Gender — 51.1% of bank managers are female, while 48.9% are male.

- Average level of education — The average bank manager has a bachelor’s degree.

- Average age — The average bank manager in the US is 45.8 years old.((https://www.zippia.com/bank-manager-jobs/demographics/))

How Much Does It Cost to Start a Bank Business?

Startup costs for a bank range from $13 million to $28 million, with the biggest expense being the startup capital required to meet federal regulations. If you start a digital rather than a physical bank, you could save up to $4 million.

You will need to apply for licenses and insurance with the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC), which is often a laborious process.

You’ll need a handful of items to successfully launch your bank business, including:

- Computer system

- Printers, money counters, other office equipment

- Security system

- Furnishings

| Start-up Costs | Ballpark Range | Average |

| Setting up a business name and corporation | $150–$200 | $175 |

| Business licenses and permits | $10,000–$20,000 | $15,000 |

| Insurance | $25,000–$50,000 | $37,500 |

| Website and app development | $100,000–$150,000 | $125,000 |

| Land plus bank construction | $1,000,000–$4,000,000 | $2,500,000 |

| Computer system | $30,000–$50,000 | $40,000 |

| Starting capital to meet regulations | $12,000,000–$24,000,000 | $18,000,000 |

| Labor and operating budget | $200,000–$400,000 | $300,000 |

| Bank furnishings and equipment | $20,000–$40,000 | $30,000 |

| Total | $13,385,150–$28,710,200 | $21,047,675 |

How Much Can You Earn From a Bank Business?

Banks make money from fees and from the interest on loans that they make. The profit margin of a bank is typically about 10%.

In your first year or two, you might get 10,000 customers and make $100,000 in fees per month and $500,000 in interest, bringing in $7,200,000 in annual revenue. This would mean $720,000 in profit, assuming that 10% margin. As you build your customer base, those numbers might increase tenfold. With annual revenue of $72,000,000, you’d make an outstanding profit of $7.2 million.

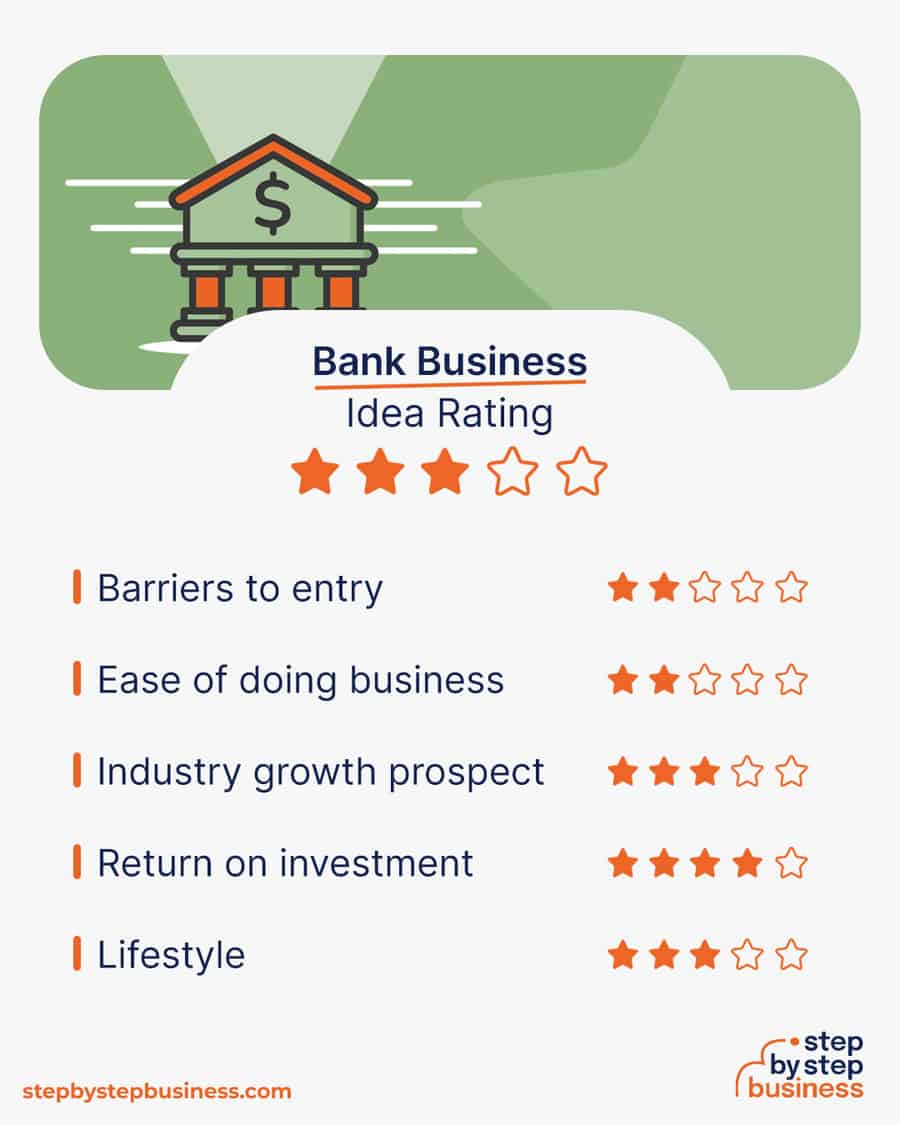

What Barriers to Entry Are There?

There are a few barriers to entry for a bank. Your biggest challenges will be:

- A large amount of initial capital

- Understanding the complex administrative processes

- Navigating the regulatory environment

2. Define Your Banking Model and Services

Now that you know what’s involved in starting a bank, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an Opportunity

Research banks in your area to examine their products and services, price points, and customer reviews. You’re looking for a market gap to fill. For instance, maybe the local market is missing a community bank that offers free checking accounts or an online bank that offers money market accounts.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as savings accounts and mortgage loans, or business accounts and loans.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Determine Your Financial Products and Services

Banks offer a variety of products and services, including:

How Much Should You Charge for Bank Services?

Account fees can range from $5 to $15 per month. Banks also charge fees for overdrafts, ATMs, and other services. Loan rates will be dictated by the current market environment. The profit margin for banks is generally about 10%.

Once you know your costs, you can use our profit margin calculator to determine your markup and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify Your Target Market

Your target market will be basically anyone. You should spread out your marketing to include TikTok, Instagram, Facebook, and LinkedIn.

Where? Choose Your Bank Location

Selecting the right location for your bank is crucial for its success. Look for a location in a high-traffic area, preferably in a commercial district or near other financial institutions. You can find commercial space to rent in your area on sites such as Craigslist, Crexi, and Instant Offices.

Consider the accessibility and convenience for clients, with easy access to parking and public transportation. Additionally, you should analyze the demographics of the surrounding area to ensure there is a demand for banking services.

By choosing a strategic location, you can position your bank to attract a wide range of customers and establish a strong presence in the financial industry.

3. Choose a Strong and Trustworthy Name

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “bank” or “community bank,” boosts SEO

- Name should allow for expansion, for example, “Peak Performance Bank” over “Student Loan Bank”

- A location-based name can help establish a strong connection with your local community and help with the SEO but might hinder future expansion

Discover over 290 unique bank business name ideas here. If you want your business name to include specific keywords, you can also use our bank business name generator. Just type in a few keywords, hit Generate, and you’ll have dozens of suggestions at your fingertips.

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool below. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. However, once you start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

4. Create a Business Plan

Here are the key components of a business plan:

- Executive summary — A concise summary highlighting the key points of the business plan, including its mission, goals, and financial projections

- Business overview — An overview of the business, detailing its mission, vision, values, and the problem it aims to solve or the need it fulfills

- Product and services — A detailed description of the products and services offered by the business, emphasizing their unique selling points and value proposition

- Market analysis — A comprehensive analysis of the target market, including demographics, trends, and potential opportunities and challenges

- Competitive analysis — An assessment of the competitive landscape, identifying key competitors, their strengths and weaknesses, and the business’s competitive advantage

- Sales and marketing — A strategy outlining how the business plans to promote and sell its products or services, including pricing, distribution, and promotional activities

- Management team — A brief introduction to the key members of the management team, highlighting their relevant skills and experience

- Operations plan — An outline of the day-to-day operations of the business, covering processes, facilities, technology, and any other critical operational aspects

- Financial plan — A detailed financial forecast, including income statements, balance sheets, and cash flow projections, demonstrating the business’s financial viability and potential for profitability

- Appendix — Supplementary materials such as charts, graphs, and additional information that support and enhance the main components of the business plan

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

5. Register Your Bank

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose Where to Register Your Company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people register their business in the state where they live, but if you’re planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to banks.

If you’re willing to move, you could really maximize your business! Keep in mind that it’s relatively easy to transfer your business to another state.

Choose Your Business Structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your bank will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Banks are typically corporations — they cannot be formed as LLCs by law.

Here are your options:

- C Corporation — Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corporation — An S Corporation refers to the tax classification of the business but is not a business entity. It can be either a corporation or an LLC, which just needs to elect to be an S Corp for tax status. Here, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number or EIN. You can file for your EIN online or by mail/fax. Visit the IRS website to learn more.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

It is important to consult an accountant or other professional to help you with your taxes to ensure you’re completing them correctly.

7. Raise Capital and Secure Funding

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans — This is the most common method but getting approved requires a rock-solid business plan and a strong credit history.

- SBA-guaranteed loans — The Small Business Administration can act as a guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan.

- Government grants — A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Venture capital — Venture capital investors take an ownership stake in exchange for funds, so keep in mind that you’d be sacrificing some control over your business. This is generally only available for businesses with high growth potential.

- Angel investors — Reach out to your entire network in search of people interested in investing in early-stage startups in exchange for a stake. Established angel investors are always looking for good opportunities.

- Friends and family — Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Personal — Self-fund your business via your savings or the sale of property or other assets.

Your best bet to finance a bank is to seek out angel investors or venture capital. You’ll have to have an extremely detailed business plan and pitch when seeking the considerable amount of money that you need.

8. Obtain Licenses and Banking Permits

Starting a bank business requires obtaining a number of licenses and permits from local, state, and federal governments. You will need to apply for licenses and insurance with the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC).

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration (OSHA), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package. They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

9. Set Up Business Banking Infrastructure

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account.

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN, articles of incorporation, and other legal documents and open your new account.

10. Take Care of Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability — The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business property — Provides coverage for your equipment and supplies.

- Equipment breakdown insurance — Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation — Provides compensation to employees injured on the job.

- Property — Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto — Protection for your company-owned vehicle.

- Professional liability — Protects against claims from clients who say they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP) — This is an insurance plan that acts as an all-in-one insurance policy, a combination of the above insurance types.

You will also need FDIC insurance, and then you can use “member FDIC” in your marketing.

11. Build Your Digital and Physical Presence

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential Software and Tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use industry-specific software, such as Salesforce, FIS, or Alogent, to manage your operations, insurance, compliance, accounts, and financial processing.

Accounting

- Popular web-based accounting programs for smaller businesses include Quickbooks, FreshBooks, and Xero.

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences of filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop Your Website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using website builders. This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech savvy, you can hire a web designer or developer to create a custom website for your bank.

However, people are unlikely to find your website unless you follow Search Engine Optimization (SEO) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Marketing

Here are some powerful marketing strategies for your future bank:

- Local SEO — Regularly update your Google My Business and Yelp profiles to strengthen your local search presence.

- Social media financial education — Utilize platforms like LinkedIn to share financial insights and advice, establishing the bank as a thought leader.

- Digital advertising — Run targeted advertising campaigns for specific financial products and services to reach the right audience.

- Financial literacy campaigns — Distribute newsletters regularly with financial wellness tips and updates on banking products.

- Educational blog — Create content that provides guidance on financial trends, investment strategies, and saving tips.

- Webinars and live Q&As — Host online sessions that address customer financial concerns and recent market changes, enhancing engagement.

- Local sponsorships — Increase your community presence by sponsoring local events and sports teams.

- Financial workshops — Offer free financial planning workshops that cater to various life stages to educate and attract customers.

- Partnerships with local businesses — Collaborate with local businesses to offer banking benefits and host financial seminars.

- Personalized banking services — Provide tailored banking solutions based on customer data to enhance customer satisfaction.

- Rewards program — Develop a rewards program that incentivizes customers to use different banking services.

- Introductory offers — Launch promotions such as new account signup bonuses or reduced rates on loans for a limited time to attract new customers.

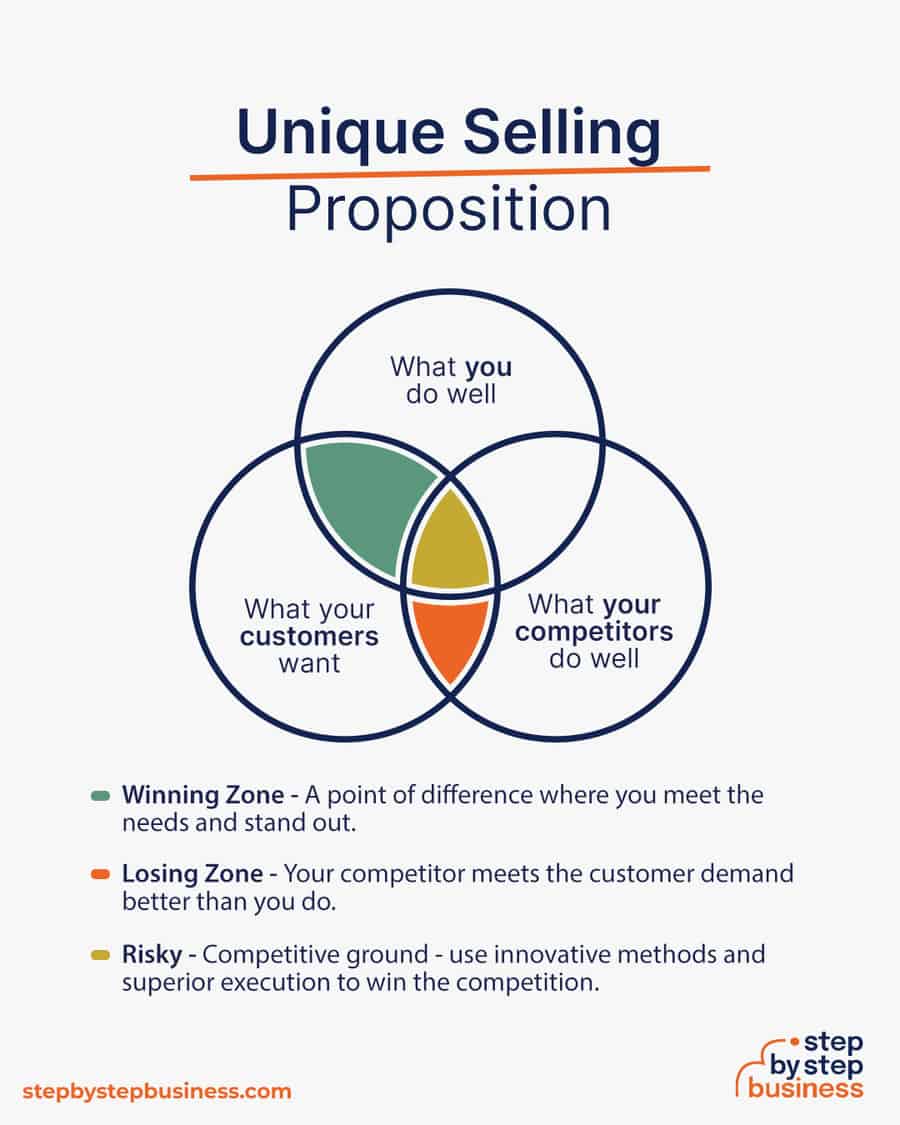

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that set it apart from the competition. Today, customers are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your bank meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your bank business could be:

- A welcoming community bank for all your financial needs

- Free checking accounts and the best loan rates in town

- Digital banking made easy

Networking

You may not like to network or use personal connections for business gain but your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a bank, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in banks for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in banks. You’ll probably generate new customers or find companies with which you could establish a partnership.

12. Assemble a Skilled and Trustworthy Team

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a bank business include:

- Bank tellers — handling bank transactions

- Personal bankers — opening accounts, taking loan applications

- Mortgage originators — taking mortgage loan applications

- Bank manager — scheduling, managing branch operations

- Operations manager — managing back-office functions

- Compliance officer — handling regulatory compliance

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed, Glassdoor, or ZipRecruiter. Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

13. Open Your Bank and Start Serving Clients!

Starting a bank takes time and money, and it’s a complicated business to run, but once you get it going, you can make a lot of money and serve your community. If you’re willing to do what it takes, you could even build your community bank into a national powerhouse!

Now that you understand what’s involved in the business, it’s time to find investors, get your bank up and running and start financing people’s dreams.

FAQs

How much does it cost to start a bank?

Startup costs for a bank range from $13 million to $28 million, with the biggest expense being the startup capital required to meet federal regulations. If you start a digital rather than a physical bank, you could save up to $4 million.

You will need to apply for licenses and insurance with the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC), which is often a laborious process.

You’ll need a handful of items to successfully launch your bank business, including:

- Computer system

- Printers, money counters, other office equipment

- Security system

- Furnishings

How much can I earn from a bank business?

Banks make money from fees and from the interest on loans that they make. The profit margin of a bank is typically about 10%.

In your first year or two, you might get 10,000 customers and make $100,000 in fees per month and $500,000 in interest, bringing in $7,200,000 in annual revenue. This would mean $720,000 in profit, assuming that 10% margin. As you build your customer base, those numbers might increase tenfold. With annual revenue of $72,000,000, you’d make an outstanding profit of $7.2 million.

How profitable are banks?

Banks are very profitable, considering that the U.S. banking industry is worth more than $860 billion. The key is to provide a variety of banking services and offer great customer service.

How do I build relationships with customers and attract deposits to my bank?

You’ll have to spend some time marketing to get the word out. Then, when customers come in, you’ll want them to receive personal service.

How do I develop a business plan for my bank?

A business plan is a detailed document that requires considerable time to develop. It includes various sections such as an executive summary, company overview, descriptions of your products and services, market analysis, competitor analysis, sales and marketing plan, management summary, operations plan, and financial projections.

How do I create a risk management plan for my bank?

A risk management plan for a bank is very complex. Your best bet is to hire an experienced banking consultant to help you. It will be worth the cost.

What is the difference between a commercial bank and a community bank?

Commercial banks generally operate nationally and are subject to federal multi-state banking regulations. Community banks only operate in one state or locality.

Comments