If you’re starting an LLC, the business entity formation process is one of the first and most important hurdles. This step can be terribly complex ...

What is a Resale Certificate and How to Apply for It

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on December 30, 2021

If you’re starting a business, you’ll likely need various licenses and permits. This may include a resale certificate, also known as a tax exemption certificate. A resale certificate allows you, as a business owner in the United States, to purchase goods for resale without having to pay sales tax.

How a Resale Certificate Works

With a valid resale certificate, you can buy goods from a wholesaler without paying sales tax, though you may pay a use tax. But keep in mind that if you do this, it is your responsibility to collect sales tax for the items when you sell them. You then pay the sales tax to the state on a quarterly basis. You need a separate state resale certificate, which is sometimes known as a resale license, for every seller you purchase goods from.

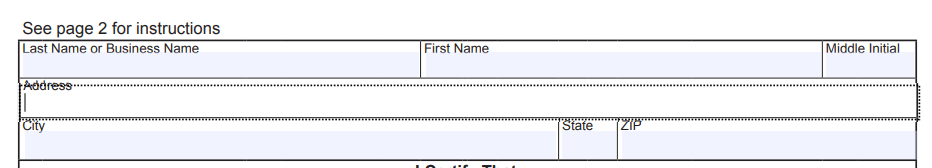

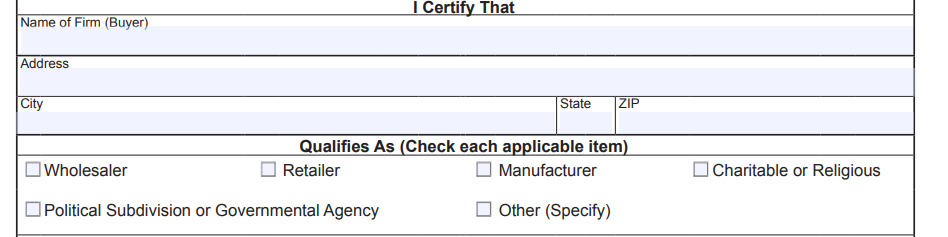

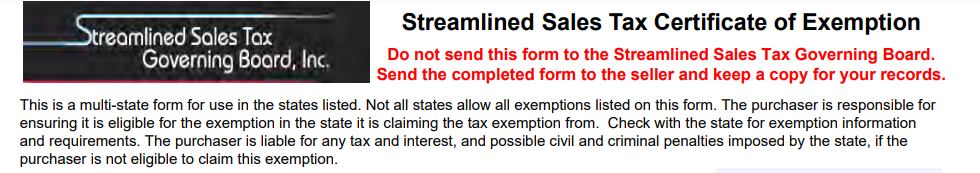

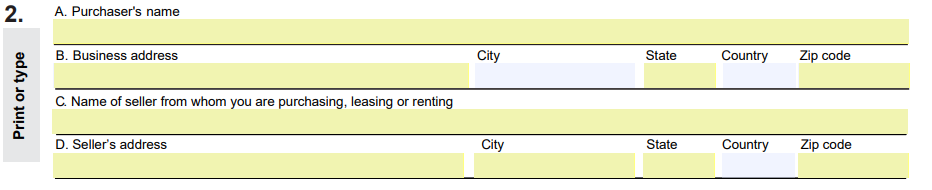

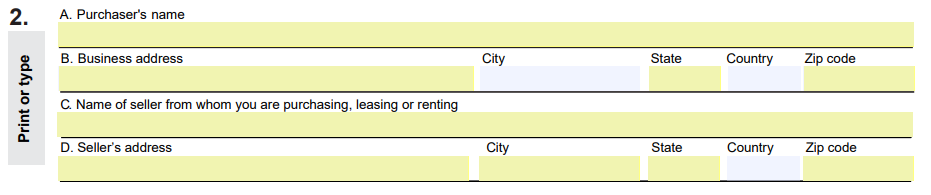

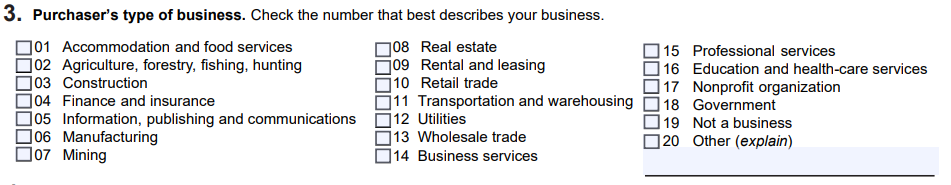

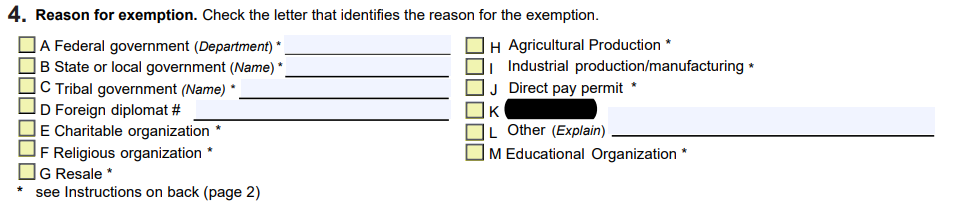

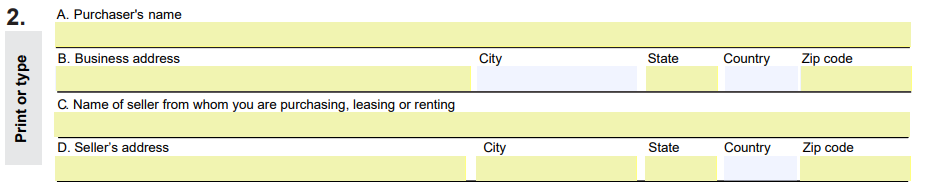

A resale certificate typically includes:

- the name and address of the buyer

- the reseller’s permit number

- a description of the items being purchased

- a statement that the property is being purchased for resale

In some states, a sales tax permit is the same as a resale certificate, while in other states you’ll need both. A sales tax permit, sometimes called a sellers permit, identifies you with your state as a collector of sales tax. If you sell tangible personal property or goods you are required to have a sales tax permit whether you operate as a sole proprietorship, a limited liability company (LLC), a partnership, or a corporation.

In some states, even a service provider like a lawyer is required to have a sales tax permit and collect state sales tax. A resale certificate has to do with the sales tax that you would have to pay without one, not the sales tax that you collect. The resale certificate applies to items that you buy for resale, or for parts that you buy to manufacture something for sale.

You cannot use a resale certificate to buy items you do not intend to resell, such as a new computer for your business. Doing so would be tax fraud, a felony offense. You are only able to buy items tax-exempt if you are going to collect sales tax on them later.

Not all wholesalers will accept resale certificates, nor do they have to. They may choose not to because of the risk of expired or false certificates, which would put the wholesaler on the hook for the sales tax.

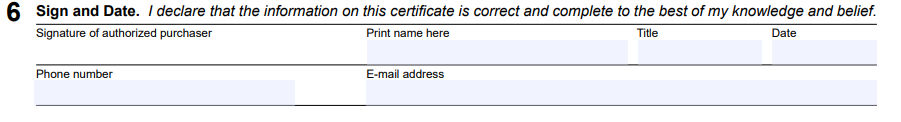

Multi-Jurisdictional Resale Certificate

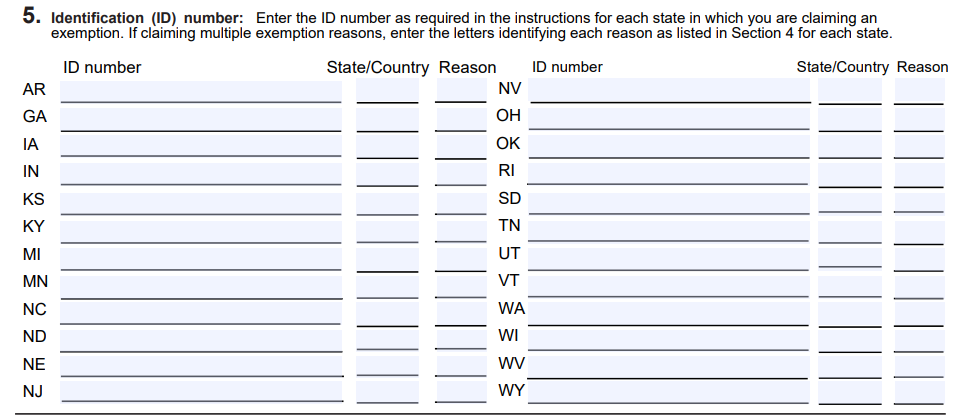

If you purchase goods in multiple states and from multiple sellers, you can get a multi-jurisdictional resale certificate. Not all states accept these, so you’ll need to check with the states you do business in.

These certificates are complex and come with many terms, so you need to make sure you use it correctly. Learn more from the Multistate Tax Commission.

How to Get a Resale Certificate

You can apply for a resale certificate through your state’s tax department. This must be the state where you physically do business, even if you formed your business entity in another state. If you sell products in more than one state, you will also need to apply for a resale certificate in those states.

Remember, if you do business with multiple sellers in multiple states, you need resale certificates for all of them. You can only get a resale certificate if you have a sales tax permit, if your state requires both. Some states will not accept resale certificates issued in other states.

To find out the requirements for obtaining a resale certificate in your state, choose a state from the list below. You will find all the specifics and information you need for your business.

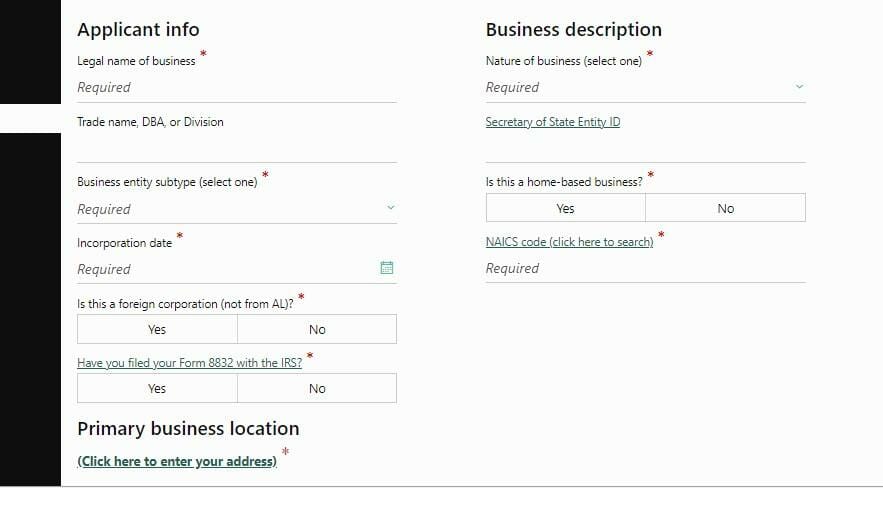

How to Apply for a Sales Tax License in Alabama

In a few states, including Alabama, a seller’s permit, or sales tax license, also serves as a resale certificate that applies to all vendors.

In Alabama, the Department of Revenue issues sales tax licenses. Start by visiting the website, then follow these simple steps:

- Enter your entity type and FEIN

- Select sales tax for the type of tax you’re applying for.

- Fill out all the requested information about your business.

The whole process may take half an hour, as you’ll be asked for detailed information about the products or services you sell. There is no fee for the application, and you should receive your sales tax license within 10 days.

In Alabama, sales tax licenses expire after one year. It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

How to Apply for a Resale Certificate in Alaska

Alaska has no state sales tax, but some municipalities and local jurisdictions do. You’ll need to contact those local offices to find out the procedure for getting a resale certificate and a sales tax permit in your jurisdiction.

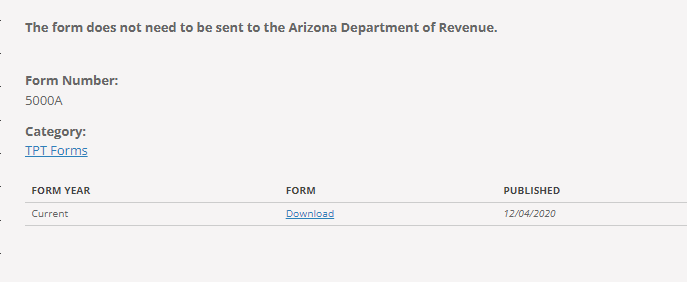

How to Apply for a Resale Certificate in Arizona

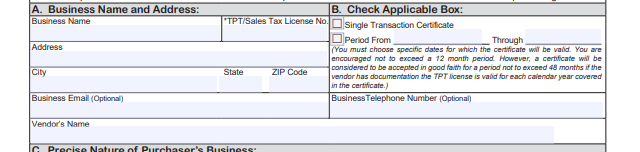

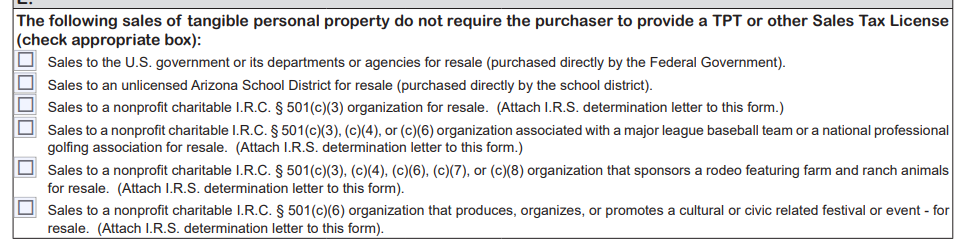

In Arizona, the Department of Revenue issues resale certificates. Start by visiting the website, then follow these simple steps:

- Download the form.

- Fill in your business name and address.

- Select whether the certificate applies to a single purchase transaction or for a specific time period.

- Fill in the nature of your business and a description of the items being purchased.

- Select any of these situations that apply.

- Fill in your name and sign the form.

Again, this form does not have to be submitted to the revenue department. You simply present it to the seller of the goods you’re purchasing.

In Arizona, resale certificates expire based on the duration dates you specified on your resale certificate form. It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to present new forms to vendors in time and run your business without interruption.

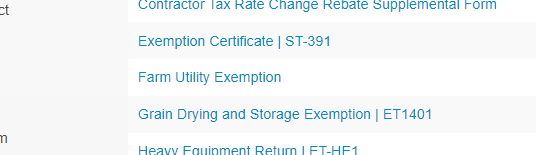

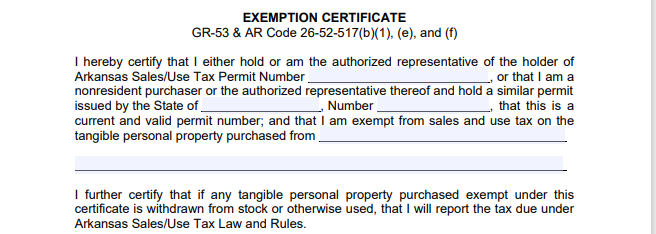

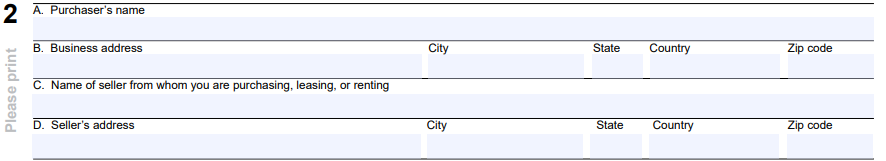

How to Apply for a Resale Certificate in Arkansas

In Arkansas, the Department of Finance and Administration issues resale certificates. Start by visiting the website, then follow these simple steps:

- Download the exemption certificate.

- Fill in your sales tax permit number and the name of the seller you’re purchasing from.

- Fill in a description of the items being purchased and the reason for the exemption, i.e. purchasing for resale.

- Fill in the activity of your business, your business name and address, and sign the form.

Again, this form does not need to be filed with the state. You simply present it to the seller of the items you’re purchasing.

In Arkansas, resale certificates expire if not used within 12 months. It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

How to Apply for a Resale Certificate in California

In California, the Department of Tax and Fee Administration handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- Go to the online form.

- Fill in your seller’s permit number, the business you’re engaged in, and the vendor’s name.

- Fill in a description of the items being purchased.

- Fill in your name, address, and phone number and then sign the form.

Again, you don’t file the form with the state. You’ll simply keep it on file and present it to your vendor at the time of purchase.

In California, resale certificates do not expire. They can only be canceled in writing by the purchaser.

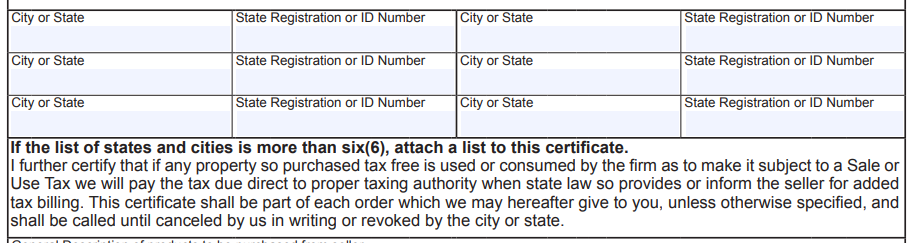

How to Apply for a Resale Certificate in Colorado

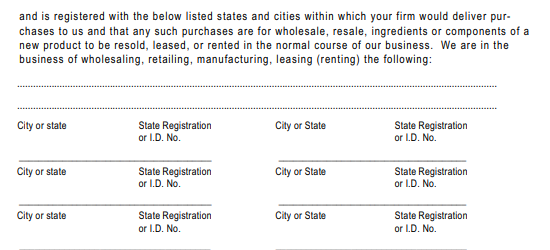

In Colorado, the revenue department handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- The link provided will take you directly to the form.

- You’ll fill in the business name and address of the seller of goods.

- Fill in your name and address as the buyer, and what kind of business you are.

- Fill in the nature of your business, i.e. furniture sales.

- Fill in each jurisdiction that you are going to sell goods in, along with your state registration or ID number for that jurisdiction. If you have more than six, you’ll need to attach a separate sheet.

- Add a description of the items being purchased from the vendor.

- Sign and date the form and store it in your files.

There’s no need to file this form with the state. You’ll simply present it to your vendor at the time of purchase.

In Colorado, resale certificates do not expire. However, your sales tax license must be renewed every year, and if it expires, the resale certificate is invalid until your license is renewed. Thus, it’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

How to Apply for a Resale Certificate in Connecticut

In Connecticut, the Department of Revenue Services handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- The link above will take you directly to the form.

- You’ll fill out the seller name and address and your business name and address as the buyer.

- Fill in each jurisdiction that you are going to sell goods in, along with your state registration or ID number for that jurisdiction. If you have more than six, you’ll need to attach a separate sheet.

- You’ll fill in a description of the goods being purchased and sign and date the form.

There’s no need to file the form with the state. You’ll simply store it in your files and present the form to your vendor at the appropriate time.

In Connecticut, resale certificates expire after three years. It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

How to Apply for a Resale Certificate in Delaware

If you are selling products in other states, you’ll need a resale certificate for those states. Generally, you’ll obtain the form from the state’s department of revenue or the department of taxation.

Generally, when you obtain a resale certificate in other states, the following information will be required:

- The seller’s name and address

- Your business name and address, and your registration or ID number in the relevant state

- A description of the goods being purchased.

States have different expiration rules for resale certificates. Check with the relevant states for requirements. It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

How to Apply for a Resale Certificate in Florida

In Florida, when you apply for your sales tax license you will automatically be issued a resale certificate, and you’ll get a new one each year when you renew your sales tax license. The resale certificate is to be presented to all of your vendors.

In Florida, resale certificates expire after one year when your sales tax license expires. You’ll get a new certificate when you renew your sales tax license. It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

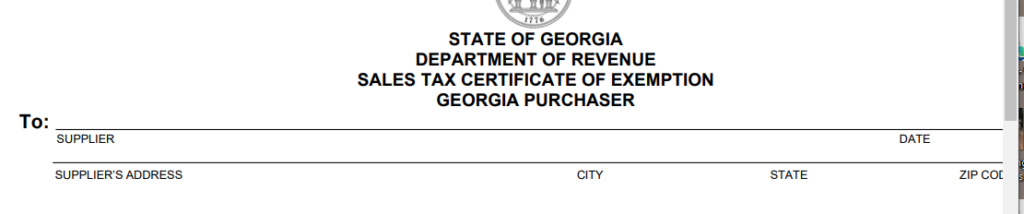

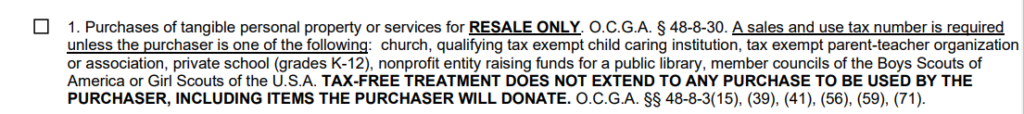

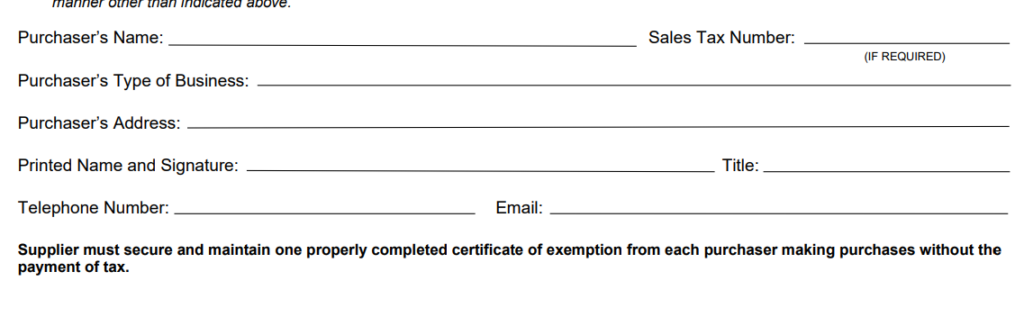

How to Apply for a Resale Certificate in Georgia

In Georgia, the Department of Revenue handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- Download the form from the provided link.

- Fill in the seller/supplier’s name and address.

- Check the appropriate box for the reason for exemption.

- Fill in your name, sales tax number, your type of business, and your business address, and sign the form.

There’s no need to file the form with the state. Just store it in your files and present it to your vendor.

Georgia resale certificates do not expire.

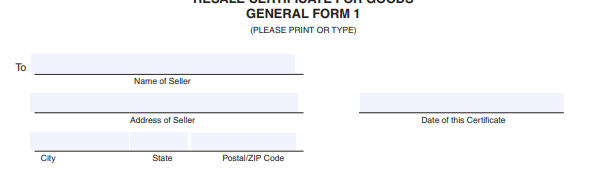

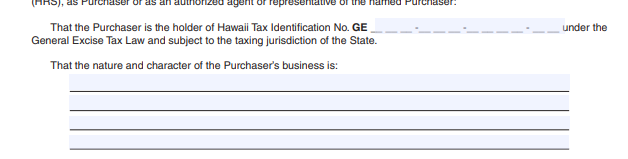

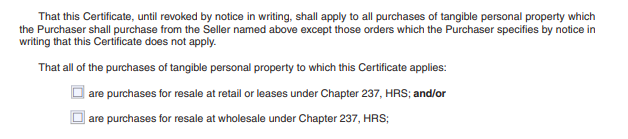

How to Apply for a Resale Certificate in Hawaii

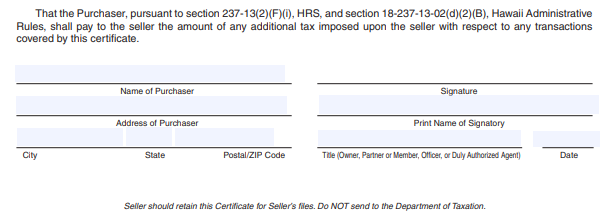

In Hawaii, the tax department handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- The link provided will take you to the fillable PDF of the form.

- Fill in the seller’s name and address, and the date.

- Fill in your Hawaii tax ID number and the nature of your business.

- Select whether the items purchased will be sold at retail or wholesale.

- Fill in your business name, address and sign the form, and file it in your records.

Again, you do not file the form with your state. You’ll simply present it to your vendor and keep a copy for your records.

In Hawaii, resale certificates don’t expire. They can only be revoked in writing by the purchaser.

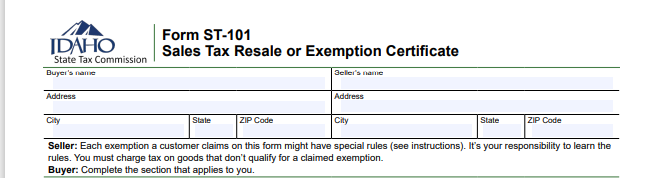

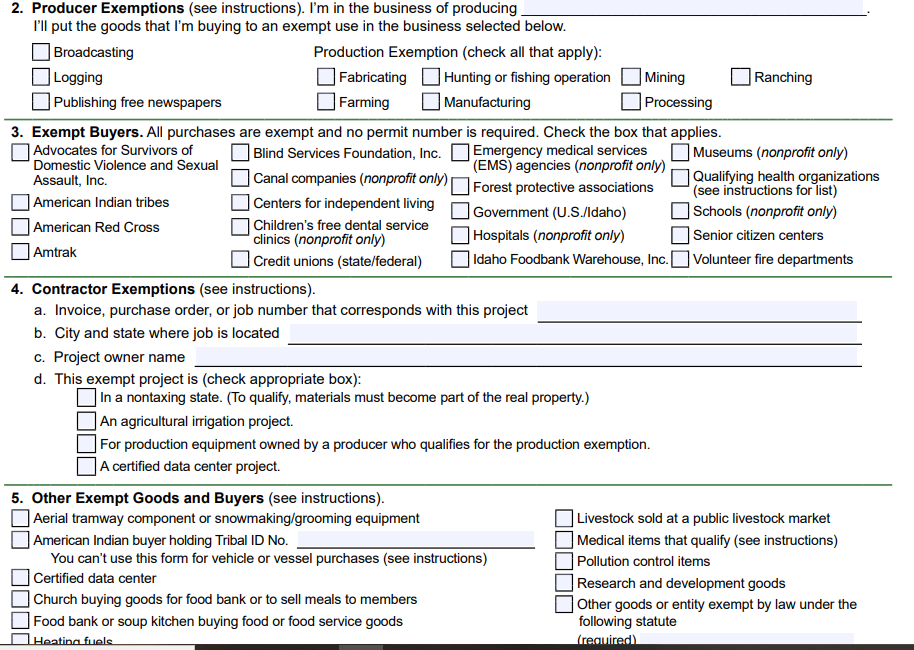

How to Apply for a Resale Certificate in Idaho

In Idaho, the State Tax Commission handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- Click on the link above to access the form.

- Fill in the buyer’s and seller’s name and address.

- Fill in the nature of your business, the items you sell, and check the appropriate box.

- In the next several sections check any boxes that apply based on your type of business.

- Sign the form, fill in your EIN or driver’s license number and print to keep in your records.

Again, the certificate does not get filed with the state. You simply provide it to your vendor and keep a copy for your records.

In Idaho, resale certificates do not expire.

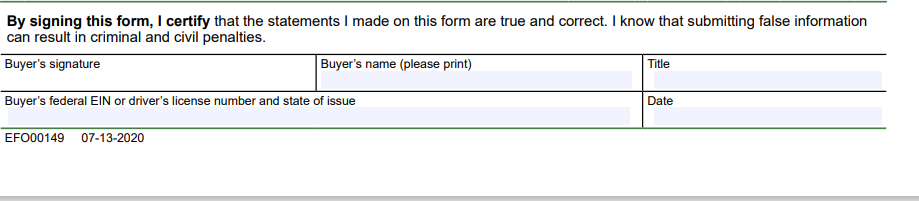

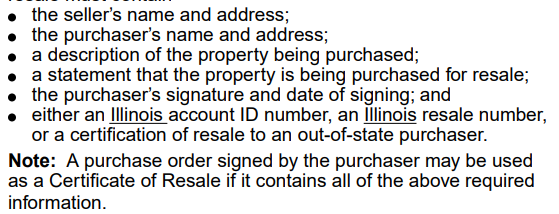

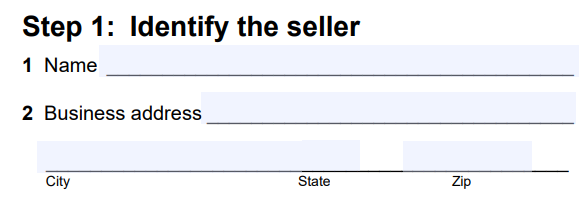

How to Apply for a Certificate of Resale in Illinois

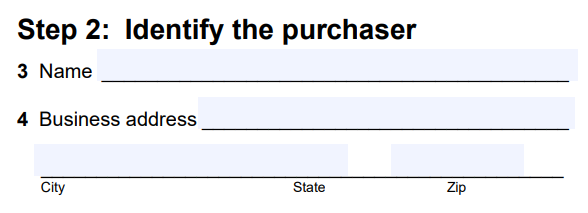

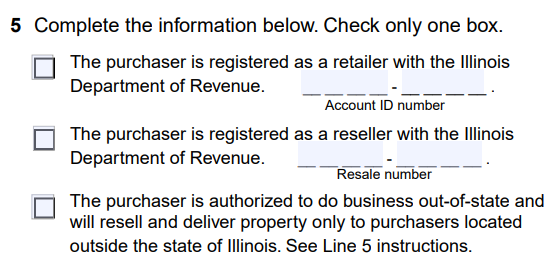

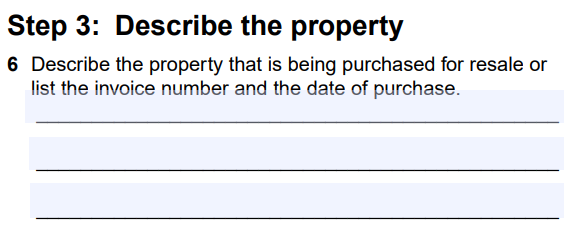

In Illinois, you can take a few different approaches to apply for a certificate of resale. For simplicity and ease, you can use a copy of the certificate of resale provided by the Illinois Department of Revenue. Alternatively, you can create your own form that meets Illinois’ certificate of resale requirements, and you can also use a purchase order as long as it includes the required details.

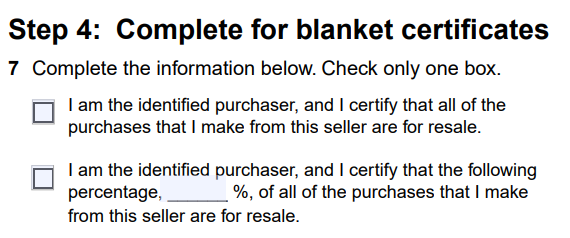

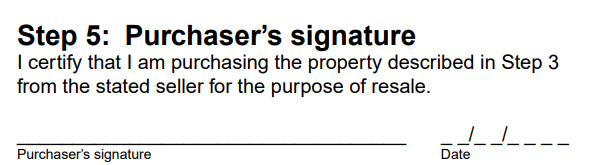

If you’re using the state-provided form, start by visiting this website, then follow these simple steps:

- Open the link above and download the document.

- First, fill in the name and address of the business selling you the items.

- As the purchaser, provide your business’s name and address.

- Carefully select the correct box that applies to your business.

- Describe what you’re purchasing for resale.

- Identify if your certificate applies to all purchases from this vendor, or only a percentage.

- Sign and date to complete the form, officially stating your intention to resell the items.

For assistance, you can contact Illinois’ Department of Revenue.

Phone: 217.782.3336

Hours: Monday through Friday, 8:00 AM – 5:00 PM

Remember, this form does not need to be filed with the state. Keep it safely stored in your records so you can easily access and present it to the seller of the goods you’re purchasing.

In Illinois, certificates of resale do not expire. However, the Illinois Department of Revenue recommends that you review your certificates of resale at least every three years and verify that the information is up to date. Create calendar reminders to monitor each certificate’s three-year update cycles effectively so you can run your business without interruption.

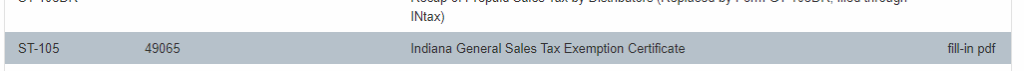

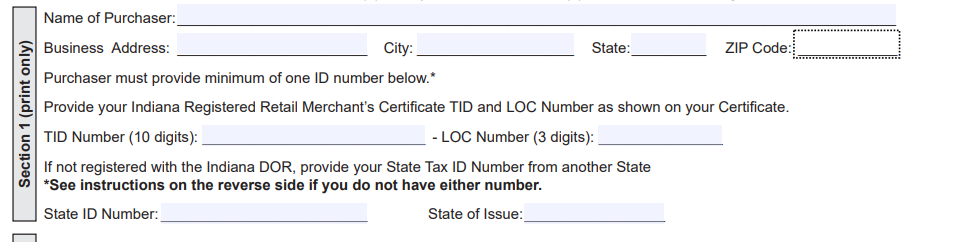

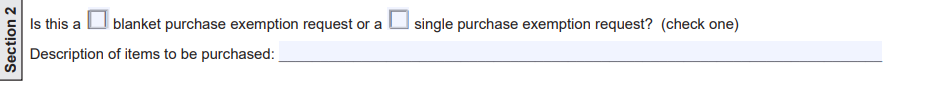

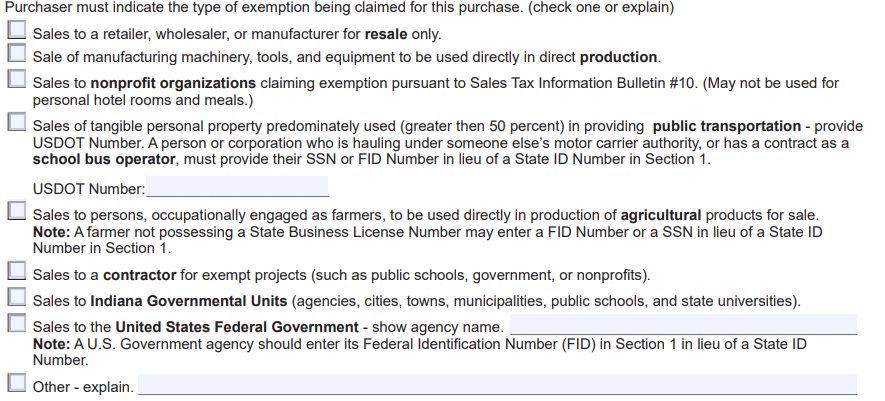

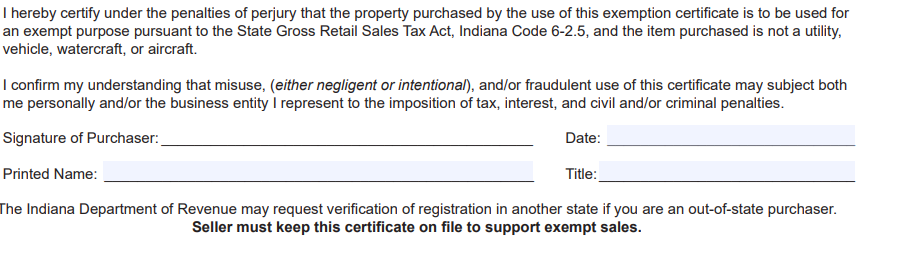

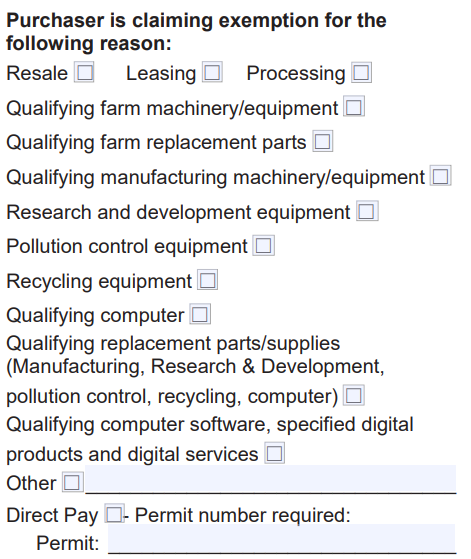

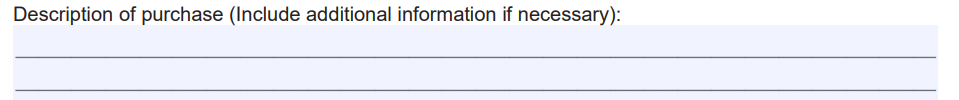

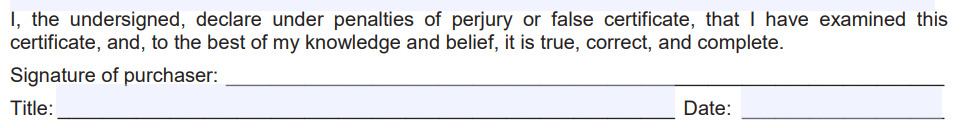

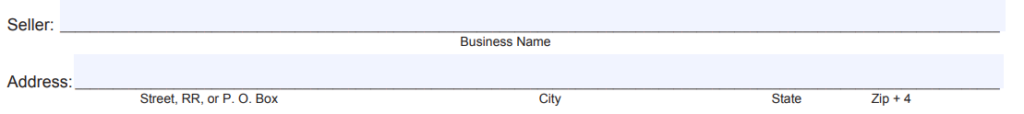

How to Apply for a Sales Tax Exemption Certificate in Indiana

In Indiana, the revenue department handles the issuance of sales tax exemption certificates. Start by visiting the website, then follow these simple steps:

- Download the form from the link provided.

- Fill in your business name and address and your Indiana Registered Retail Merchant’s Certificate TID and LOC Number as shown on your certificate.

- Indicate whether the form is for ongoing use or for a one time purchase.

- Check the type of exemption being claimed.

- Sign the form and store in your records.

Again, you won’t file the certificate with the state. You’ll simply provide it to your vendor and keep a copy for your records.

In Indiana, sales tax exemption certificates do not expire unless they are provided for a single purchase.

How to Apply for a Sales Tax Exemption Certificate in Iowa

In Iowa, the Department of Revenue handles the issuance of sales tax exemption certificates. Start by visiting the website, then follow these simple steps:

- Open the link above and download the form.

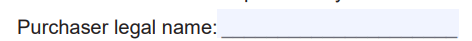

- As the purchaser, fill in your name.

- Then provide the name, address, phone number, and general nature of your business.

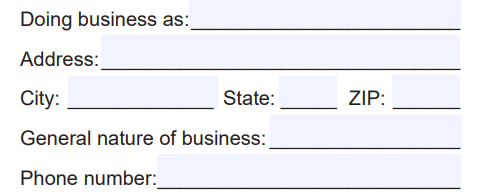

- Fill in the seller’s name and business information.

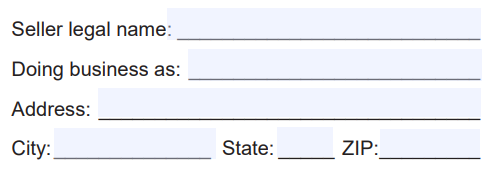

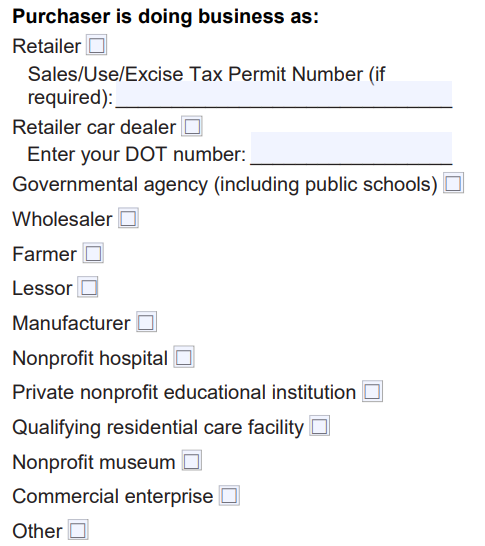

- Check the appropriate box indicating your business’s general role in this transaction.

NOTE: If applicable, fill in the associated number blanks.

- Check the relevant box that lists your reason for this sales tax exemption certificate.

NOTE: If applicable, fill in the relevant blanks.

- Detail the items you’re purchasing for resale.

- Lastly, sign and date to profess your honesty when filling out the form.

For assistance, you can contact Iowa’s Department of Revenue.

Phone: 515.281.3114

Hours: Monday through Friday, 8:00 AM – 4:30 PM

Remember, this form does not need to be filed with the state. Just store it in your records and present it to the seller of goods you purchase.

In Iowa, sales tax exemption certificates are only valid for three years. It’s best to create calendar reminders so you’re aware of upcoming expirations and are able to apply for renewal in time and run your business without interruption.

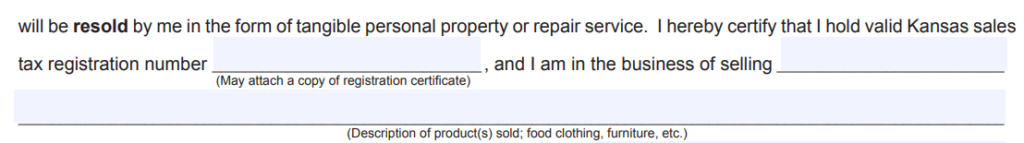

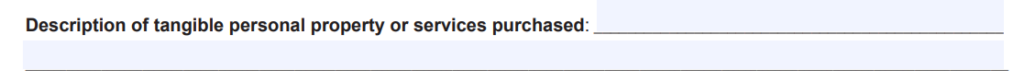

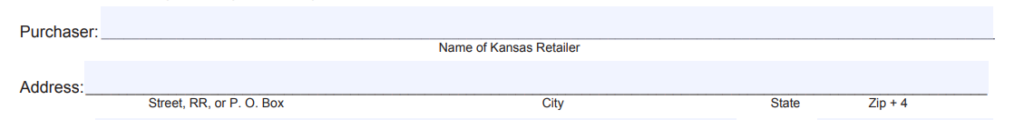

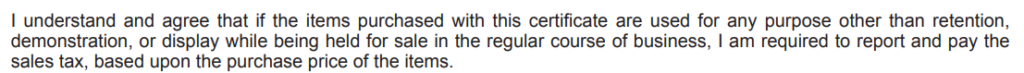

How to Apply for a Resale Exemption Certificate in Kansas

In Kansas, the Department of Revenue handles the issuance of resale exemption certificates. Start by visiting the website, then follow these simple steps:

- Open the link above and download the form.

- Fill in the name and address of the business selling you the items.

- Provide your tax registration number and a brief description of what your business sells.

- Describe what you’re purchasing for resale.

- As the purchaser, provide your business’s name and address.

- Sign and date the form and place it in your records.

For assistance, you can contact Kansas’s Department of Revenue.

Phone: 785.296.3081

Hours: Monday through Friday, 8:00 AM – 4:45 PM

Remember, this form is not filed with Kansas’s revenue department. Keep it safely filed with your LLC’s records so you can easily access and present it to the seller of the goods you’re purchasing.

In Kansas, a resale exemption certificate only needs to be renewed if more than one year takes place between transactions. It’s best to create calendar notes and reminders to know when your last purchase with a vendor occurred and its correlated expiration date. This way, you have time to assess your business relationship and decide if you want to schedule another purchase with the seller before the twelve-month mark.

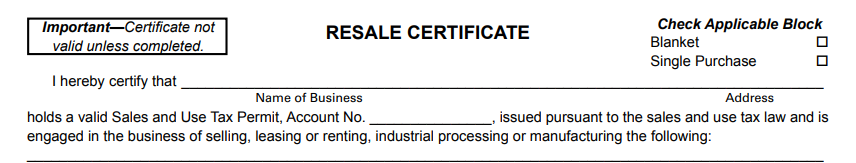

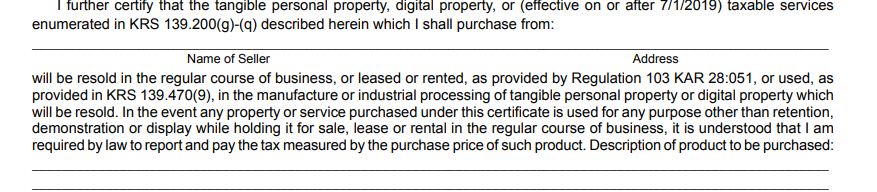

How to Apply for a Resale Certificate in Kentucky

In Kentucky, the revenue department handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- The link provided will take you directly to the form.

- Fill in your business name and address, your sales and use tax permit account number, and the type of goods your business sells.

- Fill in the seller’s name and address and a description of the items being purchased.

- Sign the form and add your title and the date.

Again, there’s no need to file the form with the state. You’ll simply give it to your vendor and keep a copy for your records.

In Kentucky, resale certificates do not expire but the state recommends that you examine them every four years to make sure the information is up to date.

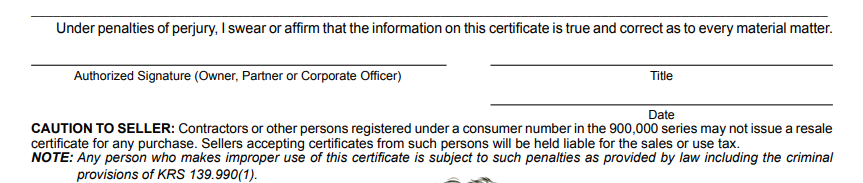

How to Apply for a Resale Certificate in Louisiana

In Louisiana, the Department of Revenue handles both the filing and issuing of resale certificates through their online LaTAP service. But before you log in, start by gathering the required information:

- The physical and mailing addresses of all business locations

- The account numbers and NAICS code for all business locations

- Your business’s resale inventory purchase amounts for the last two years

Next, visit LaTAP’s homepage and follow these simple steps:

- Log into your LaTap account.

- On the My Summary page, select your business account.

- Click the link in the upper-right corner to access resale certificate applications and renewals.

- Carefully fill in the application with the information you gathered.

- Submit your request for a resale certificate.

For assistance, you can contact Louisiana’s Department of Revenue.

Phone: 855.307.3893

Hours: Monday through Friday, 8:00 AM – 4:30 PM

You’ll be able to monitor the status of your resale certificate application through your LaTAP account, but you can expect processing to take two to three days. When your resale certificate is successfully filed, print a copy to present to the seller you’re purchasing from.

When your resale certificate has been filed with Louisiana’s Department of Revenue, you’ll be informed of its expiration date. Yearly certificate renewals are automatic as long as your business’s taxes, required filings, and reports of in-state sales are up to date. Conversely, blanket resale certificates are valid for two years before they must be updated and renewed.

If for any reason a resale certificate does not automatically renew, you’ll have 60 days from the expiration date to apply for renewal. Renewals must be requested online using the Louisiana Department of Revenue LaTAP service.

It’s best to create calendar reminders for upcoming certificate expirations to ensure you’re able to apply for renewal in time and run your business without interruption.

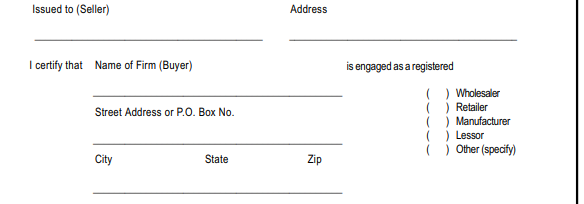

How to Apply for a Resale Certificate in Maine

In Maine, when you apply for your sales tax license, if you project that you’ll earn more than $3,000 in revenue over the next year, you’ll be automatically issued a resale certificate. You’ll present this certificate to your vendors. If you do not plan to make more than $3,000, you’re not eligible for a certificate and must pay sales tax on items you purchase from your vendors.

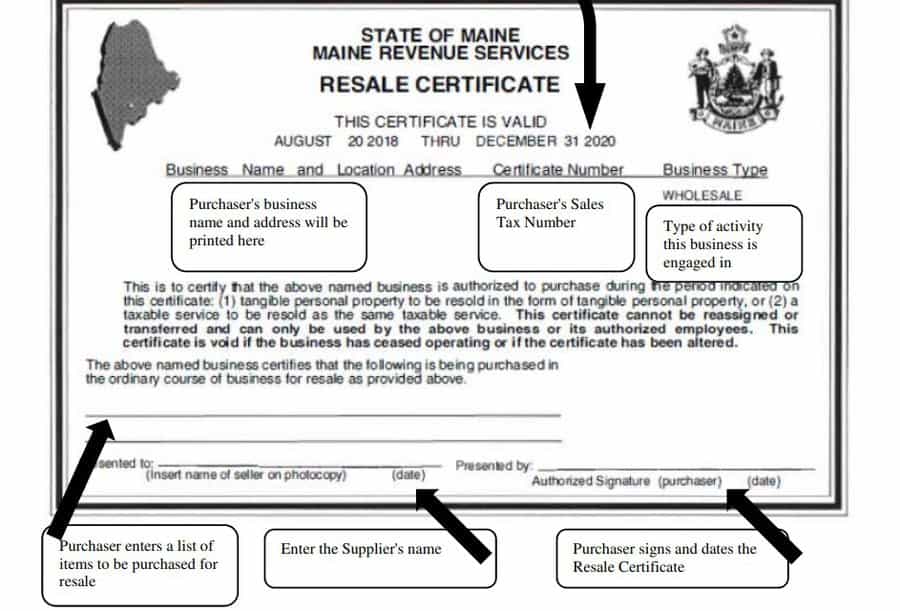

Here’s an example of what a resale certificate looks like in Maine.

In Maine, resale certificates expire on December 31st. A resale certificate issued before October 1st is valid for the remainder of that calendar year and the following three calendar years. A resale certificate issued after October 1st is valid for the remainder of that calendar year and the following four calendar years.

It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

How to Apply for a Resale Certificate in Maryland

In Maryland, you can take a few different approaches to apply for a resale certificate.

Though the state doesn’t have an official form, the Comptroller’s Office of Maryland offers an easy online service that verifies a business’s registration number and then generates a resale certificate. Maryland’s Comptroller also provides a sample blanket resale certificate. You can print it out or use it as a model for your own blanket certificates.

Alternatively, you can write up a resale certificate as long as it includes the following information and satisfies Maryland’s requirements:

- Purchaser’s name and address

- Purchaser’s Marland sales and use tax registration number

- Blanket certificates must indicate the intent of resale regarding all vendor purchases

- A signed declaration of intention that the purchased items are for resale

Remember, many purchases under $200 cannot legally utilize a resale certificate, so be sure to review Maryland’s resale certificate regulations listed above carefully.

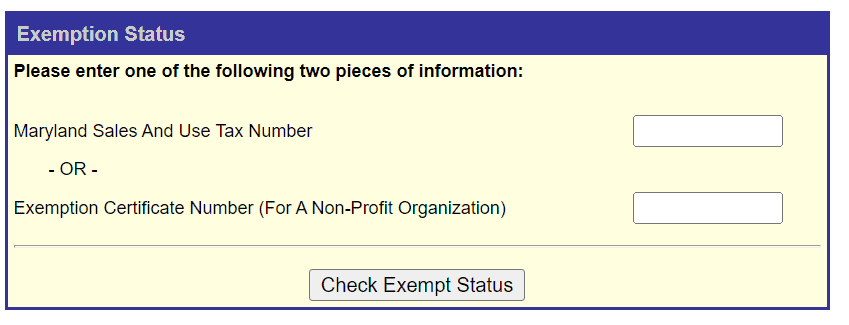

If you prefer to utilize Maryland’s tool to obtain a resale certificate, start by visiting the Comptroller’s Office of Maryland’s online verification service, and then follow these simple steps:

- Enter your business’s sales and use tax registration number.

- Check the status.

- Print out the generated resale certificate for your records.

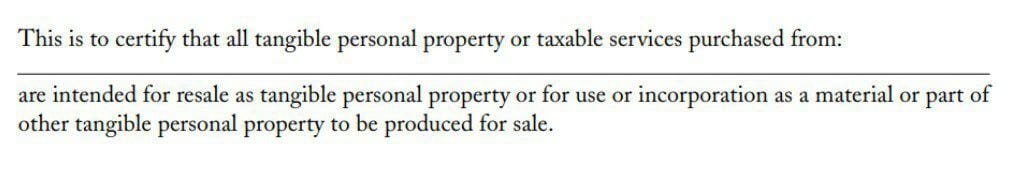

To access the Comptroller’s sample blanket resale certificate, follow these steps:

- Open the link above and download the template.

- To use this sample certificate, first fill in the seller’s name.

- As the buyer, provide your name and address.

- Identify your business’s sales and use tax registration number.

- Lastly, sign and date the certificate and keep a file in your records.

If you decide to write up your own resale certificate, doublecheck that you’ve included each requirement:

- Buyer’s name and business address

- Buyer’s Marland sales and use tax registration number

- Blanket certificates must indicate the intent of resale regarding all vendor purchases

- A signed declaration of intention that the purchased items are for resale

For assistance, you can contact Maryland’s Office of the Comptroller.

Phone: 410.260.7980

Hours: Monday through Friday, 8:00 AM – 4:30 PM

Remember, resale certificates aren’t filed with Maryland’s Office of the Comptroller. Keep it safely filed in your records so you can easily access and present it to the seller of the goods you’re purchasing.

In Maryland, resale certificates don’t ever officially expire. However, it’s recommended that you review your business’s certificates at least every three years and verify that the information is up to date.

It’s best to create calendar notes and reminders so you can monitor the age of each certificate. This allows you to schedule a time to review your certificates and run your business without interruption.

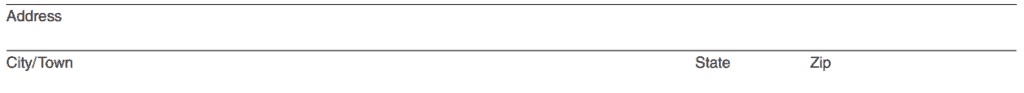

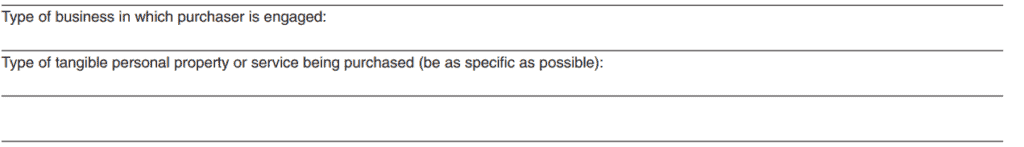

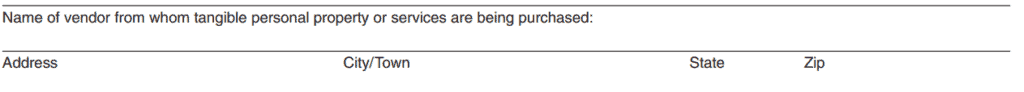

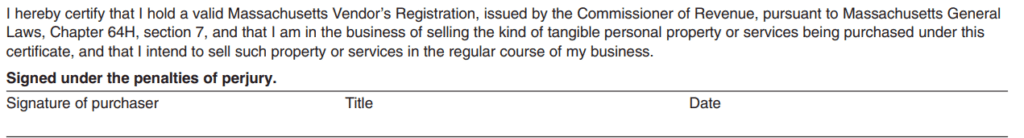

How to Apply for a Resale Certificate in Massachusetts

In Massachusetts, the Department of Revenue handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- Open the link above and download the sales tax resale form.

- As the purchaser, fill in your name and provide either your business’s account ID or federal ID number.

- Fill in your business address.

- Describe your business and detail what you’re purchasing.

- Identify the name and address of the vendor.

- Sign to certify that you have a valid Massachusetts vendor registration.

- Lastly, specify if your resale certificate applies to one or all purchases from this vendor, and file away the form.

For assistance, you can contact the Massachusetts Department of Revenue.

Phone: 617.8876367

Hours: Monday through Friday, 9:00 AM – 4:00 PM

Remember, this form does not need to be filed with Massachusetts’ revenue department. Keep it safely stored in your records so you can easily access and present it to the seller of the goods you’re purchasing.

In Massachusetts, resale certificates do not expire.

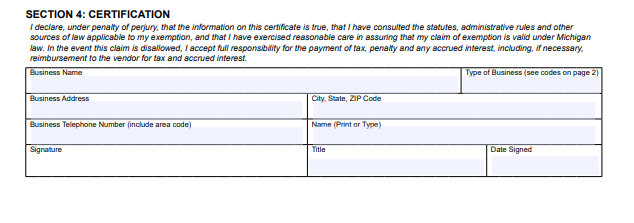

How to Apply for a Sales and Use Tax Certificate of Exemption in Michigan

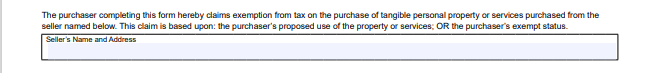

You’ll need to obtain a sales and use tax certificate of exemption form from the Michigan Department of Treasury. The certificate is not filed with the state. You simply save it in your files and then present it to your vendor.

Start by visiting the website, then follow these simple steps:

- The link provided will take you directly to the form.

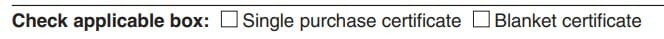

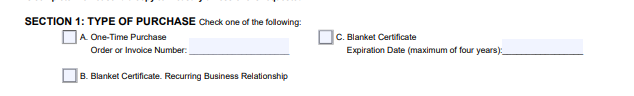

- Select whether the certificate is for a one-time purchase or a blanket certificate for a recurring business relationship or a blanket certificate with an expiration date that can be no more than four years.

- Fill in the seller’s name and address.

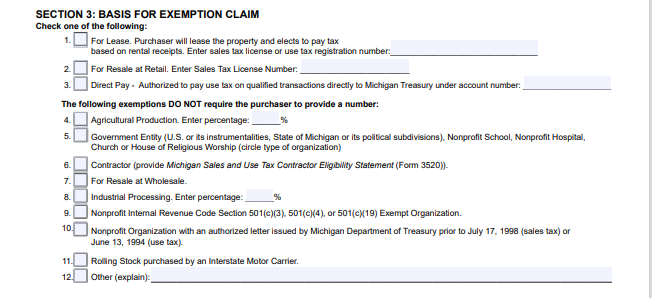

- Select the boxes that apply for the reason for exemption.

- Certify the form by filling in your business information and signing the form.

Again, the form is not filed with the state. You’ll simply present it to your vendor and keep a copy for your records.

If you chose a blanket certificate with an expiration date, that date applies (maximum four years). A blanket certificate with an expiration should be used when there may be a period of more than 12 months between sales transactions. This option is best when purchaser and seller anticipate more than one exempt transaction before the expiration date but do not have or may not maintain a recurring business relationship

If you chose a blanket certificate for a recurring business relationship, meaning when a period of not more than 12 months elapses between sales transactions between the seller and purchaser, parties do not need to renew this blanket exemption claim as long as the recurring business relationship exists.

It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

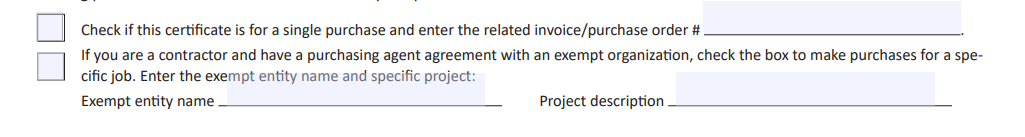

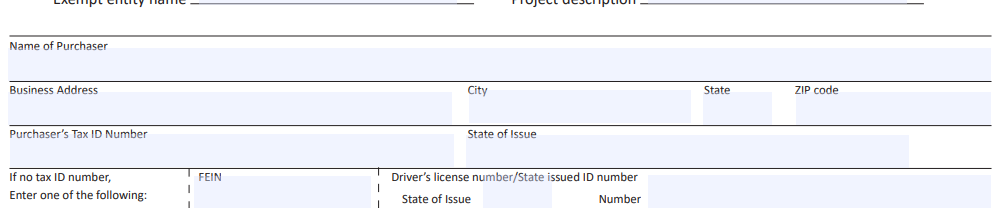

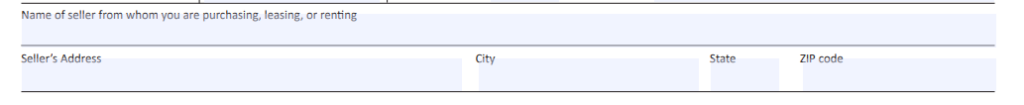

How to Apply for a Certificate of Exemption in Minnesota

You’ll obtain a blank certificate of exemption from the Minnesota Department of Revenue. The form is not filed with the state. Instead, you simply present the completed certificate to your vendor.

Start by visiting the website, then follow these simple steps:

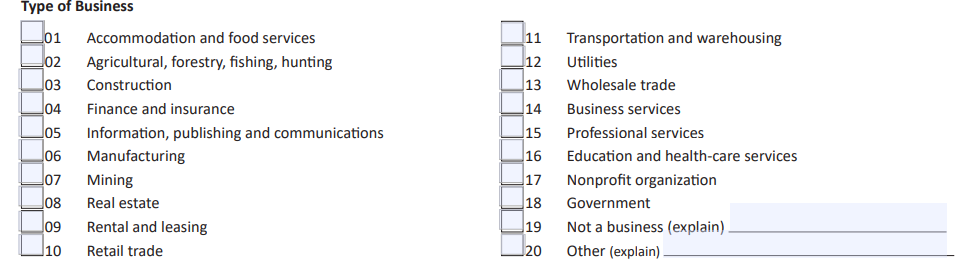

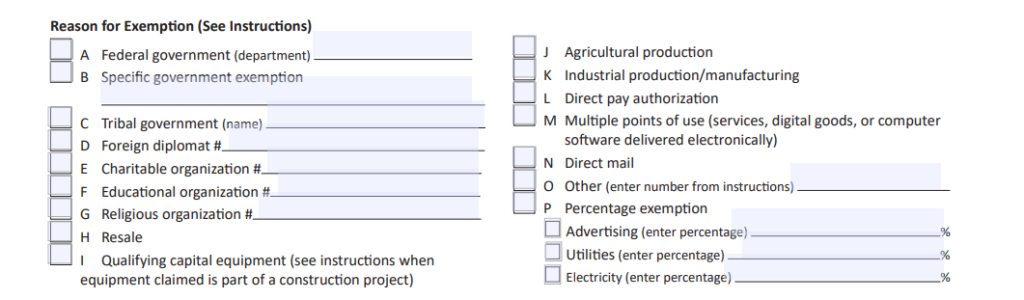

- The link provided will take you directly to the form.

- Check the box if the form is for a single purchase or if the other stated situation applies to you.

- Fill in your business name, address, and either your tax ID number, FEIN, or driver’s license number.

- Fill in the seller’s name and address.

- Check the box indicating your type of business.

- Check the box indicating the reason for exemption.

- Sign and date the form and keep in your files.

Again, you will not file the form with the state. You’ll simply give the certificate to your vendor and keep a copy for your records.

In Minnesota, certificates of exemption do not expire unless the information on them changes. However, the state recommends updating them every three to four years.

It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

How to Apply for a Resale Certificate in Mississippi

In Mississippi, the sales tax permit also serves as a resale certificate that applies to all vendors.

The seller’s permit identifies you with your state as a collector of sales tax. If you sell tangible personal property or goods you are required to have a sales tax permit. In some states, even a service provider like a lawyer is required to have a sales tax permit and collect state sales tax.

The resale certificate applies to items that you buy for resale, or for parts that you buy to manufacture something for sale.

Mississippi does not issue resale certificates. However, the sales tax permit is a one-time registration and no formal renewal process is needed once your original application is approved.

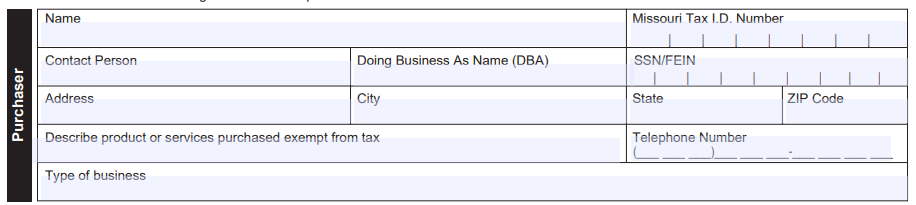

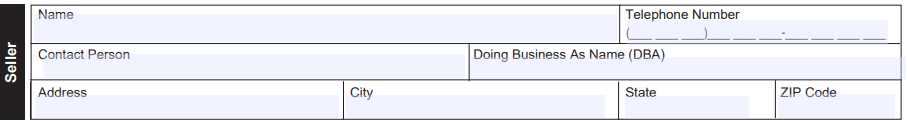

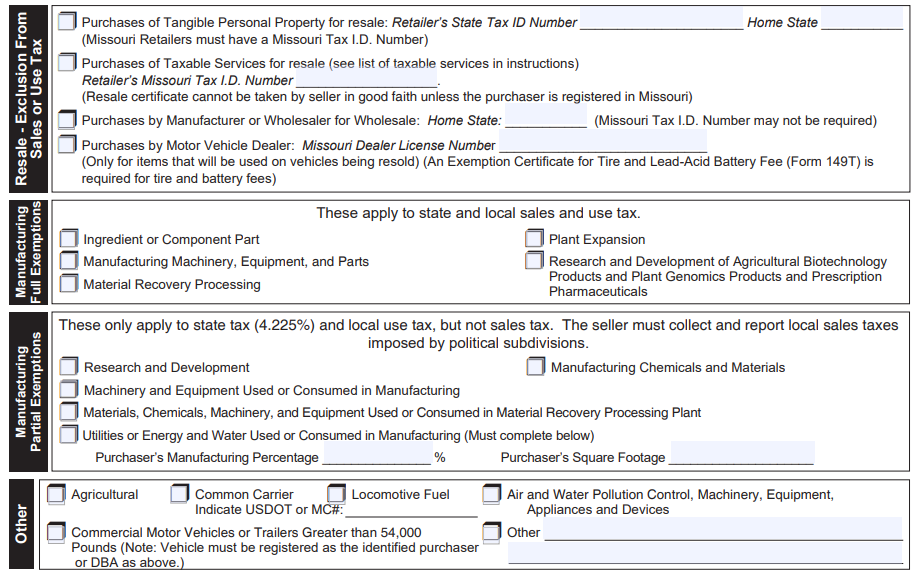

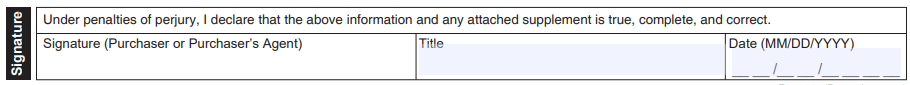

How to Apply for an Exemption Certificate in Missouri

In Missouri, you’ll need to obtain the exemption certificate form from the Department of Revenue. The certificate is not filed with the state of Missouri, it’s simply kept on file by the seller.

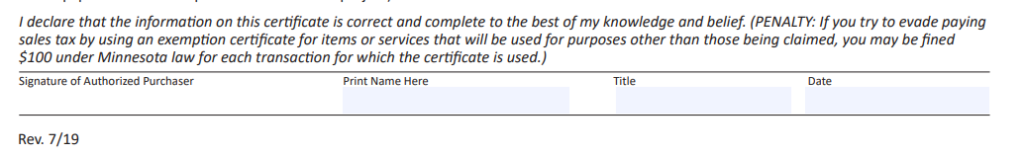

Start by visiting the website, then follow these simple steps:

- On the Forms and Manuals page, scroll down to the 149 link and download the form.

- In the first section, fill out your business information, including your Missouri Tax ID Number.

- Next, enter your seller’s information.

- The next several fields contain product and sales-specific tax information. Review and check off the boxes that apply to your business.

- Finally, sign and date the form and keep a copy for your records.

For assistance, contact the Missouri Department of Revenue at (573) 751-2836 or [email protected].

In Missouri, exemption certificates expire after five years. It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

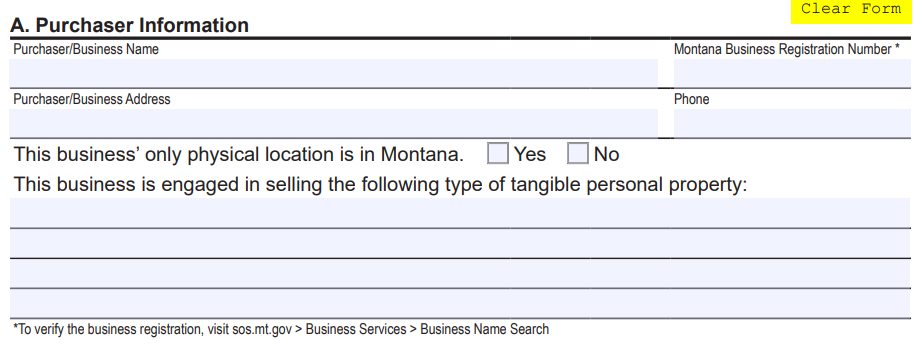

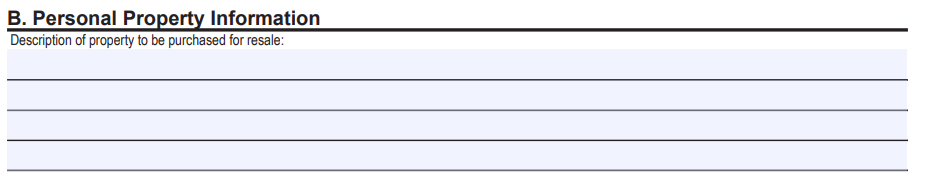

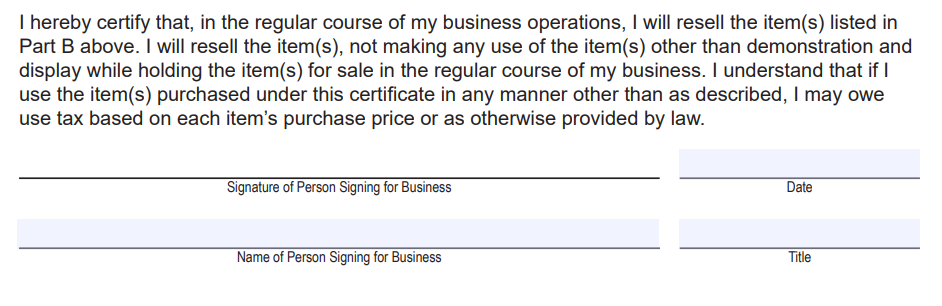

How to Apply for a Resale Certificate in Montana

In Montana, you’ll need to obtain the resale certificate form from the Department of Revenue. The certificate is not filed with the state of Montana, it’s simply kept on file by the seller.

Start by visiting the website, then follow these simple steps:

- On the Montana Business Registry Resale Certification page, click the button to download the form.

NOTE: the state of Montana does not have a general sales, use, or transaction tax. Use this form when you need to deal with out-of-state sellers.

- First, fill out your business address and information, including your Montana Business Registration Number.

- Next, enter a description of the property to be purchased for resale.

- Finally, sign and date the form and keep a copy for your records.

For assistance, contact the Montana Department of Revenue at (406) 444-6900.

In Montana, resale certificates do not expire.

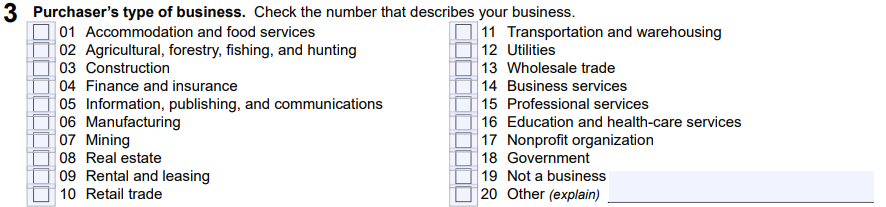

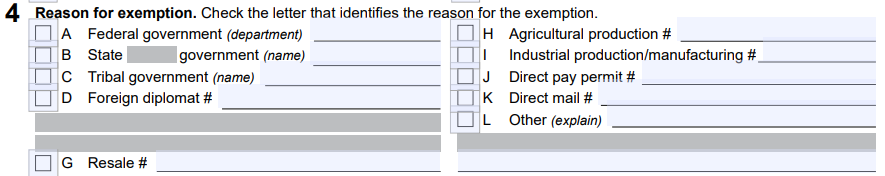

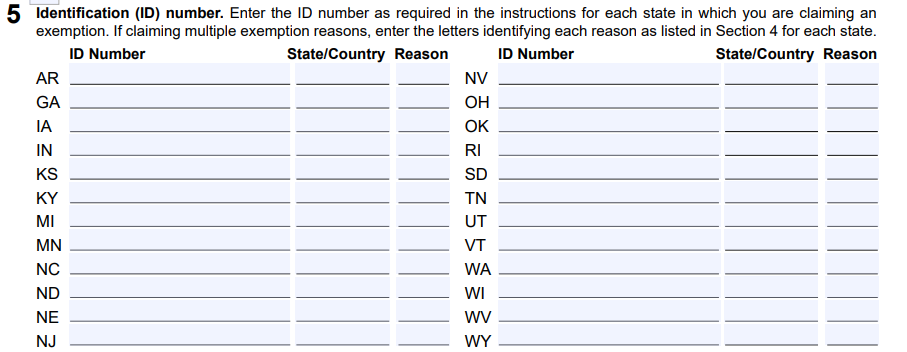

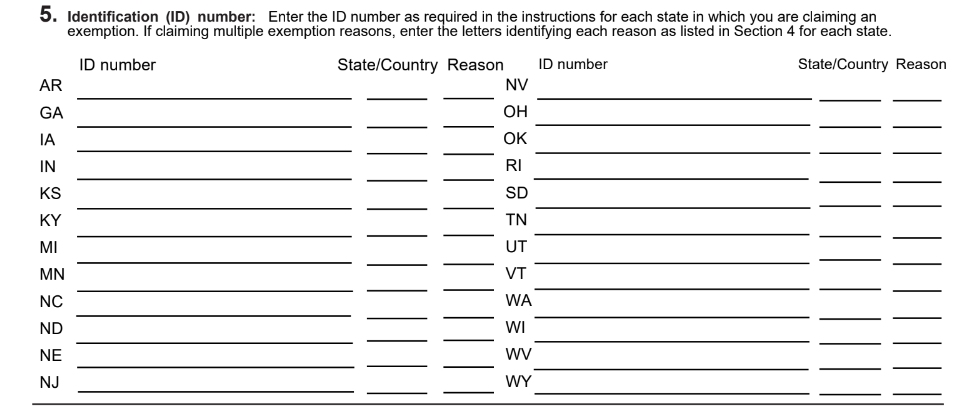

How to Apply for a Certificate of Exemption in Nebraska

In Nebraska, you’ll need to obtain the certificate of exemption form from the Department of Revenue. Keep in mind that you won’t file the certificate with the state, but simply keep it in your records.

Start by visiting the website, then follow these simple steps:

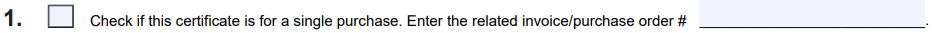

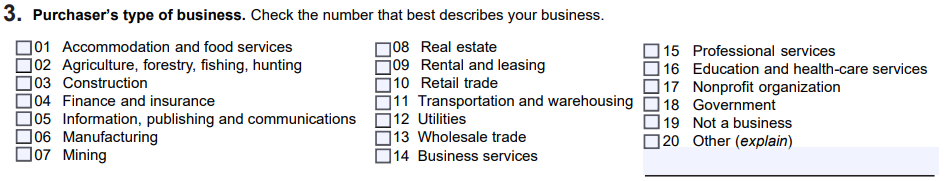

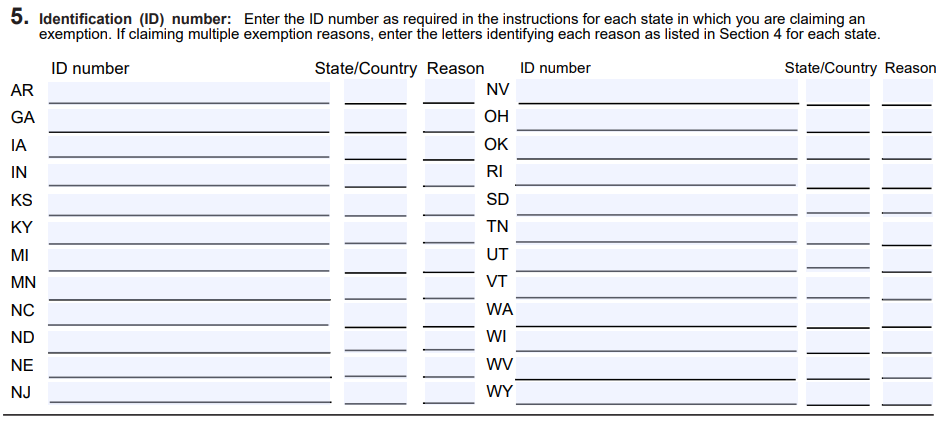

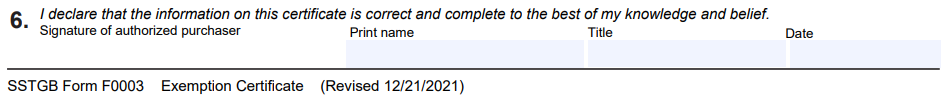

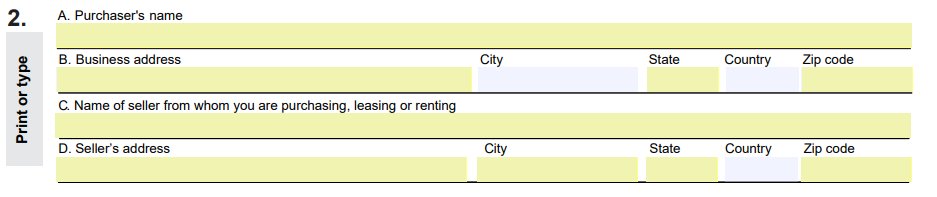

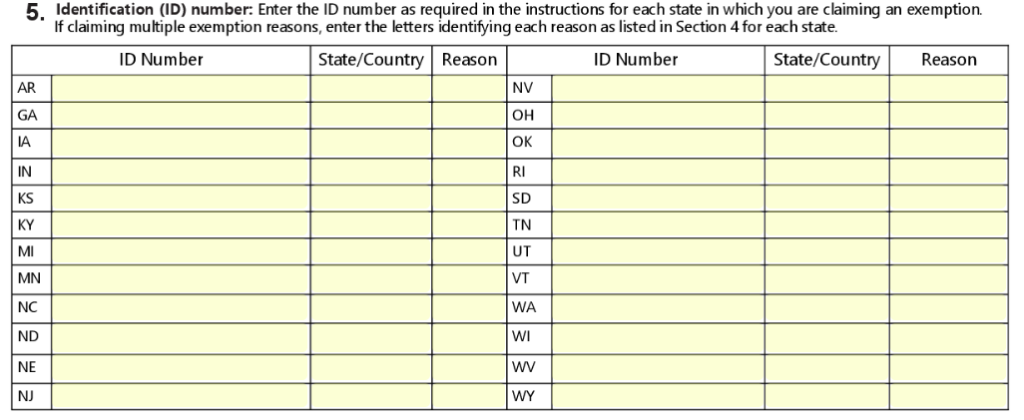

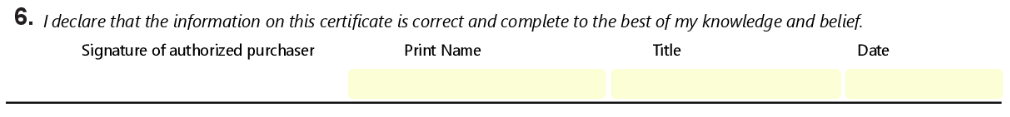

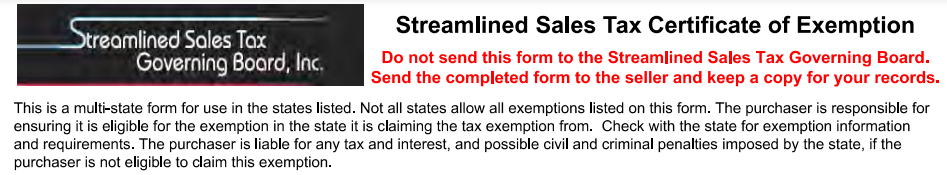

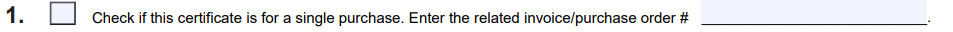

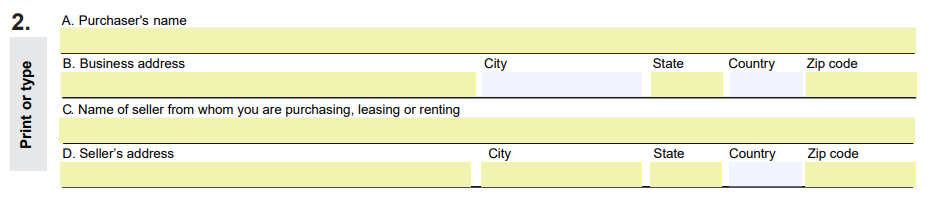

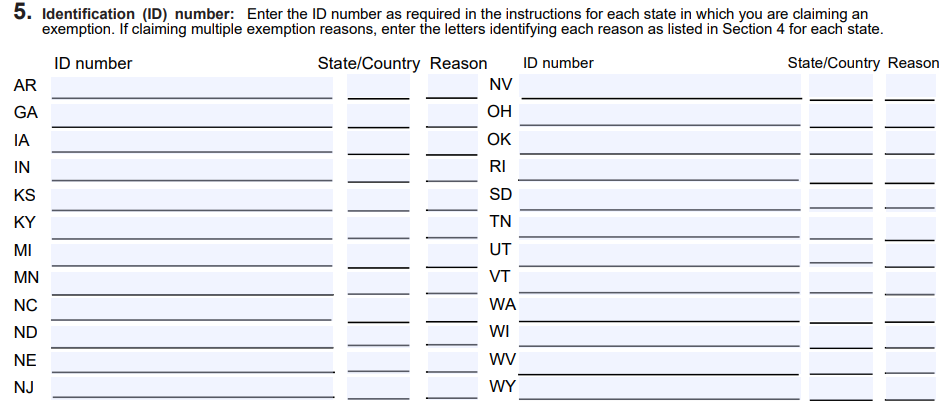

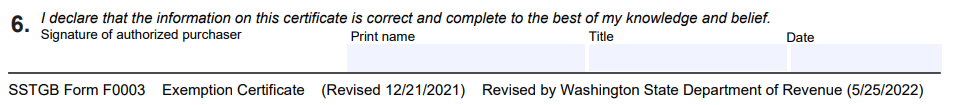

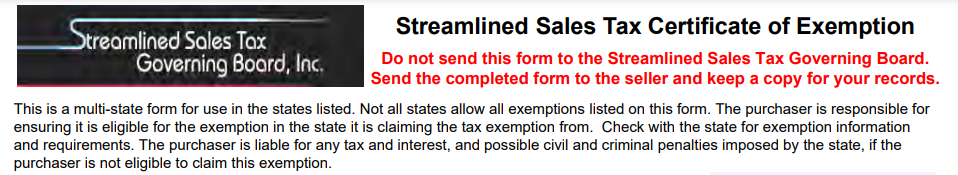

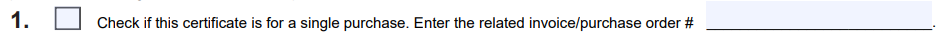

- On the Streamlined Sales and Use Tax page, click the Certificate of Exemption link to download the form.

NOTE: Nebraska is one of a group of states who participate in the Streamlined Sales Tax Governing Board and use the same standardized form.

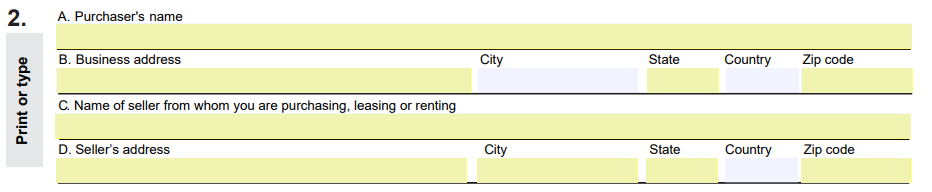

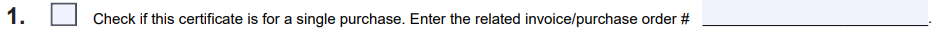

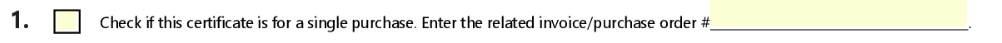

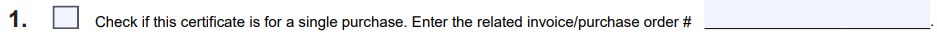

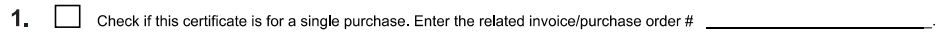

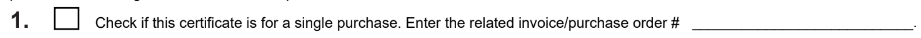

- In the first section, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

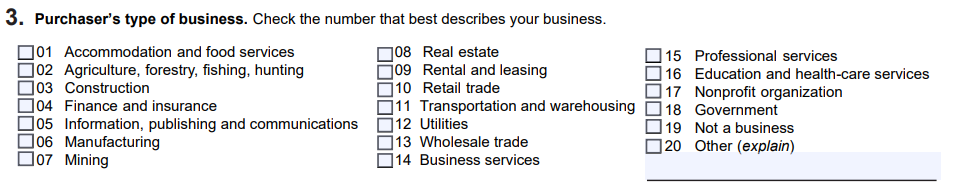

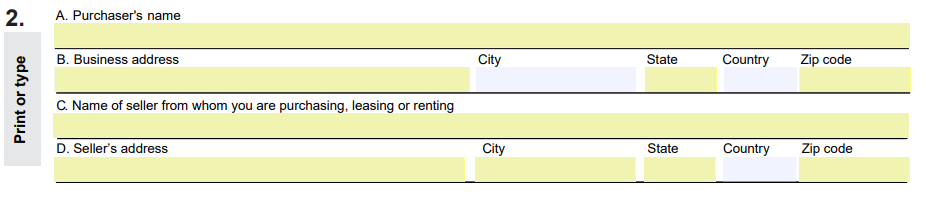

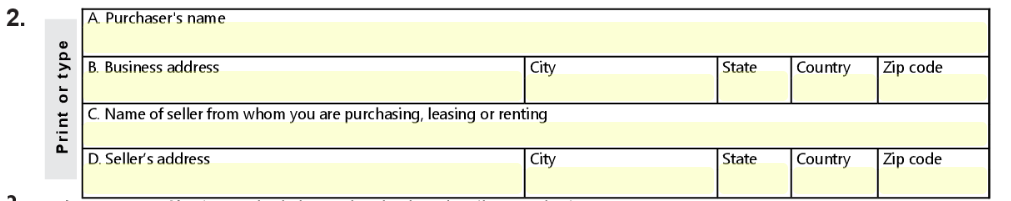

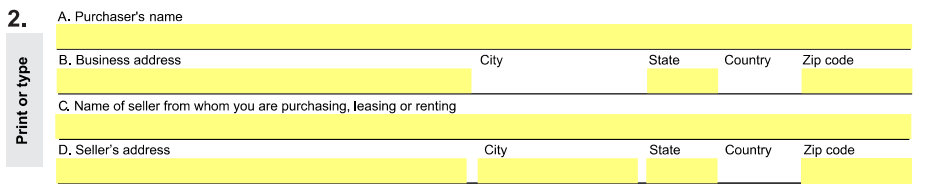

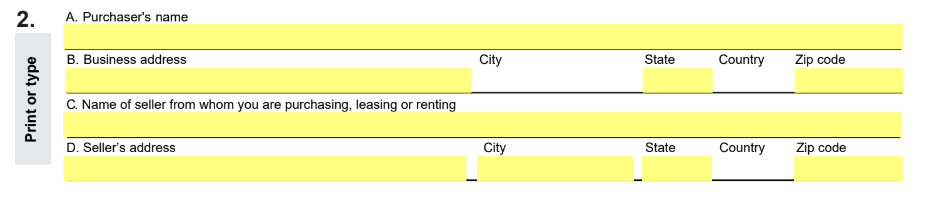

- Next, enter your contact information along with the seller’s.

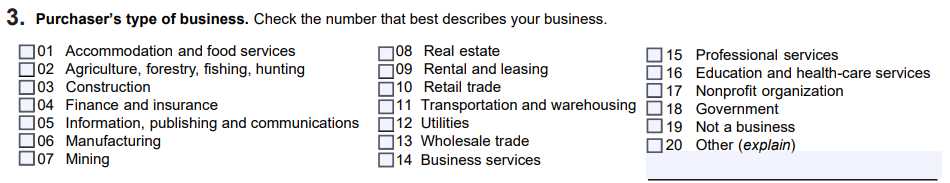

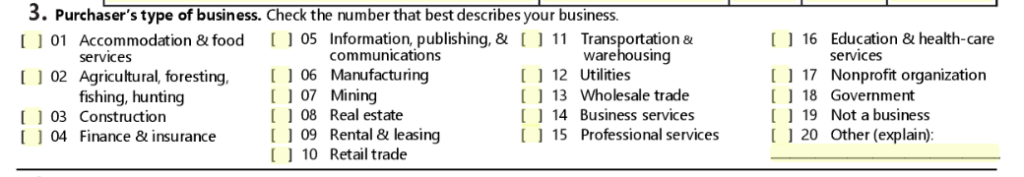

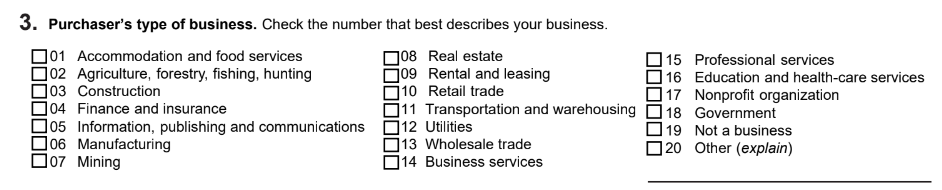

- In the following section, check the box next to the category that best describes your business.

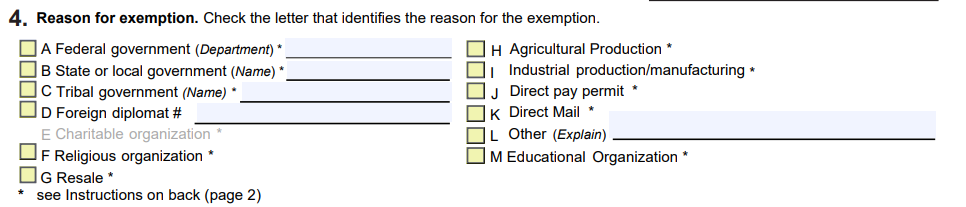

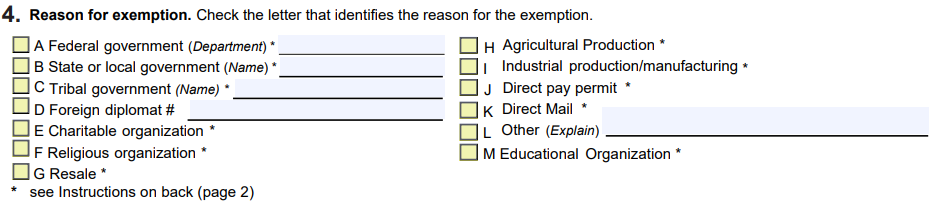

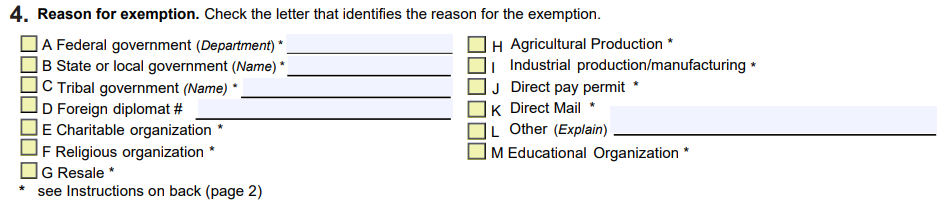

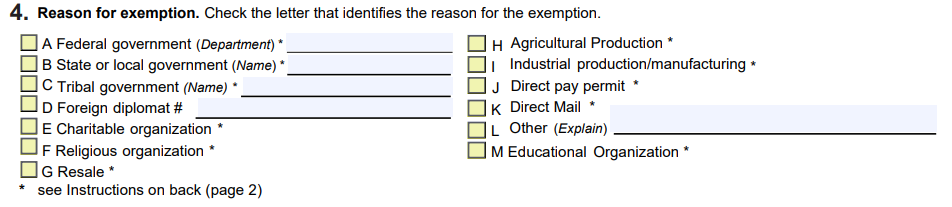

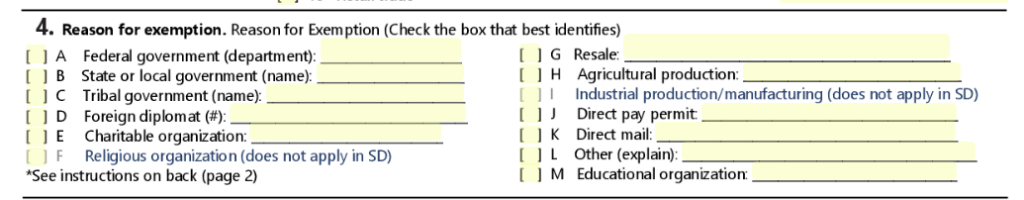

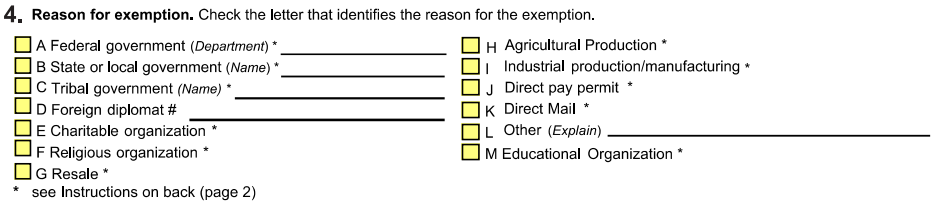

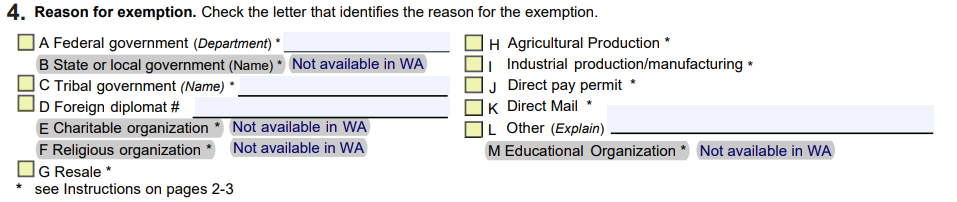

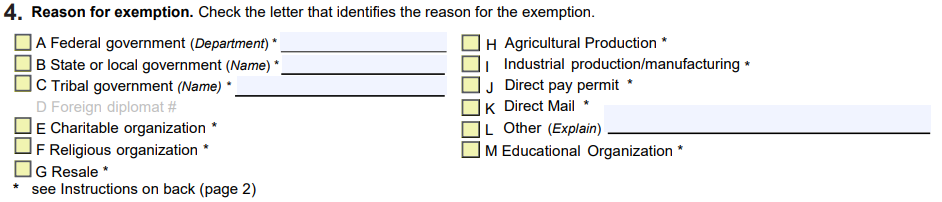

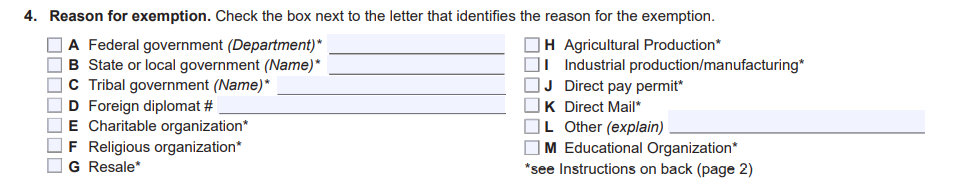

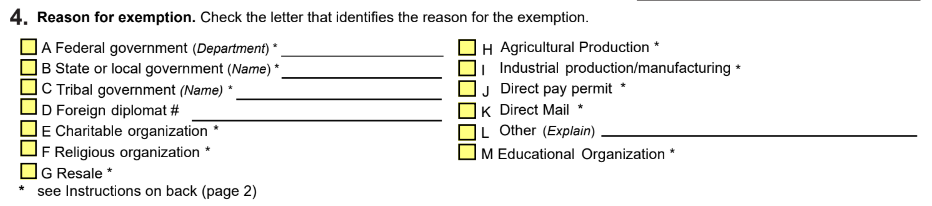

- Under “Reason for exemption”, check the letter that best identifies the reason for the exemption.

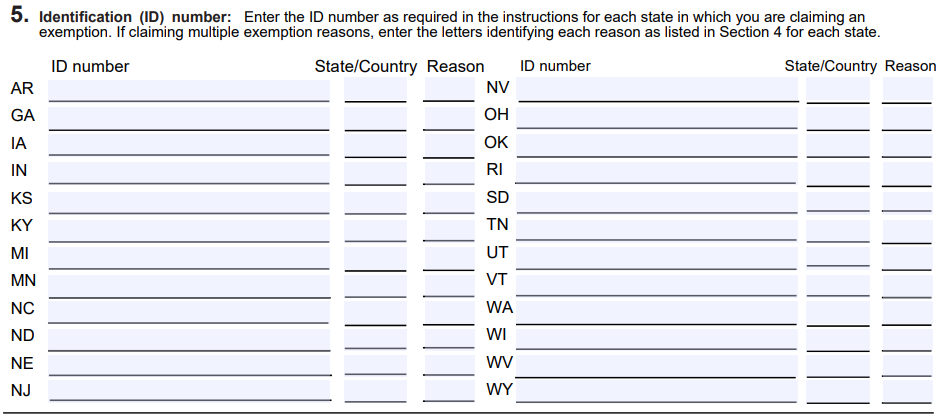

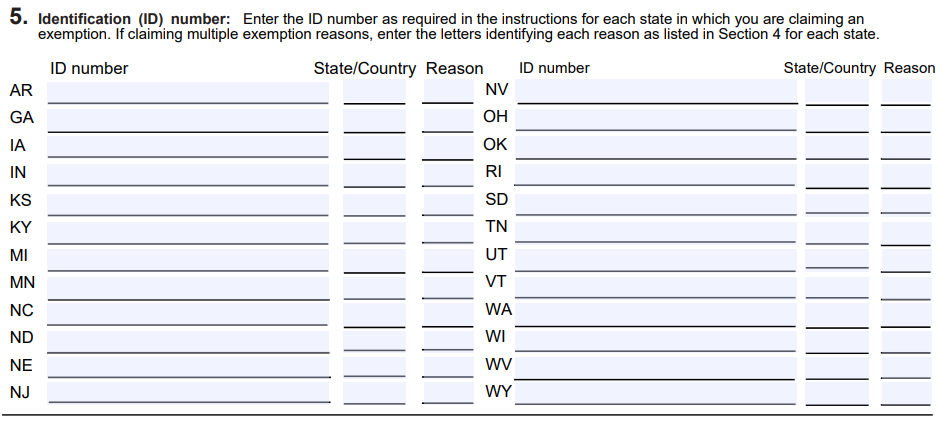

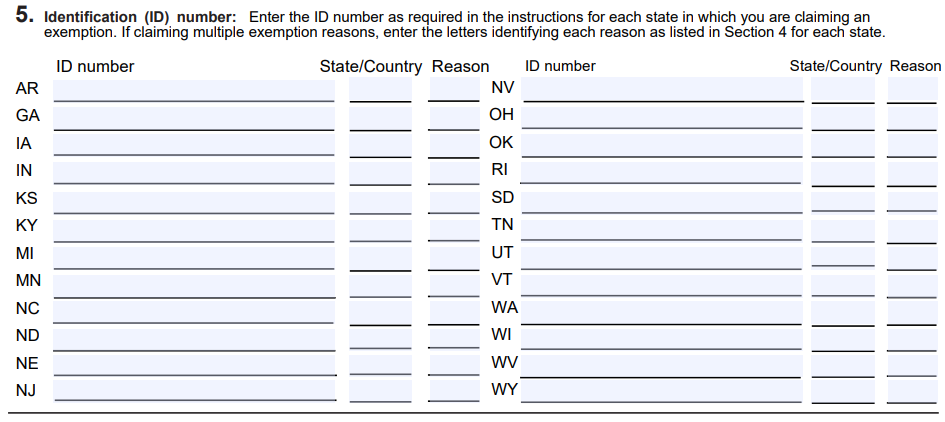

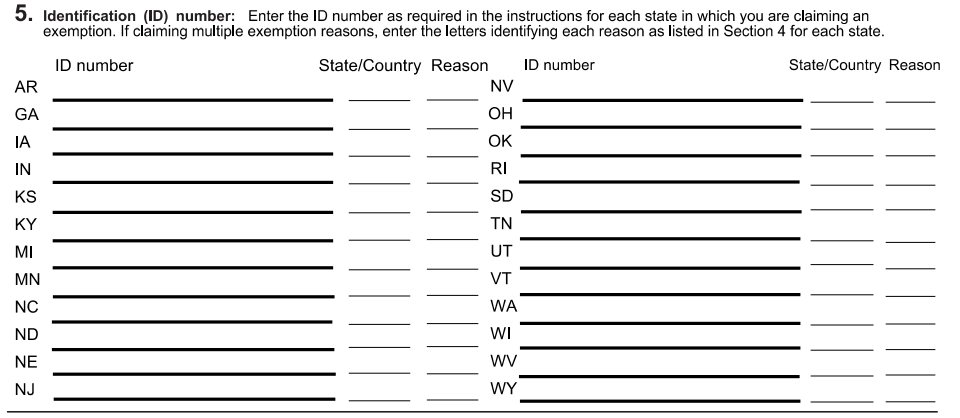

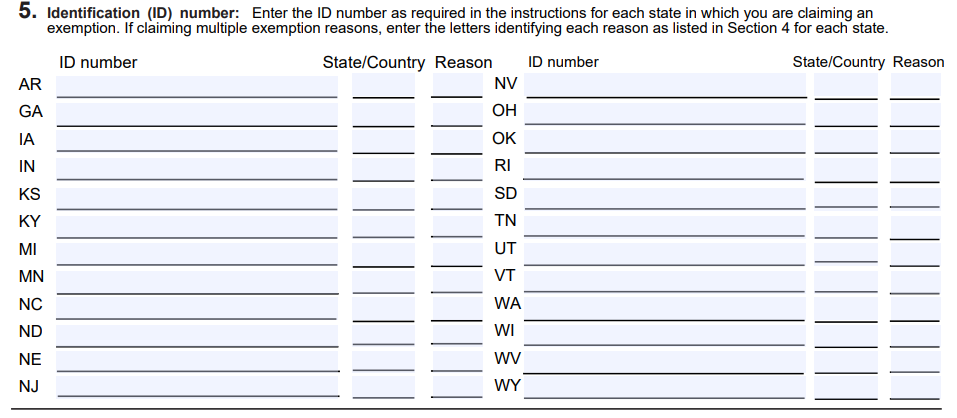

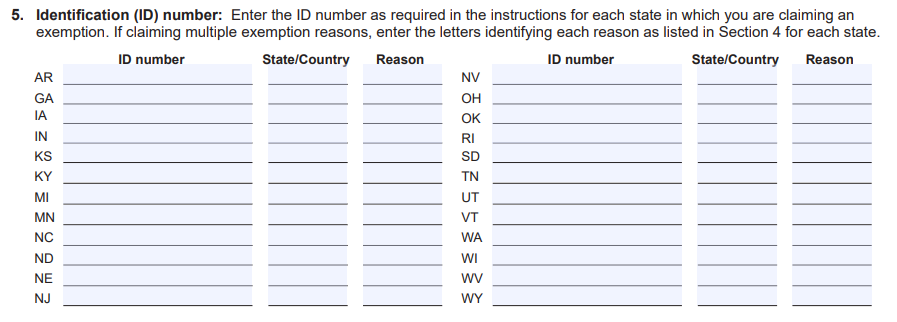

- In the next section, enter the state-appropriate ID number and reasons for exemption.

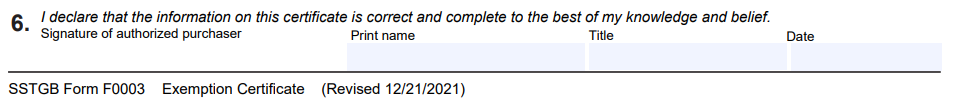

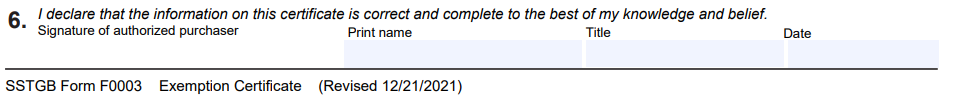

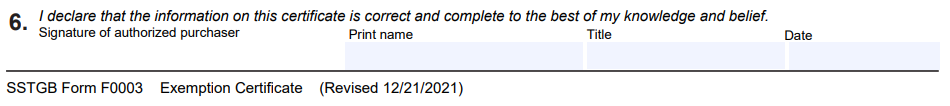

- Lastly, sign and date the form and store in your files.

For assistance, contact the Nebraska Department of Revenue at 402-471-5729.

In Nebraska, certificates of exemption do not expire as long as a purchase is made once every 12 months.

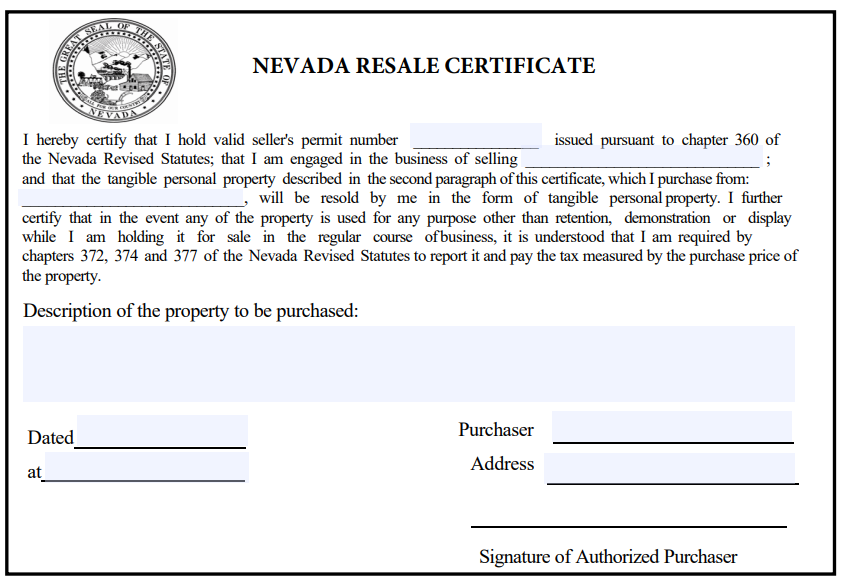

How to Apply for a Resale Certificate in Nevada

In Nevada, you’ll need to obtain the form from the Department of Taxation. The certificate is not filed with the state of Nevada, it’s simply kept on file by the seller.

Start by visiting the website, then follow these simple steps:

- Click on the Resale Certificate link to download the form.

- In the blank spaces, enter the seller’s permit number, the merchandise being sold, and the seller’s name.

- Next, enter a description of the property to be purchased.

- At the bottom of the form, add your name and address.

- Lastly, sign and date the form and keep a copy for your records.

For assistance, contact the Nevada Department of Taxation at 1-866-962-3707.

In Nevada, resale certificates expire after five years. It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

How to Indicate an Intent for Resale in New Hampshire

New Hampshire’s Department of Revenue Administration offers support to any business that experiences resistance from a seller due to not holding and presenting a certificate for resale form.

To prepare to make a purchase intended for resale, here are some steps you can take:

- Visit and review this New Hampshire state webpage.

- Print at least one copy of the page.

- You can now proffer your printed document to any seller who needs verification concerning the issuance of certificates for resale in New Hampshire.

Businesses in New Hampshire can also create a new phone contact for quick and easy access to the number vendors can call for further explication:

If you would like any assistance regarding certificates for resale, you can contact New Hampshire’s Department of Revenue Administration at the number below:

Phone: 603.230.5000

Hours: Monday through Friday, 8:00 AM – 4:30 PM

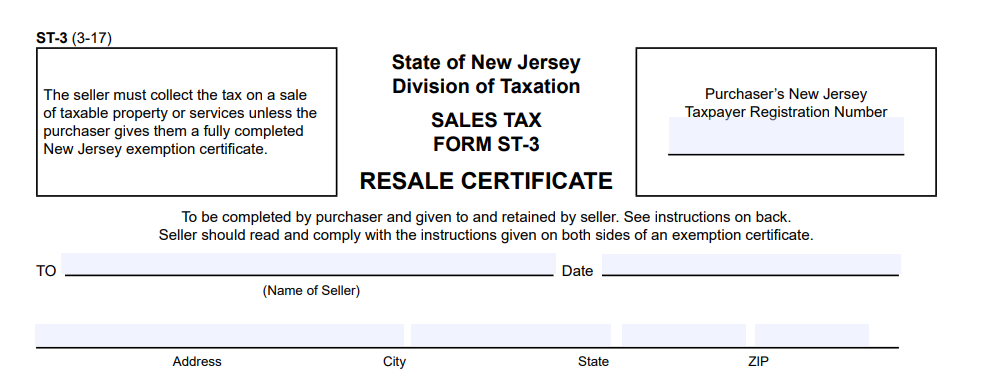

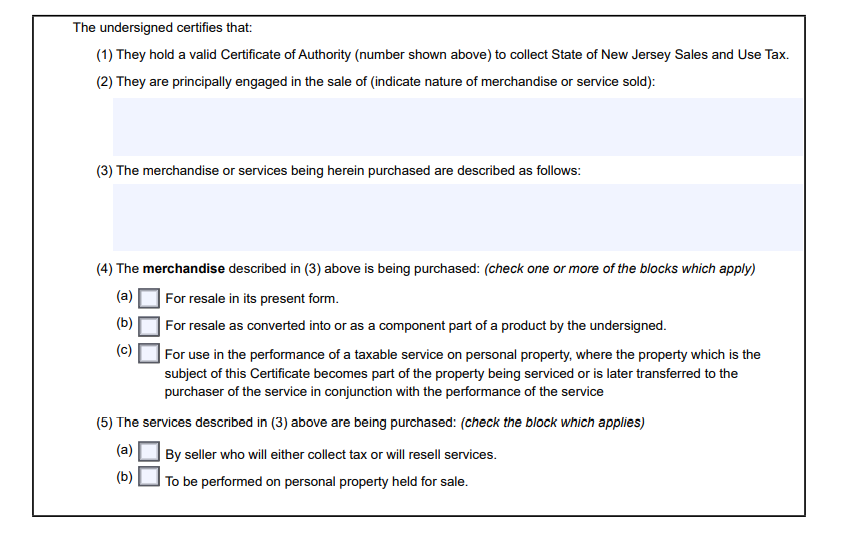

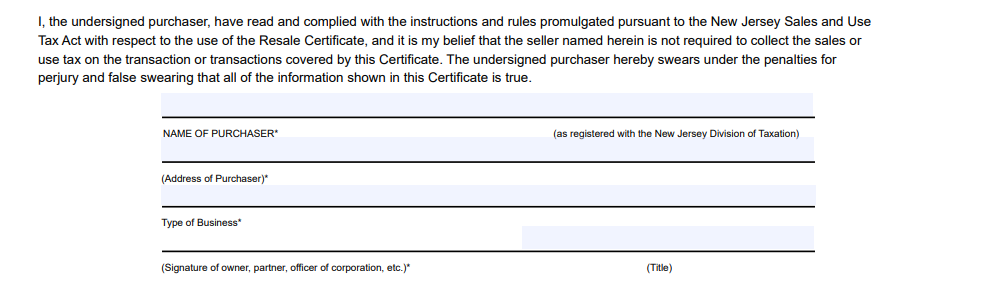

How to Apply for a Resale Certificate in New Jersey

In New Jersey, you’ll need to obtain the form from the Division of Taxation. The certificate is not filed with the state, but simply kept on file by the seller.

Start by visiting the website, then follow these simple steps:

- On the Sales and Use Tax Forms page, scroll down to the For Business Use Only heading, then click on the ST-3 link to download the form.

- At the top of the form, enter your taxpayer registration number and your seller’s contact information.

- In the next section, enter the appropriate information regarding the merchandise.

- Lastly, complete the form by signing your name and entering your business information. Keep a copy for your records.

For assistance, contact the New Jersey Division of Taxation at 609-292-6400.

In New Jersey, resale certificates do not expire unless the business information changes.

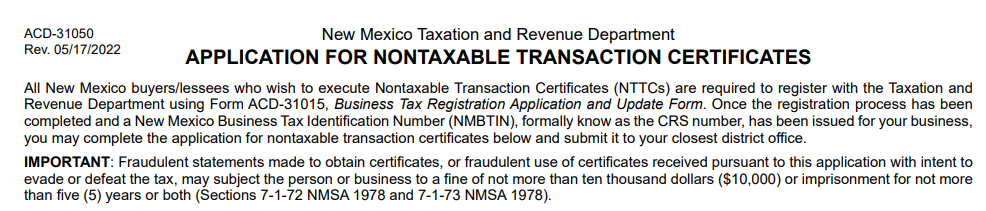

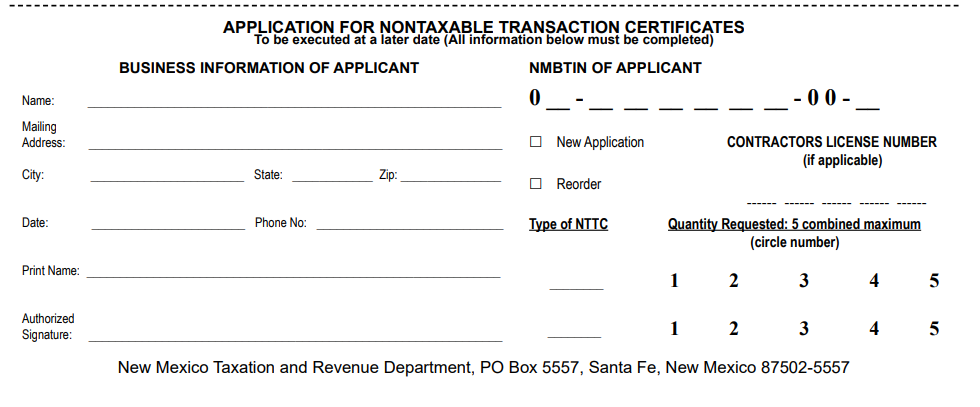

How to Apply for a Non-Taxable Transaction Certificate in New Mexico

In New Mexico, the Taxation & Revenue Department handles the issuance of non-taxable transaction certificates. Start by visiting the website, then follow these simple steps:

- On the Forms and Publications page, search for form ACD-31050 and download the form.

- At the bottom of the form, fill in your vendor’s information.

- Under Types of NTTC, refer to the second page of the form titled Type Descriptions and fill in the appropriate code.

- Lastly, sign and date the form and keep a copy for your records.

For assistance, contact the New Mexico Taxation & Revenue Department at 1-866-285-2996.

In New Mexico, non-taxable transaction certificates do not expire.

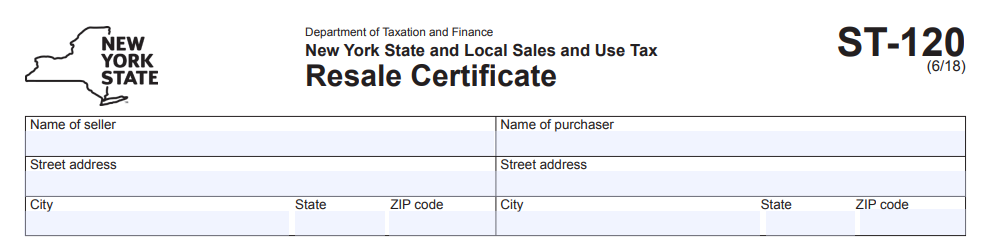

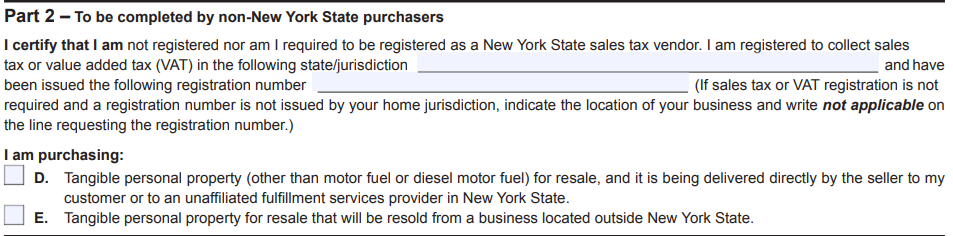

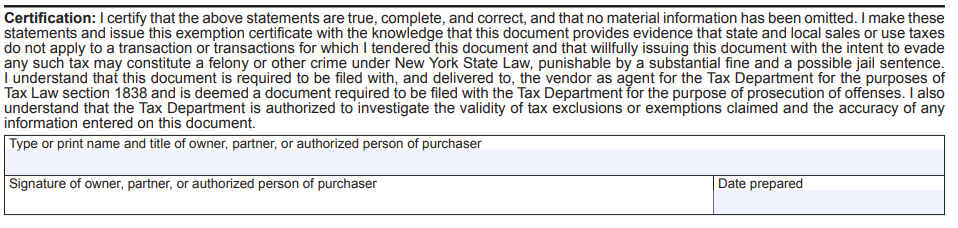

How to Apply for a Resale Certificate in New York

In New York, the Department of Taxation and Finance handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- On the Sales Tax Exemption Documents page, click on the ST-120 link to download the form.

- At the top of the form, enter your contact information as well as the seller’s.

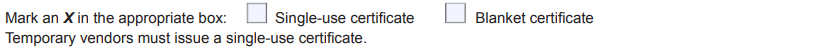

- Next, decide if the form is single-use or a blanket certificate and check the appropriate box.

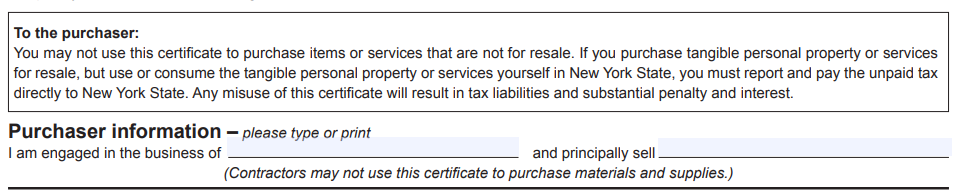

- In the following section, enter your business information.

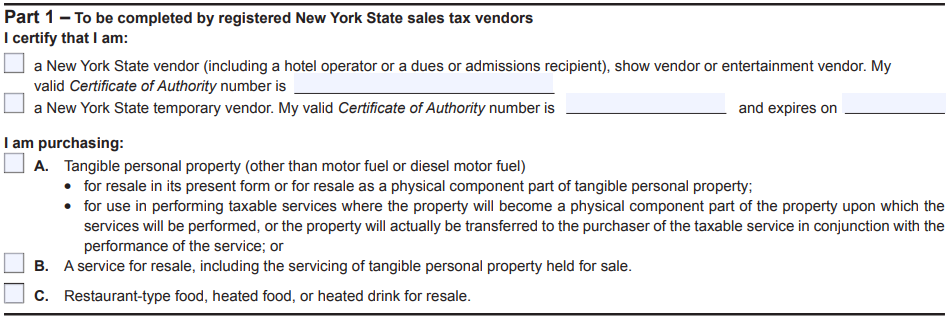

- In Part 1, if the information applies, check the appropriate boxes.

- Part 2 is reserved for non-New York State purchasers. Review and complete this section if it applies to you.

- Lastly, print and sign your name, enter the date, and keep a copy for your records.

For assistance, contact the New York Department of Taxation and Finance at 518-485-2889.

In New York, resale certificates do not expire.

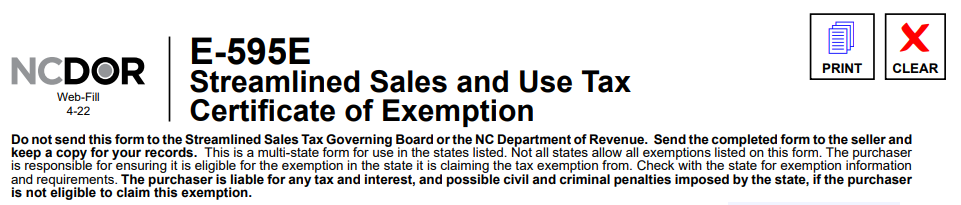

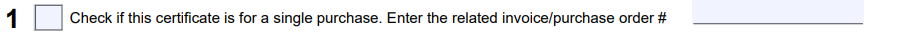

How to Apply for a Certificate of Exemption in North Carolina

In North Carolina, the Department of Revenue handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- On the Sales and Use Tax page, click the Exemption Certificates link, then click the E-595E link to download the form.

NOTE: North Carolina is one of a group of states who participate in the Streamlined Sales Tax Governing Board and use the same standardized form.

- In the first section, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

- Next, enter your contact information along with the seller’s.

- In the following section, check the box next to the category that best describes your business.

- Under “Reason for exemption”, check the letter that best identifies the reason for the exemption.

- In the next section, enter the state-appropriate ID number and reasons for exemption.

- Lastly, sign and date the form and store in your files.

For assistance, contact the North Carolina Department of Revenue at 1-877-252-3052.

In North Carolina, certificates of exemption do not expire as long as the certificate is a blanket exemption and at least one purchase is made within 12 months.

How to Apply for a Certificate of Exemption in North Dakota

In North Dakota, the Office of State Tax Commissioner handles the issuance of certificates of exemption. Start by visiting the website, then follow these simple steps:

- On the Forms page, scroll down to the Sales and Use Tax Forms heading and click on the Streamlined Sales Tax Certificate of Exemption link to download the form.

NOTE: North Carolina is one of a group of states who participate in the Streamlined Sales Tax Governing Board and use the same standardized form.

- In the first section, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

- Next, enter your contact information along with the seller’s.

- In the following section, check the box next to the category that best describes your business.

- Under “Reason for exemption”, check the letter that best identifies the reason for the exemption.

- In the next section, enter the state-appropriate ID number and reasons for exemption.

- Lastly, sign and date the form and store in your files.

For assistance, contact the North Dakota Office of State Tax Commissioner at 701-328-7088.

In North Dakota, certificates of exemption do not expire.

How to Apply for a Certificate of Exemption in Ohio

In Ohio, the resale certificate is known as the certificate of exemption and you’ll need to obtain the form from the Department of Taxation. The certificate is not filed with the state of Ohio, it’s simply kept on file by the seller and presented to vendors.

Start by visiting the website, then follow these simple steps:

- On the Exemption Certificate Forms page, scroll down to item 12. Click on the Streamlined Sales Tax System Certificate of Exemption link and download the form.

NOTE: Ohio is one of a group of states who participate in the Streamlined Sales Tax Governing Board and use the same standardized form.

- In the first section, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

- Next, enter your contact information along with the seller’s.

- In the following section, check the box next to the category that best describes your business.

- Under “Reason for exemption”, check the letter that best identifies the reason for the exemption.

- In the next section, enter the state-appropriate ID number and reasons for exemption.

- Lastly, sign and date the form and store it in your files.

For assistance, contact the Ohio Department of Taxation at 1-888-405-4039.

In Ohio, certificates of exemption do not expire.

How to Apply for a Certificate of Exemption in Oklahoma

In Oklahoma, the Tax Commission handles the issuance of certificates of exemption. Start by visiting the website, then follow these simple steps:

- On the Forms page, search for the Streamlined Certificate of Exemption and download the form.

NOTE: Oklahoma is one of a group of states who participate in the Streamlined Sales Tax Governing Board and use the same standardized form.

- In the first section, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

- Next, enter your contact information along with the seller’s.

- In the following section, check the box next to the category that best describes your business.

- Under “Reason for exemption”, check the letter that best identifies the reason for the exemption.

- In the next section, enter the state-appropriate ID number and reasons for exemption.

- Lastly, sign and date the form and store in your files.

For assistance, contact the Oklahoma Tax Commission at (405) 521-3160.

In Oklahoma, the certificate of exemption does not expire.

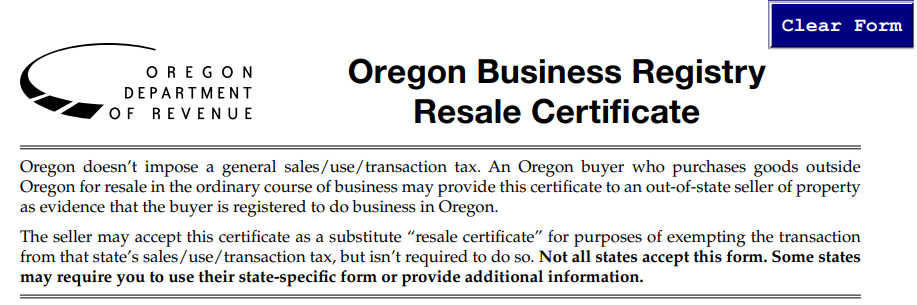

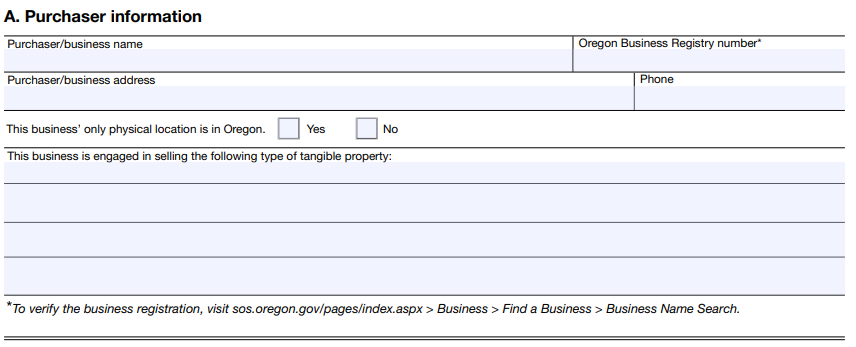

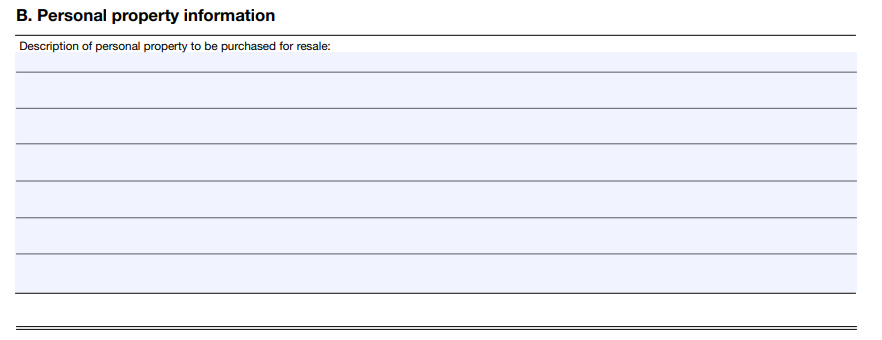

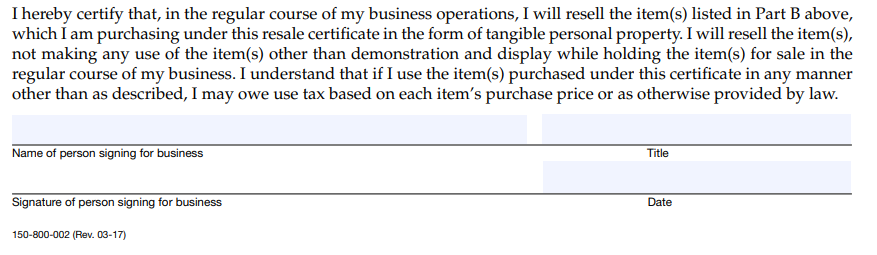

How to Apply for a Resale Certificate in Oregon

In Oregon, the Department of Revenue handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- On the Sales Tax page, click on the Oregon Business Registry Resale Certificate link to download the form.

- In the first section, enter the purchaser information, including the Oregon Business Registry number.

- Next, enter a description of the property to be purchased for resale.

- Lastly, sign and date the form and keep a copy for your records.

For assistance, contact the Oregon Department of Revenue at 503-378-4988 or [email protected].

In Oregon, resale certificates do not expire as long as all company information on the certificate is valid.

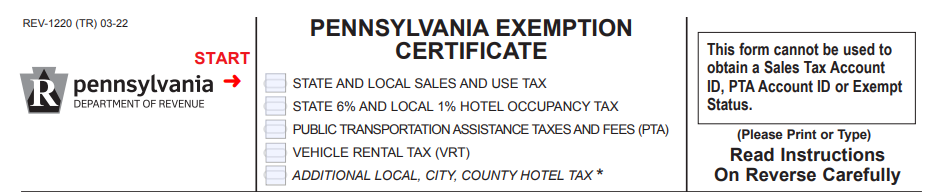

How to Apply for an Exemption Certificate in Pennsylvania

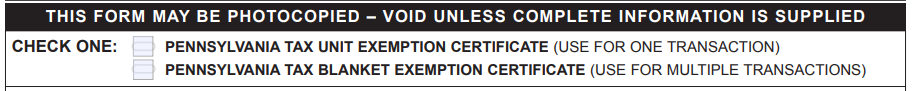

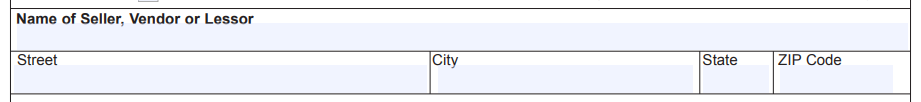

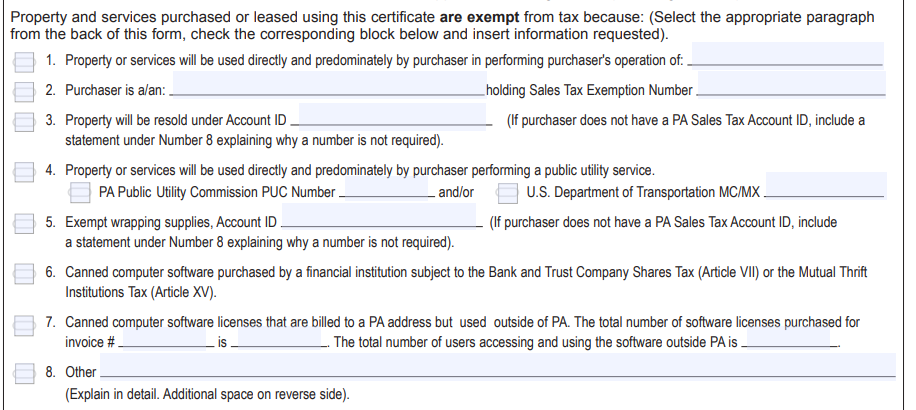

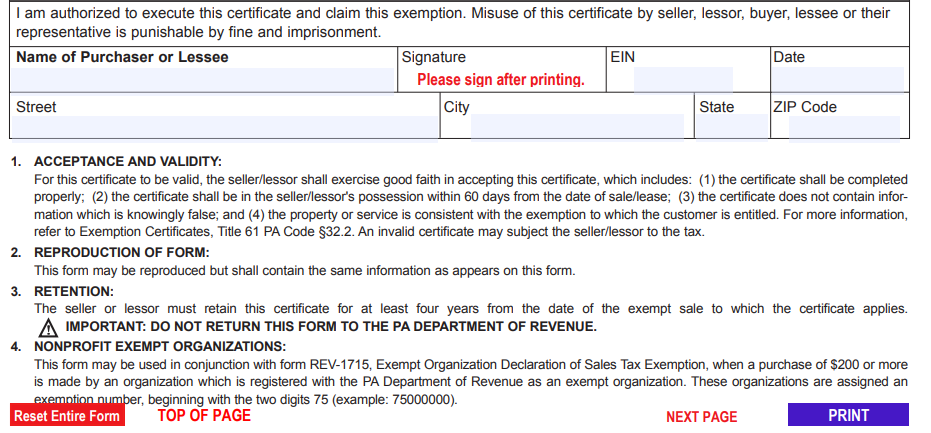

In Pennsylvania, the Department of Revenue handles the issuance of exemption certificates. Start by visiting the website, then follow these simple steps:

- On the Sales, Use and Hotel Occupancy Tax Forms page, scroll down and click on the REV-1220 Pennsylvania Exemption Certificate link to download the form.

- At the top of the form, check the appropriate box.

- Next, choose whether the form is for one-time use or a blanket exemption and check the appropriate box.

- In the next section, enter the seller’s contact information.

- In the next section, check any box that applies and fill in the blank spaces with the appropriate information.

- Finally, sign the form at the bottom and enter your contact information. Click “print” and save a copy for your records.

For assistance, contact the Pennsylvania Department of Revenue at 717-787-1064.

In Pennsylvania, exemption certificates do not expire.

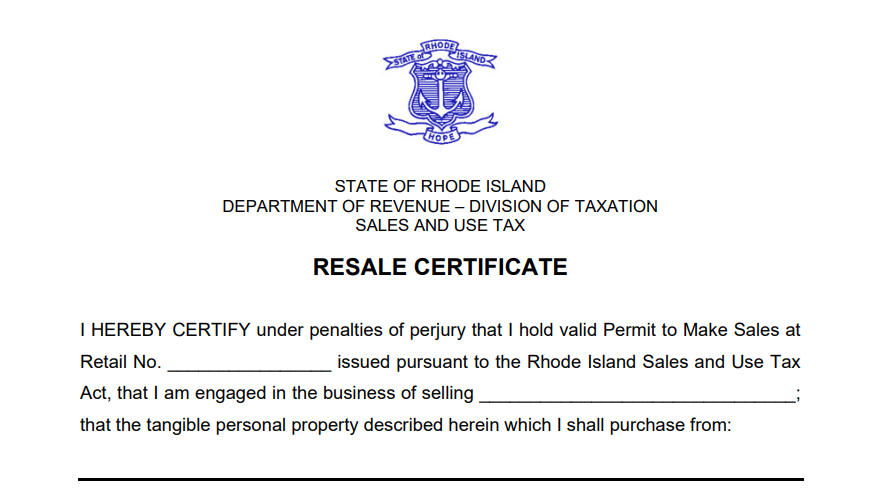

How to Apply for a Resale Certificate in Rhode Island

In Rhode Island, the Division of Taxation handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- On the Sales & Excise Forms page, scroll down and click the Resale Certificate link to download the form.

- In the first section, enter your buyer’s retail permit number, what the buyer’s business sells, and your seller’s name.

- Next, enter a description of the property to be purchased, the name of the purchaser, and address.

4. Lastly, sign and date the form and keep a copy for your records.

For assistance, contact the Rhode Island Division of Taxation at (401) 574-8829.

In Rhode Island, resale certificates expire after four years. It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

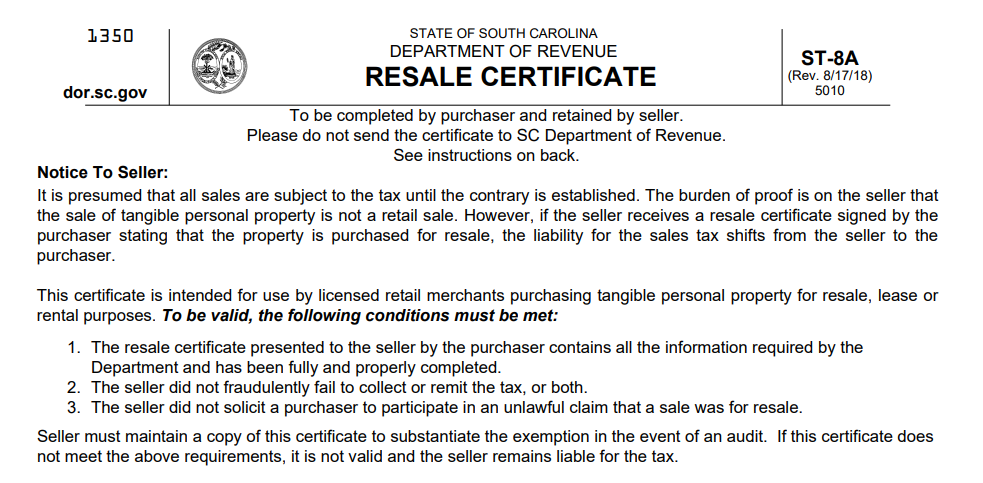

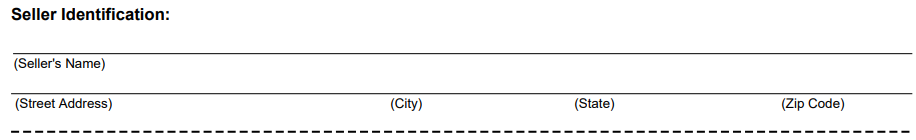

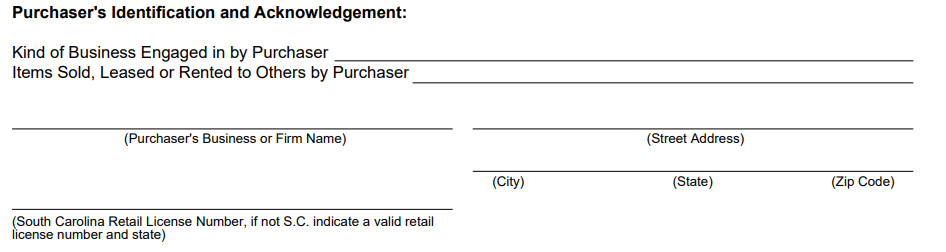

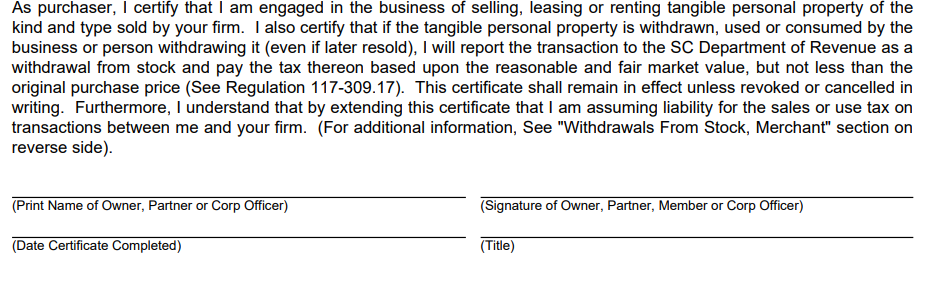

How to Apply for a Resale Certificate in South Carolina

In South Carolina, the Department of Revenue handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- On the Sales page, click Forms on the left hand side, then click the ST-8A link next to Resale Certificate to download the form.

- Under Seller Identification, enter your seller’s contact information.

- Fill in the next section with your business information and state retail license number.

- Lastly, sign and date your form and keep a copy for your records.

For assistance, contact the South Carolina Department of Revenue at 1-844-898-8542.

In South Carolina, resale certificates do not expire as long as your business is in operation.

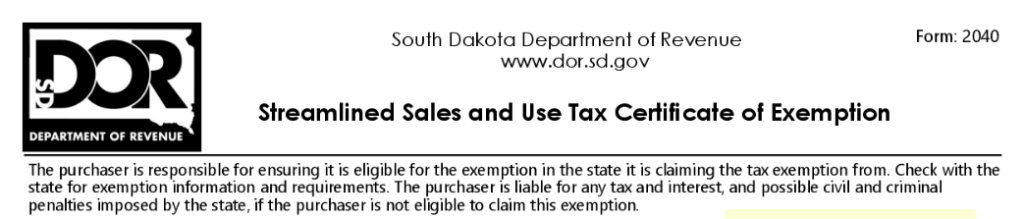

How to Apply for a Certificate of Exemption in South Dakota

In South Dakota, the Department of Revenue handles the issuance of certificates of exemption. Start by visiting the website, then follow these simple steps:

- Under the “Quick Navigation” menu, click on Exemption Certificate to download the form.

NOTE: South Dakota is one of a group of states who participate in the Streamlined Sales Tax Governing Board and use the same standardized form.

- In the first section, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

- Next, enter your contact information along with the seller’s.

- In the following section, check the box next to the category that best describes your business.

- Under “Reason for exemption”, check the letter that best identifies the reason for the exemption.

- In the next section, enter the state-appropriate ID number and reasons for exemption.

- Lastly, sign and date the form and store in your files.

For assistance, contact the South Dakota Department of Revenue at 1.800.829.9188.

In South Dakota, certificates of exemption do not expire unless the information on the certificate changes. It is recommended that businesses keep all certificates on file for at least three years.

How to Apply for a Certificate of Exemption in Tennessee

In Tennessee, the Department of Revenue handles the issuance of certificates of exemption. Start by visiting the website, then follow these simple steps:

- On the Sales and Use Tax Forms page, scroll down to the Exemptions heading. Click on the Streamlined Sales and Use Tax Certificate of Exemption and Instructions link to download the form.

NOTE: Tennessee is one of a group of states who participate in the Streamlined Sales Tax Governing Board and use the same standardized form.

- In the first section, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

- Next, enter your contact information along with the seller’s.

- In the following section, check the box next to the category that best describes your business.

- Under “Reason for exemption”, check the letter that best identifies the reason for the exemption.

- In the next section, enter the state-appropriate ID number and reasons for exemption.

- Lastly, sign and date the form and store in your files.

For assistance, contact the Tennessee Department of Revenue at (800) 342-1003.

In Tennessee, certificates of exemption do not expire.

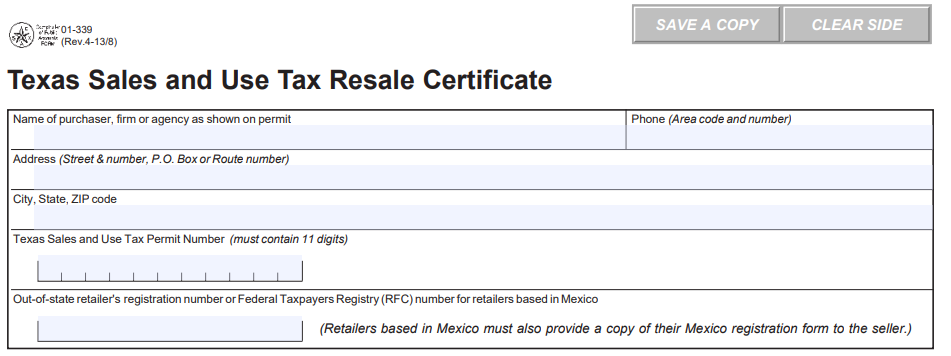

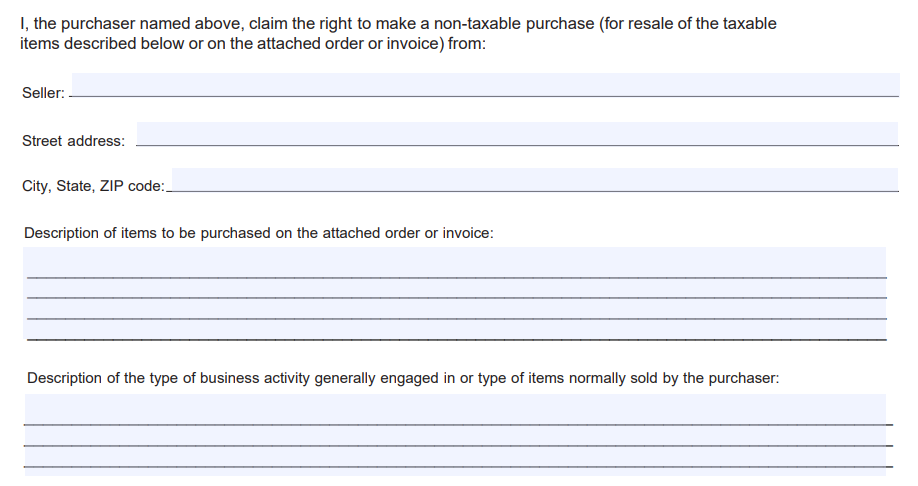

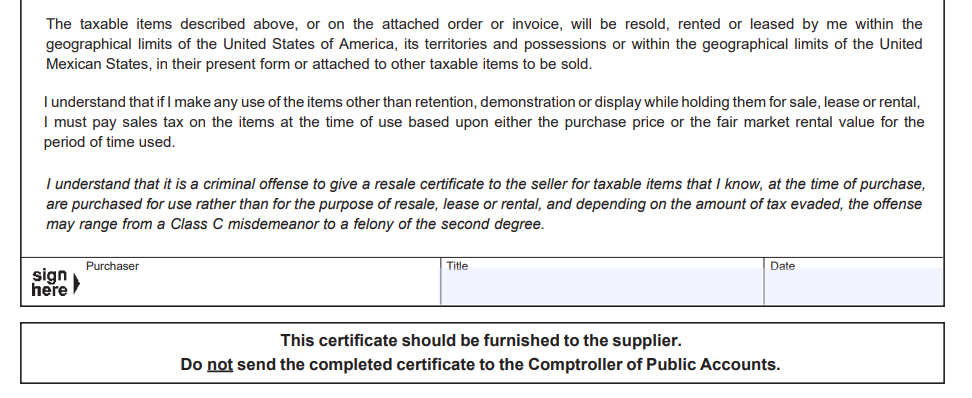

How to Apply for a Resale Certificate in Texas

In Texas, the Comptroller handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- On the Sales and Use Tax Forms page, scroll down to Resale and Exemption Certificates and click the 01-339 link to download the form.

- First, enter your business contact information, including your Texas Sales and Use Tax Permit Number.

- Next, enter your seller’s information, along with a description of the purchased items and business activity.

- Lastly, sign and date the form and keep a copy for your records.

For assistance, contact the Texas Comptroller at 800-252-5555.

In Texas, resale certificates do not expire.

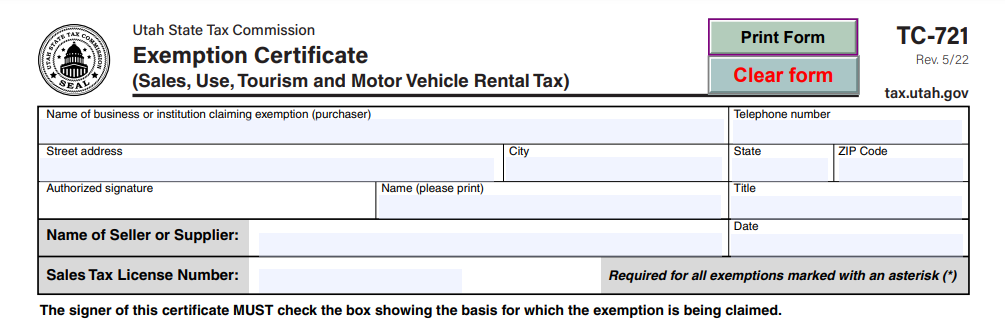

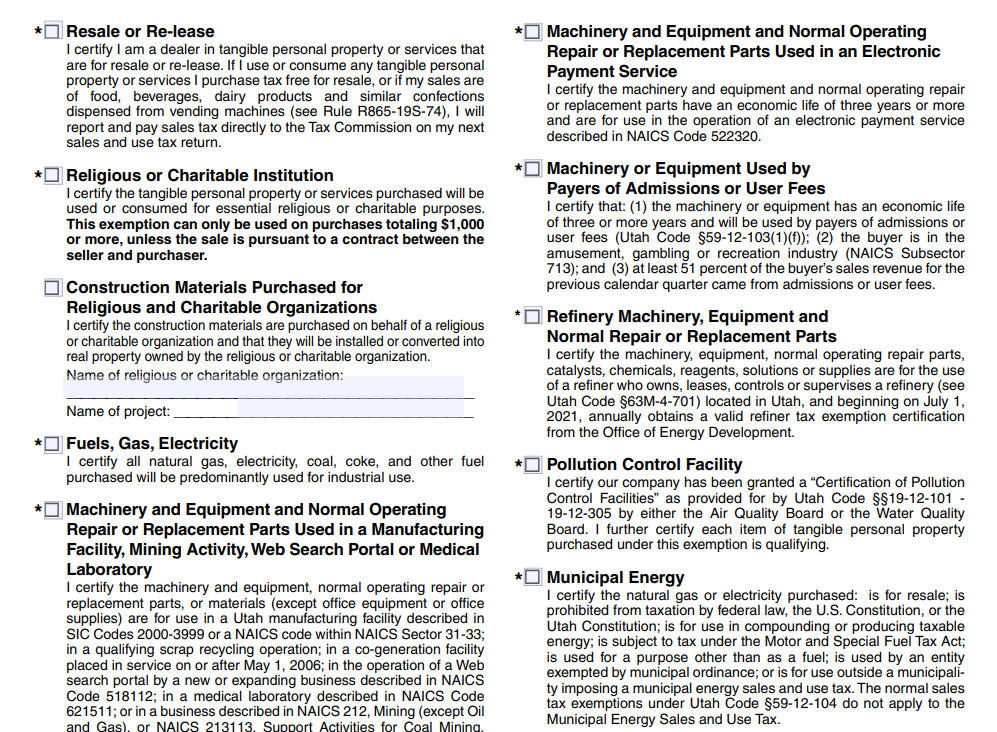

How to Apply for an Exemption Certificate in Utah

In Utah, the State Tax Commission handles the issuance of exemption certificates. Start by visiting the website, then follow these simple steps:

- Under the “What is an exemption certificate” heading, click on the TC-721 link to download the form.

- In the top section, enter your contact information along with the sellers. NOTE: in other states, the signature field is at the bottom of the form. In Utah’s, it is in this top section.

- The remainder of the form contains a series of checkboxes which may or may not apply to your business needs. Review the boxes and check them off as appropriate.

- Lastly, at the bottom of the form, click “print” to print a hard copy or save to your computer.

For assistance, contact the Utah State Department by phone at 801-297-2200 or by email at [email protected].

In Utah, exemption certificates are good as long as the buyer makes at least one purchase every 12 months.

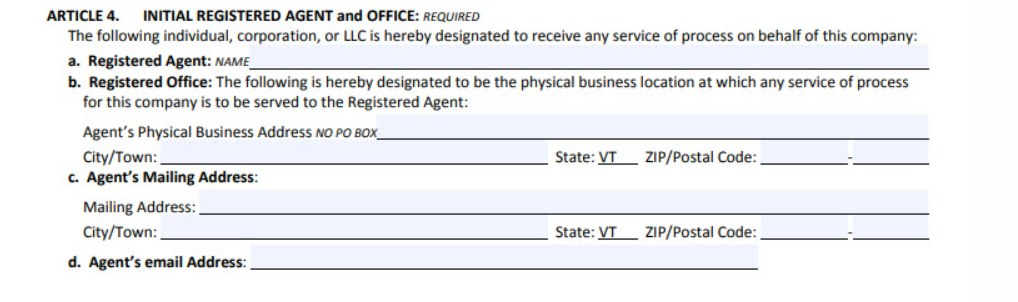

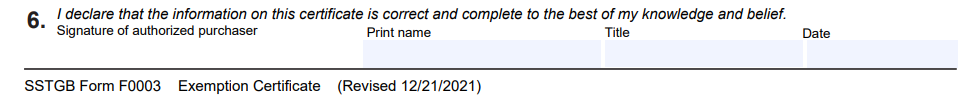

How to Apply for a Resale Certificate in Vermont

In Vermont, the Department of Taxes handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

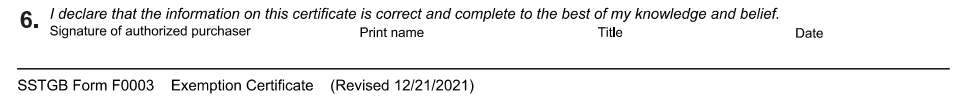

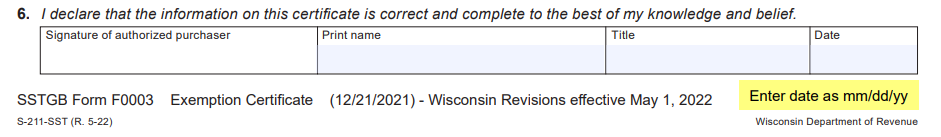

- Under the Forms and Documents section, click on the F0003 link to download the Streamlined Exemption Certificate.

NOTE: Vermont is one of a group of states who participate in the Streamlined Sales Tax Governing Board and use the same standardized form.

- In the first section, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

- Next, enter your contact information along with the seller’s

- In the following section, check the box next to the category that best describes your business.

- Under “Reason for exemption”, check the letter that best identifies the reason for the exemption.

- In the next section, enter the state-appropriate ID number and reasons for exemption.

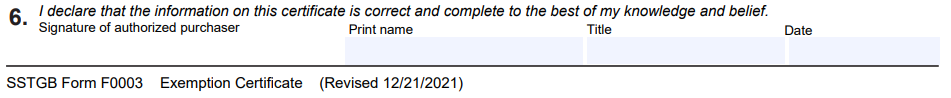

- Lastly, sign and date the form and store in your files.

For assistance, contact the Vermont Department of Taxes at (802) 828-2551.

In Vermont, the certificate of exemption does not expire.

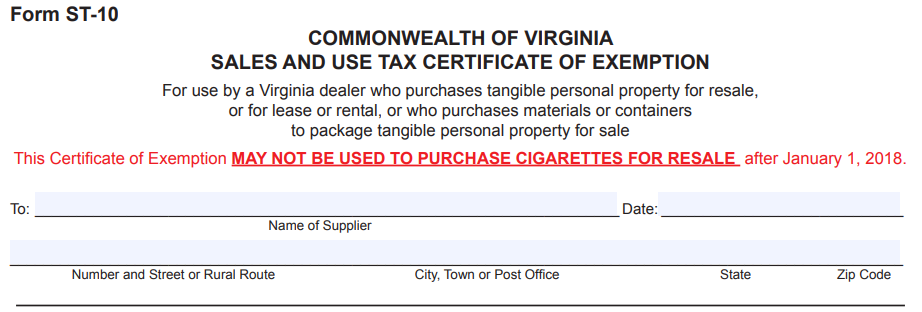

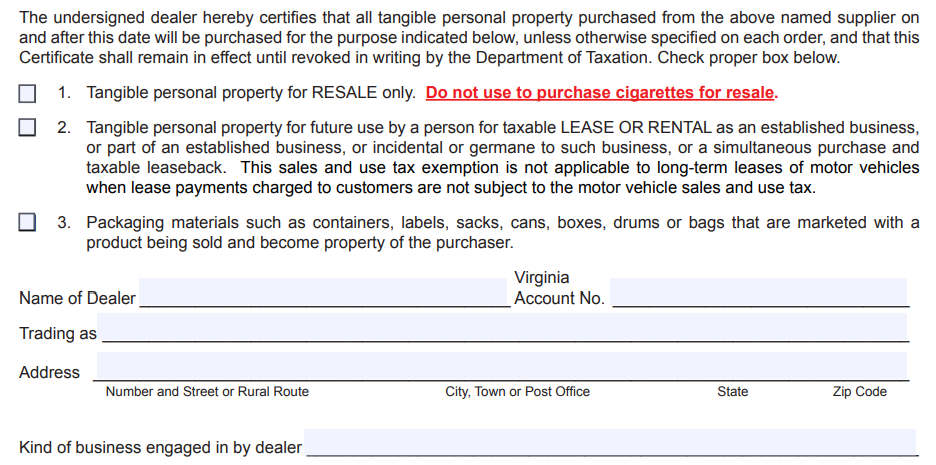

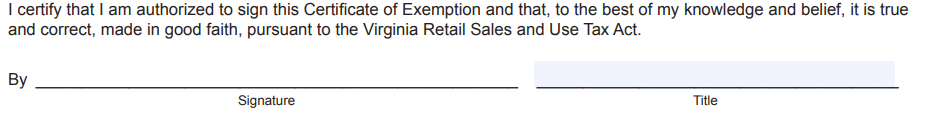

How to Apply for a Certificate of Exemption in Virginia

In Virginia, the Department of Taxation handles the issuance of certificates of exemption. Start by visiting the website, then follow these simple steps:

- On the Forms page, scroll down and click the ST-10 link to download the form.

- In the first section, enter the supplier information.

- Next, check the box most appropriate to the purchased goods and enter your seller’s information.

- Lastly, sign the form, provide your title, and keep a copy for your records.

For assistance, contact the Virginia Department of Taxation at 804.367.8037.

In Virginia, certificates of exemption do not expire.

How to Apply for a Resale Certificate in Washington

In Washington, the Department of Revenue handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- From the menu on the right hand side of the webpage, click the Exemption Certificate link to download the form.

NOTE: Washington is part of a group of states who participate in the Streamlined Sales Tax Governing Board who all use the same standardized form.

- In the first section, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

- Next, enter your contact information along with the seller’s

- In the following section, check the box next to the category that best describes your business.

- Under “Reason for exemption”, check the letter that best identifies the reason for the exemption. NOTE: some of the reasons for exemption in other states are unavailable in Washington.

- In the next section, enter the state-appropriate ID number and reasons for exemption.

- Lastly, sign and date the form and keep it on file.

For assistance, contact the Washington Department of Revenue at 360-705-6705.

In general, resale certificates in Washington expire after four years. Certificates are only valid for two years if any of the following apply:

- Your business is less than 12 months old

- You haven’t reported gross income within the last 12 months

- Your business wasn’t active at the time your certificate was received

- You haven’t filed tax returns in the last 12 months

- You are a contractor

It’s best to create calendar reminders so you’re aware when expirations are coming up to ensure you’re able to apply for renewal in time and run your business without interruption.

How to Apply for a Resale Certificate in West Virginia

In West Virginia, the State Tax Department handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- Under the “Documents” heading, click on the F0003 Streamlined Sales and Use Tax Agreement – Certificate of Exemption link and download the form.

NOTE: West Virginia is part of a group of states who participate in the Streamlined Sales Tax Governing Board who all use the same standardized form.

- In the first section, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

- Next, enter your contact information along with the seller’s

- In the following section, check the box next to the category that best describes your business.

- Under “Reason for exemption”, check the letter that best identifies the reason for the exemption.

- In the next section, enter the state-appropriate ID number and reasons for exemption.

- Lastly, sign and date the form and keep on file.

For assistance, contact the West Virginia State Tax Department at (304) 558-3333 or (800) 982-8297.

In West Virginia, blanket certificates are good as long as the buyer makes at least one purchase every

12 months. Your certificate will be considered a blanket certificate as long as you don’t check the box on the form indicating it’s for a single purchase.

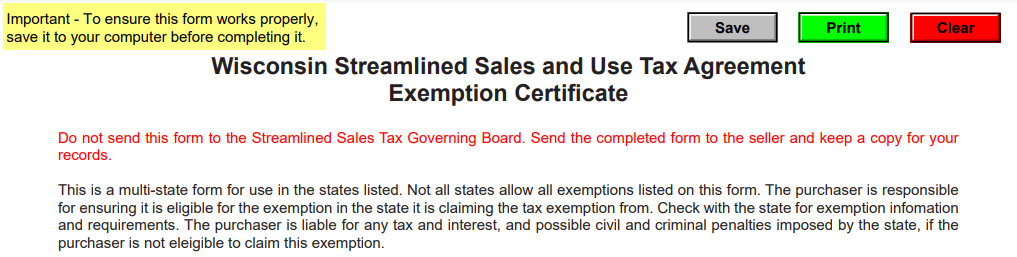

How to Apply for a Resale Certificate in Wisconsin

In Wisconsin, the Department of Revenue handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- To download the form, click on the S-211-SST form link.

NOTE: Wisconsin is one of a group of states who participate in the Streamlined Sales Tax Governing Board and use the same standardized form.

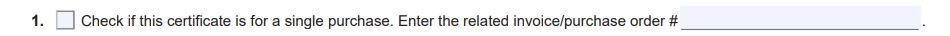

- In the first section, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

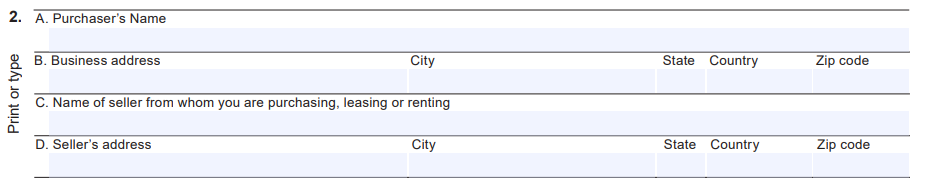

- Next, enter your contact information along with the seller’s.

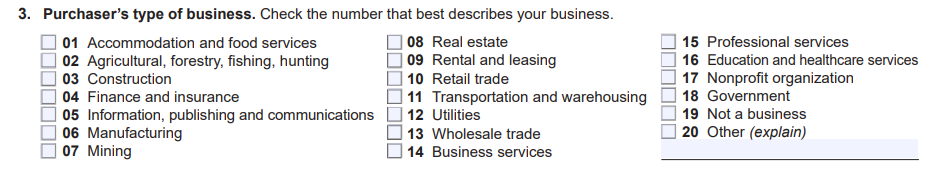

4. In the following section, check the box next to the category that best describes your business.

5. Under “Reason for exemption”, check the letter that best explains your exemption.

6. In the next section, enter the state-appropriate ID number and reasons for exemption.

7. Lastly, sign and date the form and keep it on file.

You can also complete the form online and submit either an electronic or printed copy to your vendor. For assistance, contact the Wisconsin Department of Revenue at (608) 266-2776.

In Wisconsin, the certificate of exemption does not expire.

How to Apply for a Resale Certificate in Wyoming

In Wyoming, the Department of Revenue handles the issuance of resale certificates. Start by visiting the website, then follow these simple steps:

- Look for the heading “Exemption Certificate Power of Attorney Forms” and click on “SSTP Certificate of Exemption”.

- Download the Streamlined Sales Tax Certificate of Exemption.

NOTE: Wyoming is part of a group of states who participate in the Streamlined Sales Tax Governing Board who all use the same standardized form.

- In the first field, select whether or not the certificate is for a single purchase. If so, enter the appropriate invoice or purchase order number.

- Next, enter your contact information along with the seller’s.

- In the following section, check the box next to the category that best describes your business.

- Under “Reason for exemption”, check the letter that best explains your exemption.

- In the next section, enter the state-appropriate ID number and reasons for exemption.

- Sign and date the form.

- Remember, in Wyoming, you don’t need to officially file the certificate of exemption. Keep it on file and use it as needed.

For assistance, contact the Wyoming Department of Revenue at (307) 777-5200.

In Wyoming, the certificate of exemption does not expire.

Subscribe to Our Newsletter

and gain insider access to cutting-edge business insights and trends.

Featured Resources

10 Best LLC Formation Services

Published on August 22, 2022

Read Now

How to Get a Copy of My LLC Certificate

Published on December 30, 2021

In the course of your business, you may need a copy of your limited liability company (LLC) certificate. You can order a certified copy of this ando ...

Read Now

Comments