If you’re starting an LLC, the business entity formation process is one of the first and most important hurdles. This step can be terribly complex ...

How to Purchase an LLC

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on November 10, 2021

Starting your own business can seem daunting. It’s usually risky, and requires a lot of work. Purchasing an existing business can be a way to pursue your entrepreneurial dreams without starting from scratch. A business that is already established might have a decent brand, a customer base, and an operational structure.

Many small businesses are structured as limited liability companies (LLCs), so this guide provides all the information you’ll need to purchase an LLC and enter the world of entrepreneurship!

What is an LLC?

An LLC is an increasingly popular business structure for startups, offering liability protection for ownership and greater flexibility than a corporation, particularly in terms of taxes. The LLC itself does not pay taxes. As a “pass-through” entity, income passes through the business to the owner or owners, who report it on their personal tax returns. An LLC is created by filing paperwork with your state, and nominal fees are involved.

An LLC offers its owner or owners, who are called members, considerable flexibility in terms of management. You can choose your management and operational structure and decide how you want to be taxed. Your LLC can have a single member or multiple members, all of whom have personal liability protection, meaning your personal assets are not at risk if you cannot pay business debts or are involved in a lawsuit.

Steps to Purchase an LLC

Purchasing an LLC involves several steps, which are outlined here to help you decide if buying an LLC is right for you.

1. Identify an Appealing LLC for Purchase

There are several ways to do this.

- Call local businesses that you’re interested in. Even if the owner is not interested in selling, they are part of the local business community and may know someone looking to sell. You can also find businesses by attending chamber of commerce events or other business-related events in your area.

- Contact business brokers, who are often hired by business sellers in search of potential buyers. They can help you identify businesses for sale, provide useful advice, and help negotiate and finalize any possible deal.

- Check websites that highlight small businesses for sale, such as Loopnet, Bizquest, and Bizbuysell. You can filter your search by location and industry.

2. Negotiate Terms

Your accountant can help you to figure out a fair market value and fair terms, which will include:

- Purchase price

- The structure of the deal, meaning buying assets only or buying a portion or all of the equity in the business, and how the LLC itself will be transferred

- Payment method – cash, debt, or both

- Voting rights after purchase

- Non-compete provisions

- Closing date

Business owners often have an inflated idea of what their business is worth, so negotiations can be difficult. Be prepared to walk away if you’re unable to negotiate fair market terms.

Even if you are able to reach initial terms, you’re still not ready to sign the deal.

3. Do the Due Diligence

Perform due diligence and learn all you can about the business. Ask to review the Articles of Organization for the LLC to understand its buyout provisions. Review the books and records of the business, including:

- Financial statements

- Tax returns

- Loan agreements

- Business licenses

- Contracts including employees, vendors, leases

These documents can be complex, so it is highly recommended that you have an attorney and an accountant review them with you.

4. Create a Term Sheet

Your final negotiation with the seller will be based on your review of all the above information, resulting in the drafting of a document specifying the terms of your planned purchase. This is still not a final agreement – its intention is to clarify the views of both parties on final terms.

5. Close the Deal

Once terms are agreed upon, attorneys for the buyer and seller draw up the official purchase agreement. Finally, the closing can occur with both attorneys present. Other documents may be involved, such as an assignment of current leases, new vendor agreements, non-compete agreements, and any other relevant documents.

Transferring the LLC Ownership

The actual method of transferring the LLC ownership will depend on the LLC’s operating agreement and the laws of the state in which it’s registered. The terms of the operating agreement must also be followed in the purchase agreement.

Once the purchase is complete, the sale needs to be recorded with your state’s business registration agency, which is usually the secretary of state. This will transfer ownership, and the buy-sell terms in the operating agreement will specify how assets are transferred.

Some states will not allow you to transfer ownership, so the LLC will need to be dissolved and a new one created. Again, the operating agreement will specify how assets are to be transferred.

You will also need to notify other parties of the change of ownership including the LLC’s registered agent — the person or company that sends and receives legal documents on behalf of your LLC.

You can notify the registered agent and appoint a new one if you choose. The registered agent can be a member of the LLC, or you can choose a third party such as an attorney or a company that offers registered agent services. Most states require you to have a registered agent who is a state resident or a corporation authorized to do business in that state.

You also need to notify the IRS, which may require you to get a new EIN number for the business, as well as your banks, vendors, and other parties that have contracts with the LLC.

Pros of Buying an LLC

Many entrepreneurs choose to purchase an established LLC because it offers several advantages over starting and building their own business.

1. Established Customer Base

When you start a new business, one of the biggest challenges is getting those first customers. If you buy an existing LLC that’s profitable, you’ll already have customers and should be able to continue earning revenue and start reaping the rewards of the business right away.

2. Established Credit

If the business has been operating for a while it should have a good credit history, so if you need financing it’ll be relatively easy to obtain. This can keep you from having to personally guarantee a business loan, which is common for startups. When you personally guarantee a loan, you’re personally liable for the payments.

3. Tax Deduction

The cost to buy the LLC may be tax deductible, which can significantly lower your tax bill.

4. Established Brand

Another one of the challenges of starting a business is building a trusted reputation. An existing business should already have an established name, which should cut your marketing costs.

Cons of Buying an LLC

As with everything in business, you’ll also need to consider the downside of buying an LLC.

1. Expensive

An established and profitable business is unlikely to come cheap. Its market value could be quite substantial, depending on the type of business, its profitability, assets, and so on. You may be able to get a business loan to make the purchase, which will still require a large down payment.

2. Difficult to Transfer

LLC ownership can be difficult to transfer, unlike a corporation with easily transferrable shares. Purchasing an existing LLC requires the proper agreements and the relevant state procedures. You’ll likely need an attorney to handle the process, which is another significant expense.

3. Due Diligence

Before you buy any business, you’ll want to perform due diligence to make sure it’s accurately valued. This involves a detailed analysis of the company’s financials. You’ll likely need an accountant to complete this financial review, which is yet another expense.

Conclusion

Purchasing a new business is exciting and will surely begin a new chapter of your life. By purchasing an LLC instead of starting your business from scratch, you should have a strong foundation to start your entrepreneurial journey.

It is absolutely critical, however, to make sure everything is done correctly and your rights are protected. Professionals will make the process much easier, ensuring you close the deal and start doing business!

Subscribe to Our Newsletter

and gain insider access to cutting-edge business insights and trends.

Featured Resources

10 Best LLC Formation Services

Published on August 22, 2022

Read Now

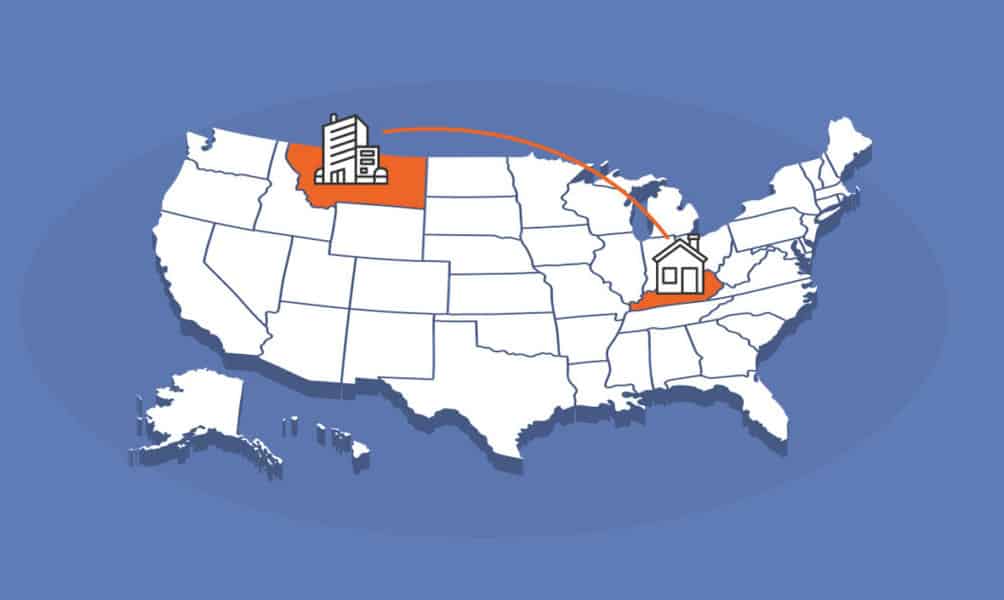

Can You Live in One State and Own a Business in Another?

Published on July 20, 2021

Do some digging into the owners of industry and you will find the vast majority do not live in the state where they own theirbusinesses. ItR ...

Read Now

Comments