If you’re starting an LLC, the business entity formation process is one of the first and most important hurdles. This step can be terribly complex ...

LLC vs. Partnership: Key Differences

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on January 19, 2022

Starting a business takes great consideration and preparation, and a key question is which type of business entity to form. If you’re forming a business with partners, two of your options are a limited liability company (LLC) and a partnership. You need to understand the differences to decide which is right for you.

What Is an LLC?

An LLC is an increasingly popular business structure for startups, offering liability protection for ownership and greater flexibility than a corporation, particularly in terms of taxes. The LLC itself does not pay taxes. As a “pass-through” entity, income passes through the business to the owner or owners, who report it on their personal tax returns. An LLC is created by filing paperwork with your state, and nominal fees are involved.

An LLC offers its owner or owners, who are called members, considerable flexibility in terms of management. You can choose your management and operational structure and decide how you want to be taxed. Your LLC can have a single member or multiple members, all of whom have personal liability protection, meaning your personal assets are not at risk if you cannot pay business debts or are involved in a lawsuit.

What Is a Partnership?

Partnerships are informal business structures for companies with two or more owners. If you and one or more people are running a business and you haven’t formed a business entity in your state, you’re automatically considered a partnership. You should have a partnership agreement, although one is not required by law, to detail how ownership and profits and losses are divided, as well as other provisions regarding how disputes are resolved, and what happens if a partner leaves or is added. An attorney is recommended to draw up the partnership agreement.

Partnerships are not considered separate entities from the owners and are not taxed. Profits and losses are passed through to the partners who report the income on their personal tax returns on a Schedule C. Partners may be eligible for the 20% pass-through deduction that was part of the Tax Cuts and Jobs Act, meaning they can deduct up to 20% of business income.

A partnership must also file form 1065 with the IRS, which is the Return of Partnership Income. Attached to this will be K-1 forms for each partner, showing their share of the business income. Form 1065 is for reporting only – again, the partnership itself is not taxed.

How Partnerships and LLCs Compare

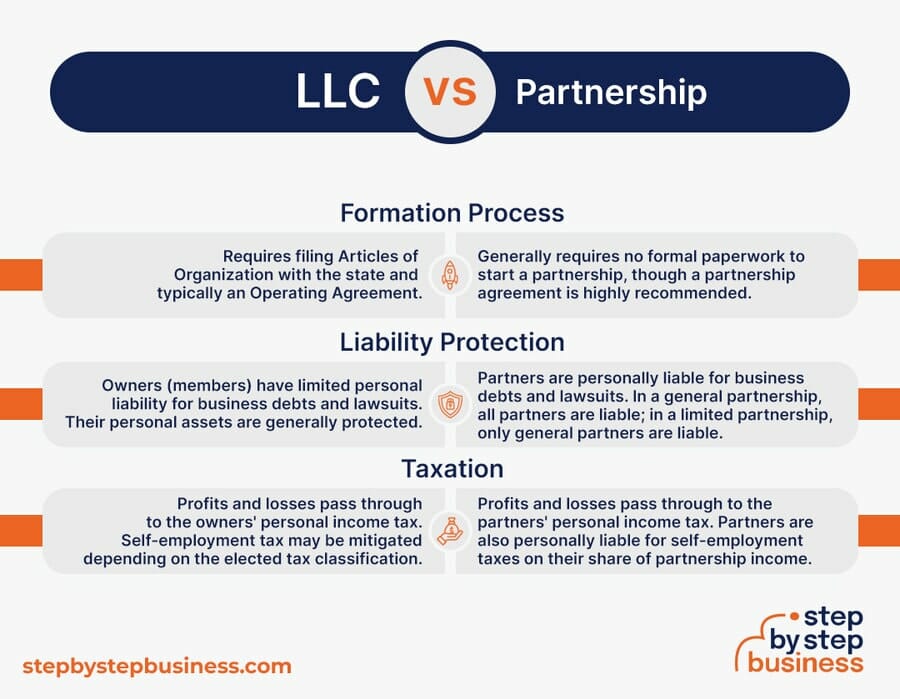

Formation Process

Partnerships do not have to go through a formal formation process with the state, while LLCs must file articles of organization with the state. There is no required paperwork for a partnership.

An LLC should have an operating agreement, which is similar to a partnership agreement. Both specify ownership, profit sharing, management responsibilities, and more. Neither document is required, but both are extremely useful.

In the case of disputes, an LLC would have to consult state LLC regulations to resolve an issue if it had no operating agreement in place. In the case of a partnership, state regulations do not apply, so a dispute would be settled by the courts, if no partnership agreement is in place.

Liability Protection

The key difference between an LLC and a partnership is liability protection.

LLC members have personal liability protection, meaning the members are not personally liable for debts or obligations of the company.

Partnerships do not offer that protection, meaning that if debts of the company are unpaid, or the company is sued, the partners’ personal assets are at risk. This means any assets, including their homes. This is the number one reason that business owners choose an LLC over of a partnership.

Taxation

In terms of taxation, they are essentially the same. Income is passed through to the owners and reported on their personal tax returns. The exception to this is if the LLC has chosen to be taxed as a corporation. To do so, the LLC must file a document, referred to as an election, with the IRS. The LLC must then decide if it wishes to be taxed as an S corporation or a C corporation.

C Corp status means profits are taxed at the current rate for corporations (21% as of early 2022), which is significantly lower than the typical individual taxpayer rate. But keep in mind, C Corp shareholders, which includes members, must also pay taxes on their distributions (but not self-employment taxes). Thus, the C Corp is subject to what is sometimes referred to as double taxation.

As with a partnership and an LLC, S Corp taxation considers the LLC a pass-through entity, which means income passes through the company and into the hands of the owners. At this point, taxes are applied at the same rate as those of individual taxpayers.

S Corps use Form 1120S to file their taxes, which is used to report the income, losses, and dividends of S corporation shareholders. S Corp shareholders do not pay self-employment taxes, which is the primary advantage of S Corp status compared to sole proprietorship or partnership.

Generally, S Corp tax status is beneficial if the company is profitable enough to pay the owners a salary and at least $10,000 in annual distributions. This way, the owners can be taxed as employees and not pay self-employment taxes. It costs more to run an S Corp than an LLC due to additional bookkeeping and payroll expenses. Thus, the tax benefits should be more than the additional costs for S Corp status to make financial sense.

In Closing

Partnerships and LLCs have significant similarities, particularly in terms of taxation. The key difference is that LLCs offer personal liability protection while partnerships do not. This is an extremely important factor to consider when making your decision. In a partnership, you risk the seizure of your personal assets, including your home, if the business is sued. It’s recommended that you seek the advice of an attorney when making your decision.

If you choose an LLC, you should have an operating agreement; while if you choose a partnership you should have a partnership agreement, as both are very important documents. An attorney can make sure these documents cover all bases and protect the interests of the business and its owners.

Subscribe to Our Newsletter

and gain insider access to cutting-edge business insights and trends.

Featured Resources

10 Best LLC Formation Services

Published on August 22, 2022

Read Now

Series vs Restricted LLC: What is the Difference?

Published on February 15, 2022

Limited liability companies (LLCs) are an increasingly popular business structure for startups, offering liability protection for ownership andgreat ...

Read Now

Comments