If you’re starting an LLC, the business entity formation process is one of the first and most important hurdles. This step can be terribly complex ...

What Is a Registered Agent for an LLC?

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on September 10, 2021

In most states, when you form an LLC, you need a registered agent. A registered agent is a person or business that is authorized to accept legal, tax, and financial documents on behalf of your business. You can check your state’s website to see if you are required to have a registered agent for your LLC.

A registered agent is also known as a resident agent, statutory agent, or agent for service of process.

Who Can Be a Registered Agent?

A registered agent can be an individual (you or another member of the LLC) or a business. You can also choose to have another individual who is not a member, or a professional agency that offers registered agent services.

The requirements to be a registered agent are:

- Age 18 years or older

- Have a physical address in the state where your business is formed

- Be available during normal business hours to accept correspondence personally

- If the agent is a business entity, it must be registered to operate in your state

Many LLCs choose a member who is highly involved in the business to be the registered agent, although a registered agent service can save you time and ensure compliance with the law.

What Is the Purpose of a Registered Agent?

Essentially, the purpose of a registered agent is to ensure compliance with state laws and that all legal, tax, and financial matters are handled in a timely manner. Having one person or entity to handle important documents helps to ensure nothing is missed, helping avoid any potential potholes.

Documents that the agent may receive include:

- Tax forms and documents

- Government correspondence

- Legal documents

- Summons documents in case of a lawsuit

Can I Be My Own Registered Agent?

You or another member of the LLC can be your registered agent in any state as long as you have a physical address in the state where your LLC is registered.

In most states, however, the LLC itself cannot be its own registered agent. Some entrepreneurs choose to be their own registered agents so that they are in full control of all correspondence and documents received.

Reasons Why You Shouldn’t Be Your Own Registered Agent

There are a number of reasons why it’s better not to be your own registered agent.

1. Keep Your Address Private

If you appoint yourself as your LLC’s registered agent, you must specify your registered agent address on your articles of organization. This document, once filed, is public record, so anyone can obtain your address. Particularly if you are running your business from home, you might not want your personal address publicly associated with your business.

2. Restricted Hours

If you’re your own registered agent, you must be available at your registered agent address during normal business hours to accept correspondence. This means that you can’t leave to go on sales calls or to other business appointments. This can seriously hinder your ability to manage and grow your business.

3. Avoid Embarrassment

If your business is ever sued, the service of process will come to your registered agent address. If this address is your business location, it could happen in front of customers or your employees. This could be an embarrassing situation that you’ll want to avoid.

4. Expansion Hassles

If you expand your business to other states, you’ll need a registered agent in each state where you register as a foreign LLC. Clearly, you can’t be everywhere, so you would need to find a registered agent in each state.

5. Avoid Junk Mail

Your registered agent address, as discussed above, would be public record, which generally means that you’ll start getting all sorts of junk mail at your address. You’ll have to sort through all that mail, which will take time that is better spent focusing on your business.

What Is a Registered Agent Service?

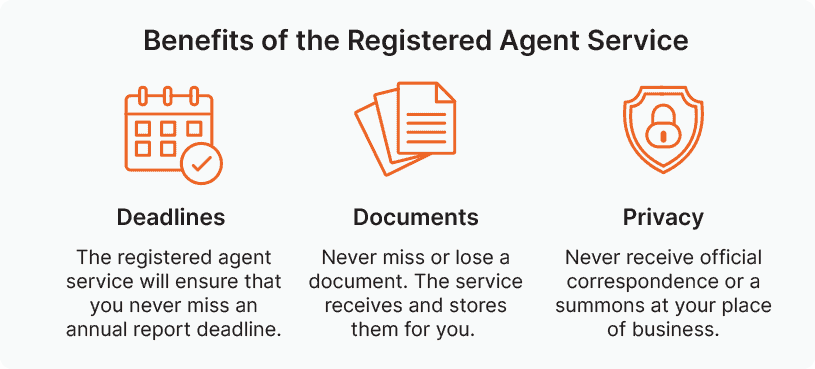

A registered agent service is a professional service that will handle official correspondence and documents for your business. They will ensure that all correspondence is handled on time and keep copies of documents for you. They will keep track of deadlines for you and send you reminders of things you may have to file, such as tax forms or annual reports.

A registered agent service will help keep you in compliance with the law and save you time by keeping track of key documents and filing deadlines. This also frees you up to focus on growing your business. The agency will also offer support if problems or questions come up.

Utilizing an agency enables you to have flexible hours. If you are your own registered agent, you must be available from 8 AM to 5 PM at your registered agent address. If you use an agency, they are available during those hours so that you don’t have to be.

If you use a national agency, you can also form an LLC or corporation in another state or multiple states where you do not have residency.

An agency also offers you a level of privacy, as you would never be served with a summons at your business in front of customers or employees.

Benefits of Using a Registered Agent Service

Many entrepreneurs choose to use a registered agent service because it offers many benefits.

1. Never Miss Important Correspondence

As a business owner, you have a lot going on, so it’s easy to miss an important piece of mail. A registered agent service will accept all your correspondence, notify you of critical documents received, and make your important documents available to you online. This is particularly important if a document received is about a matter that has a deadline.

2. Time Saver

A registered agent service will review your correspondence, record its receipt, and digitally store it for you. This saves you the time that you would spend tracking and filing everything yourself.

3. Protection from Process Servers

A registered agent service will accept service of process if your LLC is sued. As discussed above, this can save you from an embarrassing situation. The registered agent service will also notify you immediately of the legal action so that you can promptly respond.

4. Freedom

As stated earlier, if you’re your own registered agent, you must be available at your registered agent address during normal business hours. A registered agent service will be available during those hours so that you’re free to do what you need to do to manage and grow your business.

5. Easier Expansion

Most registered agent services operate in all states, so if you expand your business and register as a foreign LLC in other states, the registered agent service can be your agent in all states.

How to Choose a Registered Agent Service

You need a service that has an office in your state, but you may want to choose a national service so that as you grow and expand you have the flexibility to form LLCs in other states. Other than that, you should choose a service that offers the following:

- Compliance management – a plan to send you reminders of important deadlines to stay in compliance.

- Document copying and digital storage so you can access documents online.

- Availability during the required hours, and prompt customer service.

- Service in all 50 states.

How to Elect a Registered Agent

To elect yourself or another individual as your registered agent, you will simply fill in their information on the LLC. To elect yourself or another individual as your registered agent, simply fill in the relevant information on the LLC formation forms or Articles of Incorporation when you set up your business. If you choose an agency, the agency will tell you the information to include on the forms.

Can I Change My Registered Agent Later?

If you decide to change your registered agent, you can do so at any time. You just need to file the appropriate paperwork with your state, and in most cases, you can do this online. There may be a small fee involved.

States have varying requirements about changing a registered agent, so check your secretary of state website to see how to file the change.

FAQs

Can I be penalized for not having a registered agent for my business?

When you form your LLC, you must include a registered agent’s name and address on the documents, or it will be rejected. If you fail to maintain that registered agent, you could be subject to fines and penalties, and ultimately, your LLC could be administratively dissolved by the state.

What are the pros and cons of being my own registered agent?

Being your own registered agent allows you to be in control of all your own important correspondence and documents. However, as your own registered agent you must be personally available at your registered agent address during normal business hours. You could also be served with a process at your business if your business is sued, which could occur in front of customers or your employees.

What is the difference between a registered agent and a member?

A member of an LLC is an owner of the business. A registered agent is simply someone who is authorized to accept correspondence and service of process on behalf of the business. A registered agent can be a member of the LLC, but does not have to be. Appointing a registered agent gives the agent no ownership or rights to your company.

Subscribe to Our Newsletter

and gain insider access to cutting-edge business insights and trends.

Featured Resources

10 Best LLC Formation Services

Published on August 22, 2022

Read Now

How to Get a DUNS Number for Your Small Business

Published on January 25, 2022

As a business owner, at some point, you may seek to obtain financing from a bank or other lender. Unless your business has a credit history, youwill ...

Read Now

How to Register an LLC with a Virtual Address

Published on January 13, 2022

When forming a limited liability company (LLC) for your business, you need to have a street address in order to register your LLC with your state.St ...

Read Now

Comments