If you’re starting an LLC, the business entity formation process is one of the first and most important hurdles. This step can be terribly complex ...

Arizona, Ohio, Missouri and New Mexico don’t require an LLC annual report or fee.

We earn commissions if you shop through the links below. Read more

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on January 5, 2022

An annual report, sometimes known as a statement of information, for a limited liability company (LLC) needs to be filed with your state to keep your LLC in good standing.

Most states require an annual LLC report, which simply verifies your business information and that you’re still doing business.

Every state’s form and requirements are different but most annual reports will require:

If any of this information has changed since you originally formed your LLC, you should update it in your annual report. Your state may also require an amendment to change your LLC information.

Filing an annual report is usually relatively simple, but not in all cases. This handy guide walks you through the process to ensure an easy filing and the continued smooth operation of your business.

A-M

M-W

Every state has its own reporting requirements. Some states require an annual report, others a biennial report. In most states, a fee is involved. Reports are generally filed with the Secretary of State, so you should be able to find the information on their website.

Arizona, Ohio, Missouri and New Mexico don’t require an LLC annual report or fee.

Below, you’ll discover guides on how to file an annual report for all 50 states. This includes direct links to the relevant state agencies responsible for the submission and processing of annual reports, along with a breakdown of the filing fees required in each state.

In Alabama, the annual report and business privilege tax return is filed with the Department of Revenue. You can file online by visiting the revenue department’s website and taking the following steps.

If you choose to file by mail, you can download the forms and mail them, along with the $10 fee and your business privilege tax, to:

Alabama Department of Revenue

Business Privilege Tax Section

P.O. Box 327320

Montgomery, AL 36132-7320

Phone (334) 242-1820

In Alabama, annual reports are due on the 15th day of the 3rd month after the beginning of the taxable year. The penalty for late filing is $50, and interest will continue to accrue if you don’t file.

In Alaska, the biennial report is filed with the Division of Corporations. You can file online by visiting the corporation division’s website and taking the following steps.

If you choose to file by mail, you can print a paper copy of the biennial report form and mail it, along with the $100 fee, to:

Corporations Division

550 W 7th AVE, STE 1500

Anchorage, AK 99501-3567

Phone: (907) 269-8160

Fax: (907) 269-8156

In Alaska, biennial reports are due every two years on January 2. The penalty for filing late is $37.50, while the penalty for failing to register a report altogether is the dissolution of the LLC.

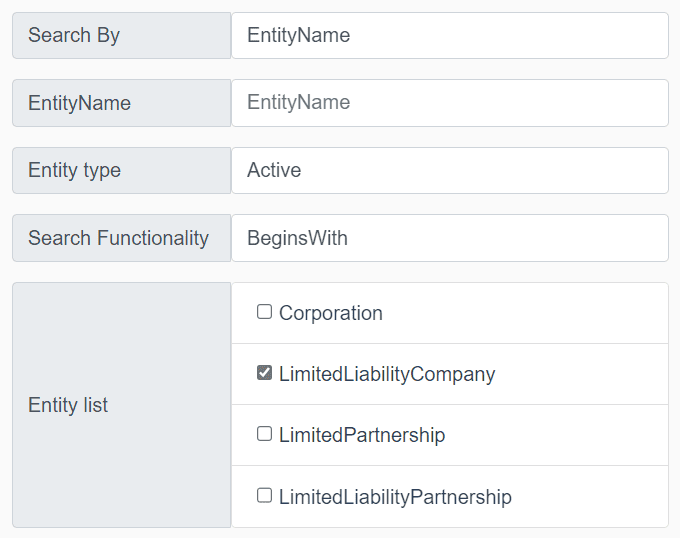

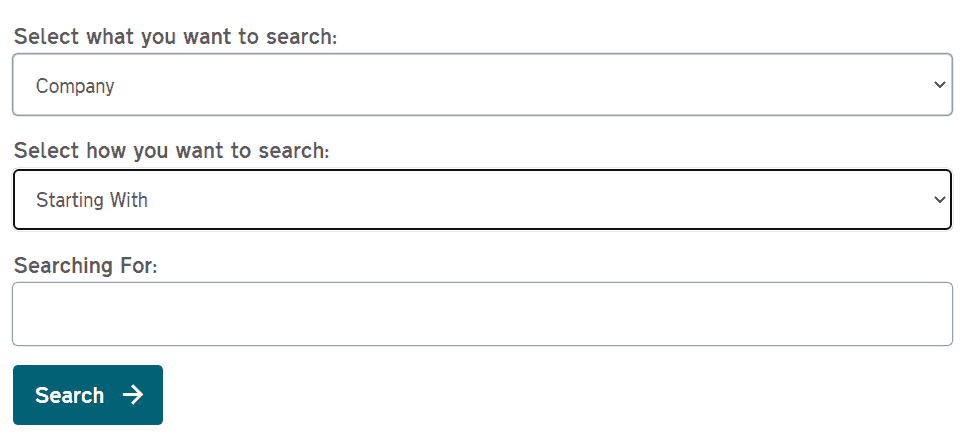

In Arkansas, the annual franchise tax report is filed with the Secretary of State. You can file online by visiting the secretary of state’s website and taking the following steps.

If you choose to file by mail, you can download the form and mail it, along with the $150 filing fee, to:

Business and Commercial Services

P.O. Box 8014

Little Rock, Arkansas 72203

Phone: 501-682-3409

In Arkansas, annual franchise tax reports are due every year by May 1st. The penalty for filing late is $25 plus interest, while the penalty for failing to register a report altogether is the dissolution of your LLC.

In California, the statement of information is filed with the Secretary of State. You can file online by visiting the secretary of state’s website and taking the following steps.

If you choose to file by mail, you can download the form and mail it, along with the $20 filing fee, to:

Secretary of State Business Programs Division

Business Entities

1500 11th Street

Sacramento, CA 95814 or

P.O. Box 944260, Sacramento, CA 94244-260

Phone (916) 657–5448

In California, statements of information are due every two years within 90 days of the date you started your business. The penalty for filing late is $250, while the penalty for failing to register a report altogether is suspension of the LLC.

In Colorado, the periodic report is filed with the Secretary of State. You can file online by visiting the secretary of state’s website and taking the following steps.

You cannot file your periodic report by mail. You can only file online.

If you need any assistance you can contact the secretary of state’s office at:

303-894-2200

303-869-4864 (FAX)

In Colorado, periodic reports are due every year on the date you started your business. The penalty for filing late is $50, while the penalty for failing to register a report altogether is the dissolution of the LLC.

In Connecticut, the annual report is filed with the business division. You can file online by visiting the business division’s website and taking the following steps.

Colorado annual reports cannot be filed by mail. They must be filed online. If you need any assistance, you can contact the business division at:

State of Connecticut

165 Capitol Avenue

Hartford, CT 06106

Email: [email protected]

Telephone: (860) 509-6200

In Connecticut, annual reports are due every year by March 31st. The penalty for filing late is $0, while the penalty for failing to register a report altogether is the dissolution of the LLC.

In Delaware, the annual tax is paid through the Division of Corporations. You can file and pay online by visiting the corporations division’s website and taking the following steps.

In Delaware, annual taxes are due every year by June 1st. The penalty for filing late is $200, while the penalty for failing to register a report altogether is additional interest on the tax and the penalty, and eventual dissolution of the LLC.

If you need assistance, you can contact the Division of Corporations at (302) 739-3073.

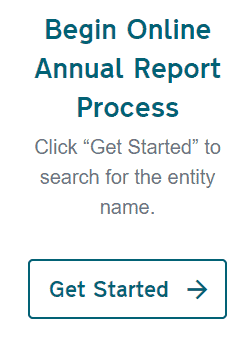

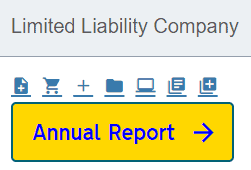

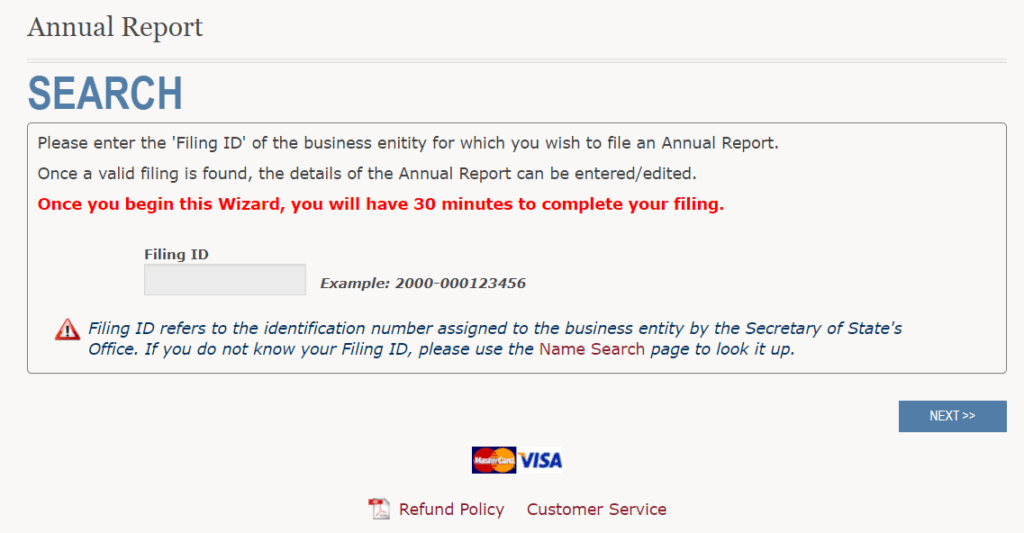

In Florida, the annual report is filed with the Division of Corporations. You can file online by visiting the corporation division’s website and taking the following steps.

You cannot file your annual report by mail. You can only file online. If you need assistance, you can contact the corporations division at 850.245.6000.

In Florida, annual reports are due every year by May 1st. The penalty for filing late is $400, while the penalty for failing to register a report altogether is the administrative dissolution of the LLC.

In Georgia, the annual registration is filed with the Secretary of State. You can file online by visiting the secretary of state’s website and taking the following steps.

To file by mail, do the following:

Georgia Corporations Division

2 MLK Jr. Dr.

Suite 313, Floyd West Tower

Atlanta, GA 30334

Phone: (404) 656-2817

In Georgia, annual reports are due every year on April 1st. The penalty for filing late is $25, while the penalty for failing to register a report altogether is a civil suit or administrative dissolution of the LLC.

In Hawaii, the annual report is filed with the Department of Commerce and Consumer Affairs. You can file online by visiting the Hawaii business express website and taking the following steps.

If you choose to file by mail, you can download the form and mail it, along with the $15 fee, to:

Annual Filing – BREG

P.O. Box 40

Honolulu, HI 96810

Phone: (808) 586-2727

In Hawaii, the annual report due date is dependent on the registration date. If the date of registration falls between:

The penalty for filing late is $100 per month of delinquency, while the penalty for failing to register a report altogether is the administrative termination of the LLC.

In Idaho, the annual report is filed with the Secretary of State. You can file online by visiting the SOSbiz website and taking the following steps.

You cannot file your annual report by mail. You can only file online.

In Idaho, annual reports are due every year by the end of the anniversary month of your LLC registration. The penalty for filing late is $0, but the penalty for failing to register a report altogether is the dissolution of your LLC.

If you need assistance, contact the Idaho Secretary of State’s office at:

(208) 334-2301

[email protected]

In Illinois, the annual report is filed with the Secretary of State. You can file online by visiting the secretary of state’s website and taking the following steps.

If you choose to file by mail, you can download the form and mail it, along with the $75 filing fee, to:

Secretary of State

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62756

Phone: 217-524-8008

In Illinois, annual reports are due every year by the end of the month prior to the anniversary month of the LLC registration. The penalty for filing late is $100, while the penalty for failing to register a report altogether is the dissolution of the LLC.

In Indiana, the business entity report is filed with the Department of Revenue. You can file online by visiting the INbiz website and taking the following steps.

If you choose to file by mail, you can download the form and mail it, along with the $50 fee, to:

Secretary of State

Business Services Division

302 West Washington St. Room E018

Indianapolis, IN 46204

Phone: (317) 232-6576

In Indiana, business entity reports are due every other year at the end of the anniversary month of the LLC registration. The penalty for filing late is $0, while the penalty for failing to register a report altogether is the dissolution of the LLC.

In Iowa, the biennial report is filed with the Secretary of State. You can file online by visiting the Iowa fast track filling website and taking the following steps.

If you choose to file by mail, there is no specific form to fill out. You’ll need to create your own report that includes:

You’ll mail your report, along with the $45 fee, to:

Business Services

First Floor, Lucas Building

321 E. 12th St.

Des Moines, IA 50319

Phone: 515-281-5204

In Iowa, biennial reports are due every other year by April 1st. The penalty for filing late is $0, but the penalty for failing to register a report altogether is the dissolution of the LLC.

In Kansas, the annual report is filed with the Secretary of State. You can file online by visiting the secretary of state’s website and taking the following steps.

If you choose to file by mail, you can download the form and mail it, along with the $55 fee, to:

Memorial Hall, 1st Floor

120 S.W. 10th Avenue

Topeka, KS 66612-1594

(785) 296-4564

In Kansas, annual reports are due every year by April 15th. The penalty for filing late is $0, while the penalty for failing to register a report for 90 days or more is forfeiture of the LLC.

In Kentucky, the annual report is filed with the Secretary of State. You can file online by visiting the secretary of state’s website and taking the following steps.

You can print the form from the same site and file by mail if you choose. You can mail it, along with the $15 filing fee, to:

Office of the Secretary of State

Filings Branch

700 Capital Ave.

P.O. Box 718

Frankfort, KY 40602

Phone: (502) 564-3490

Fax: (502) 564-5687

In Kentucky, annual reports are due every year by June 30th. If you do not file your annual report by June 30th your LLC will be immediately dissolved and you will have to apply for reinstatement.

In Louisiana, the annual report is filed with the Secretary of State. You can file online by visiting the geauxBIZ website and taking the following steps.

If you choose to file by mail, you can print the form from the same website and mail it, along with only a $30 fee, to:

Louisiana Secretary of State

P.O. Box 94125

Baton Rouge, LA 70804-912

225.922.2880

225.922.2003 fax

In Louisiana, annual reports are due every year on the date you started your business. The penalty for filing late is $0, but the penalty for failing to register a report altogether is dissolution of the LLC.

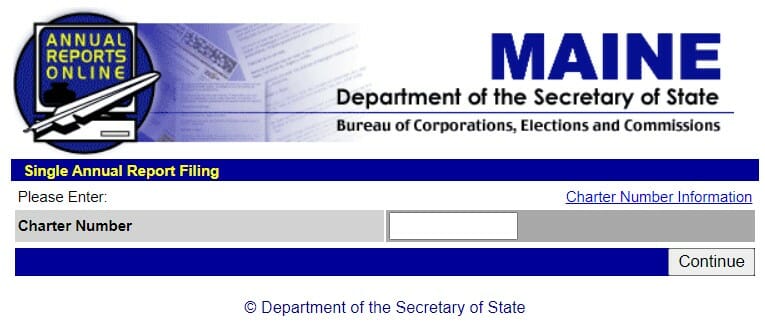

In Maine, the annual report is filed with the Secretary of State. You can file online by visiting the Annual Reports Online page and taking the following steps.

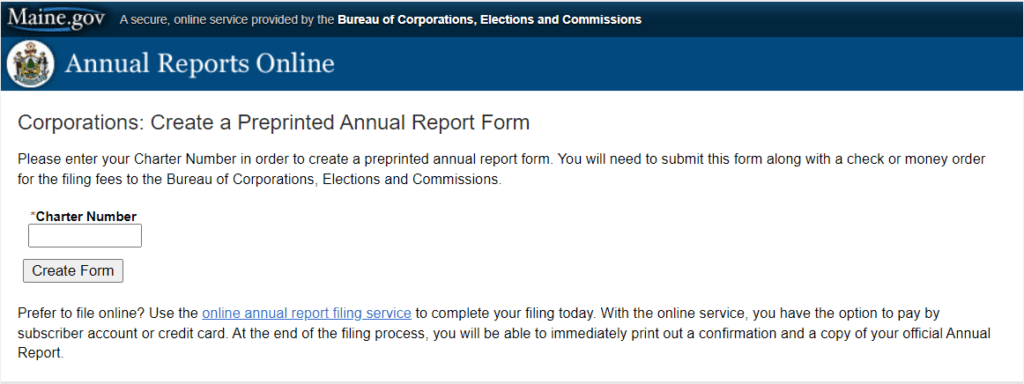

Alternatively, you can create a preprinted annual report form and file by mail.

Mail your completed annual report form and a check for the filing fee to:

Maine Secretary of State

Division of Corporations, UCC and Commissions

101 State House Station

Augusta, ME 04333-0101

In Maine, annual reports are due by June 1st each year. The penalty for filing late is $50, while the penalty for failing to register a report altogether could result in the dissolution of your LLC.

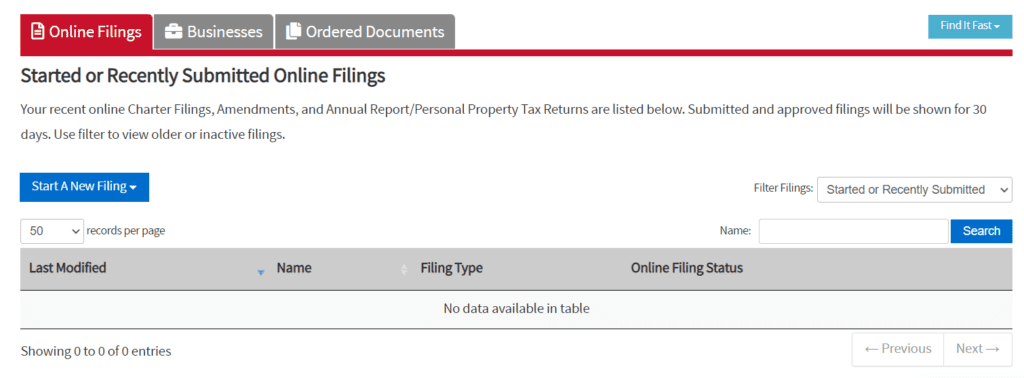

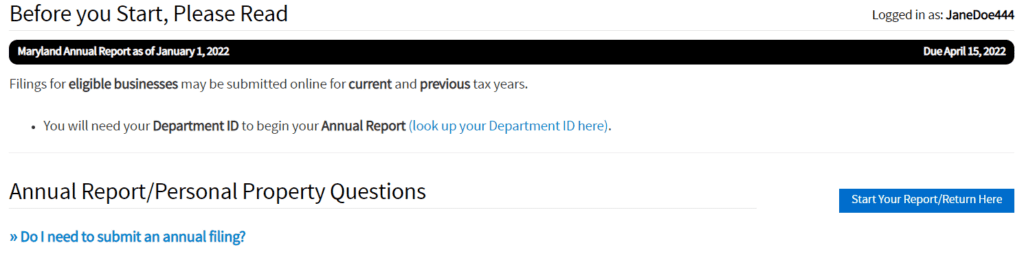

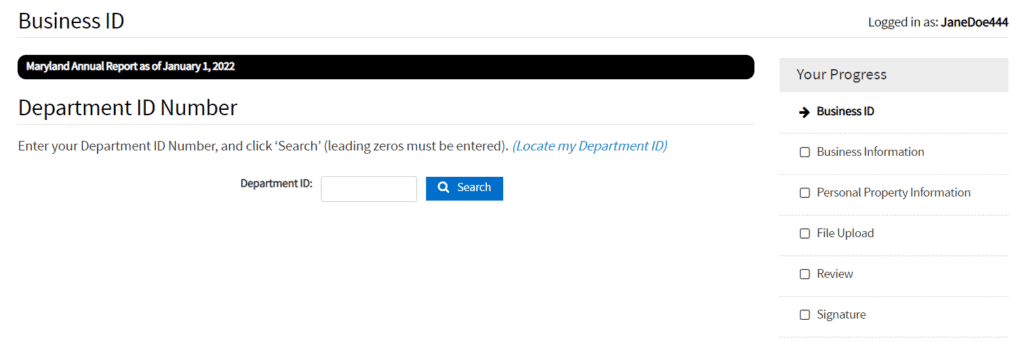

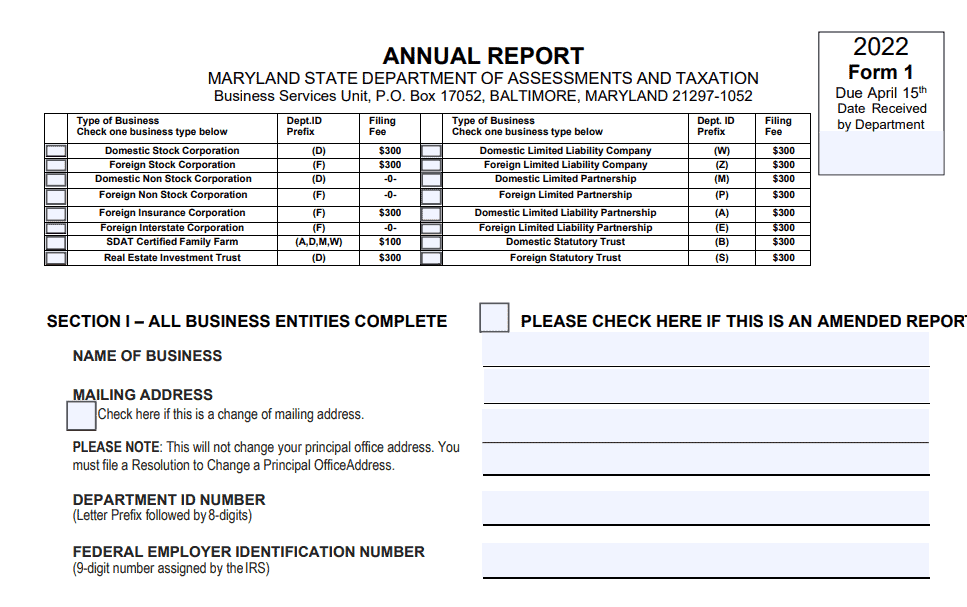

In Maryland, the annual report is filed with the State Department of Assessments and Taxation. You can file online by visiting the Business Express webpage and taking the following steps. Note that if you don’t already have a Business Express account, you’ll need to create one to file online.

Alternatively, you can download and complete a paper form.

Mail your completed documentation and a check for your $300 filing fee to:

Maryland State Department of Assessments and Taxation

Business Services Unit

P.O. Box 17052

Baltimore, Maryland 21297-1052

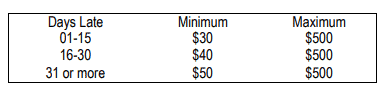

In Maryland, annual reports are due by April 15th each year. The penalty for filing late depends on how many days it is past due. The base late fee is $30 with a maximum of $500.

The penalty for failing to register a report altogether is potential dissolution of your LLC. To request a 60-day extension, complete an application with the State Department of Assessments and Taxation.

In Massachusetts, the annual report is filed with the Secretary of the Commonwealth. You can file online by visiting the state’s online filing system and taking the following steps.

To file by mail, fill out Massachusetts’ LLC Annual Report form and send it to the address below.

State of Massachusetts Secretary of the Commonwealth

Corporations Division

McCormack Building

One Ashburton Place, 17th floor

Boston, MA 02108

Phone: 617.727.9640

In Massachusetts, annual reports are due every year on or before the date you initially filed your LLC’s certificate of organization. There are no penalties for LLCs that file an annual report late, but the penalty for failing to file a report altogether is administrative dissolution after two years.

In Michigan, the annual statement is filed with the Department of Licensing and Regulatory Affairs. You can file online by visiting the corporations online filing system and taking the following steps.

To file by mail, you can fill out your form on the same system, print it, and mail it, along with the $75 fee, to:

Ottawa Building

611 W. Ottawa

P.O. Box 30004

Lansing, MI 48909

Phone: 517-241-9223

In Michigan, annual statements are due every year on February 15th. The penalty for filing late is $50. Failure to file the annual statement will result in your company no longer being in good standing after two years and your business name becoming available.

In Minnesota, the annual renewal is filed with the Secretary of State. You can file online by visiting the online business services website and taking the following steps.

If you choose to file by mail, download the form and mail it to:

Minnesota Secretary of State – Business Services

First National Bank Building

332 Minnesota Street, Suite N201

Saint Paul, MN 55101

Phone: 651-296-2803

In Minnesota, annual renewals are due every year by December 31st. The penalty for filing late is $0, while the penalty for failing to register a report altogether is the dissolution of the LLC.

In Mississippi, the annual report is filed with the Secretary of State. You can file online by visiting the business services website and taking the following steps.

To file by mail, you can print the form from your account and mail it to:

P.O. Box 136

Jackson, MS 39205-0136

Phone: 601-359-1633

In Mississippi, annual reports are due every year by April 15th. The penalty for filing late is $0, while the penalty for failing to register a report altogether is the dissolution of the LLC.

In Montana, the annual report is filed with the Secretary of State. You can file online by visiting the secretary of state’s business services website and taking the following steps.

You cannot file your annual report by mail. You can only file online.

If you have questions, call 406-444-3665.

In Montana, annual reports are due every year by April 15th. The penalty for filing late is $15, while the penalty for failing to register a report altogether is the dissolution of the LLC.

In Nebraska, the biennial report is filed with the Secretary of State. You can file online by visiting the secretary of state’s business services website and taking the following steps.

To file by mail, you’ll fill out the form on the same system, but print it instead of file it and mail it, along with the $10 fee, to:

Nebraska Secretary of State

1201 N Street, Suite 120

P.O. Box 94608

Lincoln, NE 68508

[email protected]

402.471.2554 Phone

402.471.3237 Fax

In Nebraska, biennial reports are due every odd year by April 1st. The penalty for filing late is $0, while the penalty for failing to register a report altogether is the dissolution of the LLC.

In Nevada, the annual list is filed with the Secretary of State. You can file online by visiting the Silver Flume website and taking the following steps.

If you choose to file by mail, you can download the form and mail it, along with the $150 fee, to:

Secretary of State

202 North Carson Street

Carson City, Nevada 89701-4201

Phone: (775) 684-5708

In Nevada, annual lists are due every year by the end of the anniversary month of your LLC formation. The penalty for filing late is $75, while the penalty for failing to register a report altogether is the dissolution of the LLC.

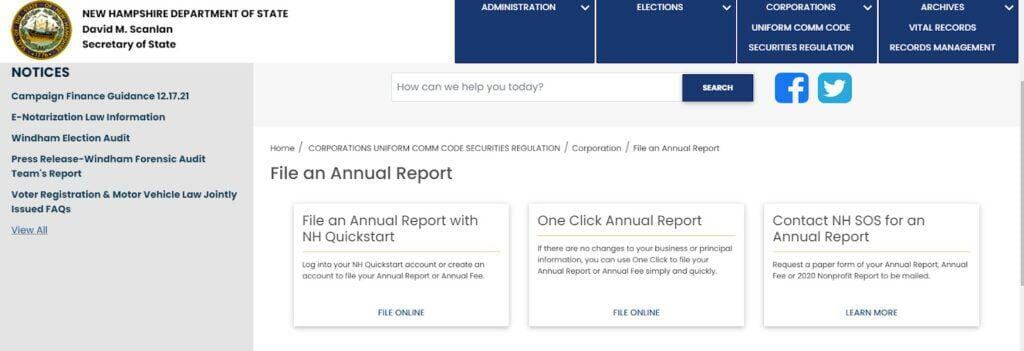

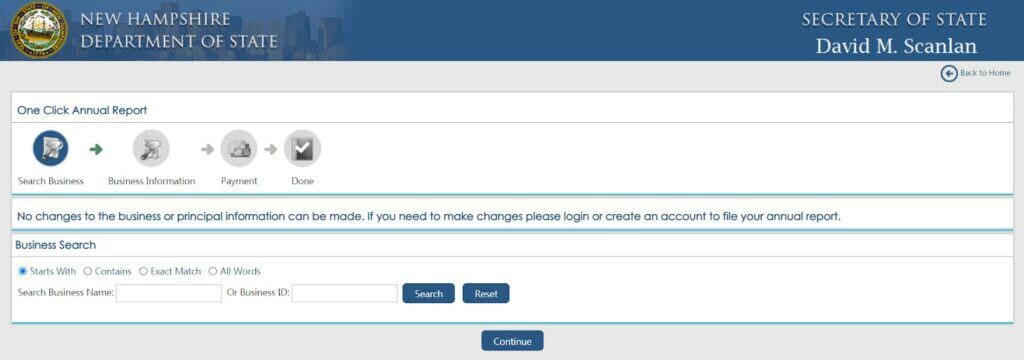

In New Hampshire, the annual report is filed with the Secretary of State. You can file online by visiting the Secretary of State website and taking the following steps.

Alternatively, you can request a paper form by sending an email to [email protected] or calling 603-271-8200.

Mail your completed form, $100 fee, and documentation to:

Corporation Division

NH Department of State

107 N. Main St.

Concord, NH 03301-4989

In New Hampshire, annual reports are due by April 1st each year. The penalty for filing late is $50, while the penalty for failing to register a report altogether is potential dissolution of your LLC.

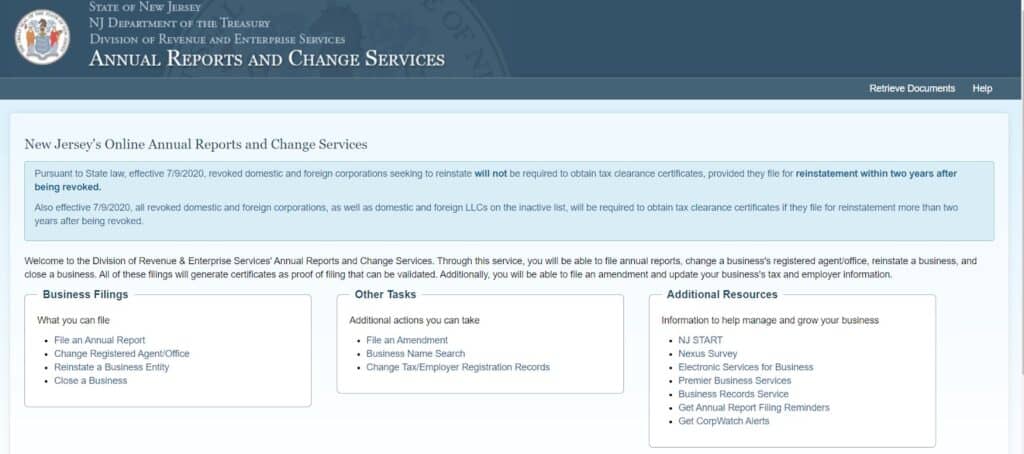

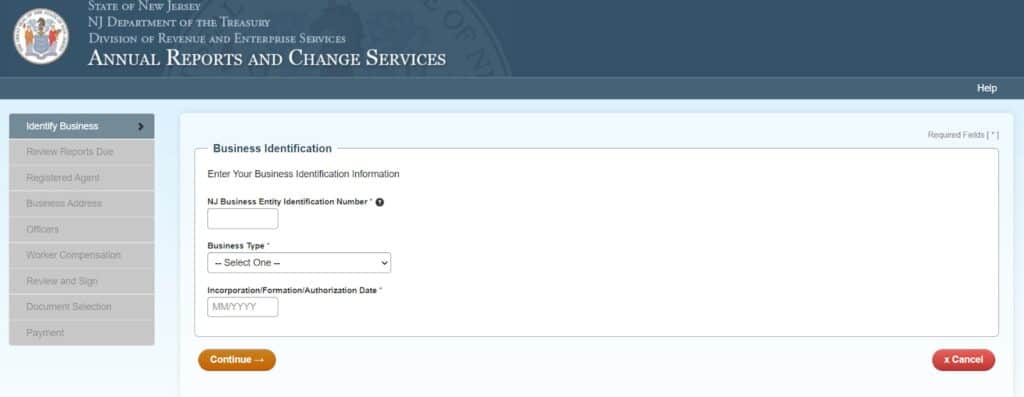

In New Jersey, the annual report is filed with the Department of the Treasury Division of Revenue and Enterprise Services. You can file online by visiting the Annual Reports and Change Services website and taking the following steps. There is no mail-in option in New Jersey.

In New Jersey, annual reports are due every year at the end of the month in which you incorporated your LLC. For example, if your business anniversary is on May 15th, your annual report will be due each year by May 31st.

There are no late fees associated with failing to file your annual report on time. However, failure to file altogether could result in the state revoking your good standing status and dissolving your business. Failure to file two consecutive years in a row will require you to pay all outstanding filing fees plus a $75 reinstatement fee.

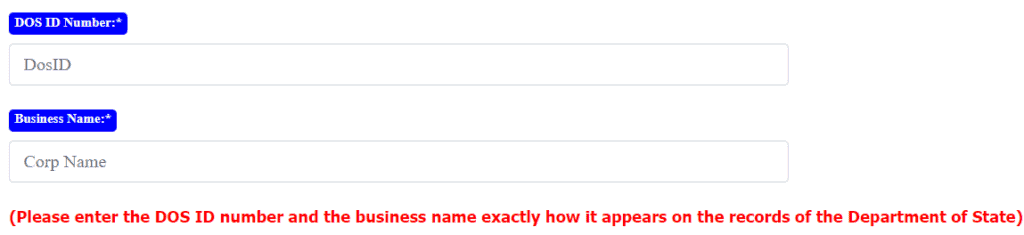

In New York, the biennial statement is filed with the Department of State. You can file your statement online by using the Department of State’s online filing system when the service is available:

Hours: Monday through Friday from 6:00 AM – 7:30 PM

When you’re ready to file, visit New York’s e-Statement Filing System and take the following steps.

New York State does not currently provide online access to biennial statements to print and mail, as you’ll see elaborated below.

In New York, biennial statements are due every two years and must be filed within the same calendar month that a business originally filed its articles of organization. An LLC that is late to file or fails to file a biennial statement altogether will have a statement status of past due and no longer be in good standing with the state. Additionally, failure to file a biennial statement may interfere with business transactions or even result in a business’s dissolution.

Late biennial statements can usually be filed online through New York’s Department of State. If you’re extremely late to file your business’s biennial statement, however, online filing might not be available. In this case, you must request a paper biennial statement form from the state.

All biennial statement requests must be submitted in writing and must explicitly identify your LLC’s name. Either your business’s DOS ID number or the date of its creation must also be included.

Use the contact information below to request a paper biennial statement form by mail, fax, or email.

New York State Department of State

Division of Corporations, Statement Unit

One Commerce Plaza, 99 Washington Avenue

Albany, NY 12231

Phone: 518.473.2492

Fax: 518.486.4680

Email: [email protected]

In North Carolina, the annual report is filed with the Secretary of State. You can file online by visiting the Secretary of State’s Annual Report webpage and then taking the following steps.

Filing an annual report is a little more complicated than filing one online. For guidance through the filing process, follow these steps:

NOTE: Your form will be pre-populated with information from previous filings.

Mail your completed annual report and the filing fee of $200 to the state address listed below:

North Carolina Secretary of State

Business Registration Division

P.O. Box 29525

Raleigh, NC 27626

Phone: 919.814.5400

In North Carolina, business entities that file annual reports have different due dates according to their entity type. For LLCs, annual reports are due every year on April 15– excluding the year you started your business. For more information, you can review North Carolina’s chart of business entity annual report due dates.

LLCs that have not filed their annual report by the due date will receive the penalty of a Notice of Grounds from North Carolina’s Secretary of State. They will have 60 days from the notice’s date to file their annual report.

In North Dakota, the annual report is filed with the Secretary of State. You can file online by visiting the First Stop website and taking the following steps.

To file by mail, you’ll fill out the form the same way. Just click “print and mail” instead of file, and mail the form, along with the $50 fee, to:

Secretary of State

State of North Dakota

600 E Boulevard Avenue Dept 108

Bismarck ND 58505-0500

Telephone: 701-328-2900

In North Dakota, annual reports are due every year by November 15th. The penalty for filing late is $50, while the penalty for failing to register a report altogether is the termination of the LLC.

In Oklahoma, the annual certificate is filed with the Secretary of State. You can file online by visiting the secretary of state’s website and taking the following steps.

If you choose to file by mail, you can download the form and mail it, along with the $25 fee, to:

Oklahoma Secretary of State

421 N.W. 13th, Suite 210

Oklahoma City, OK 73103

Telephone: (405) 522-2520

In Oklahoma, annual certificates are due every year on the date you started your business. The penalty for filing late is $0, while the penalty for failing to register a report altogether is the dissolution of the LLC.

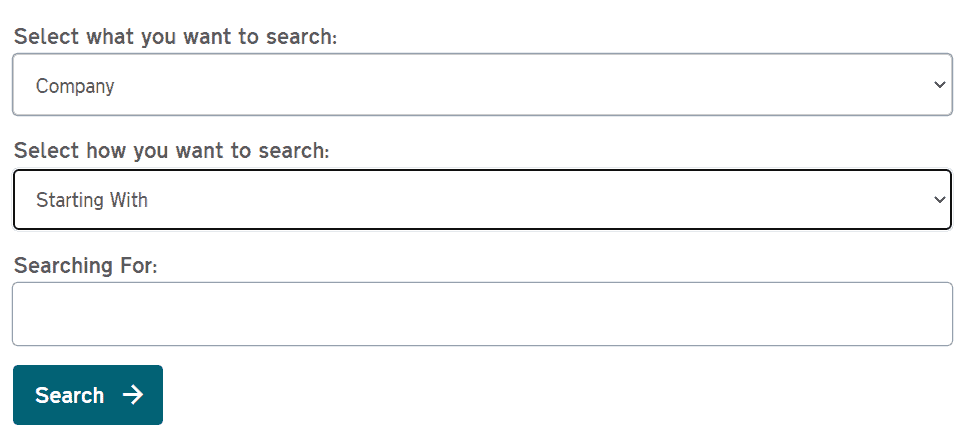

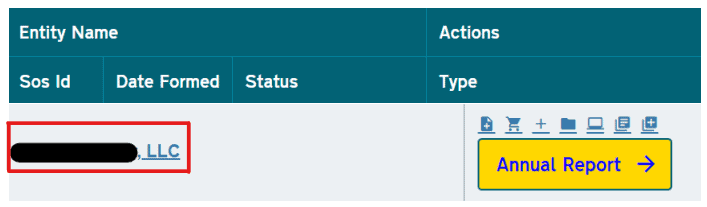

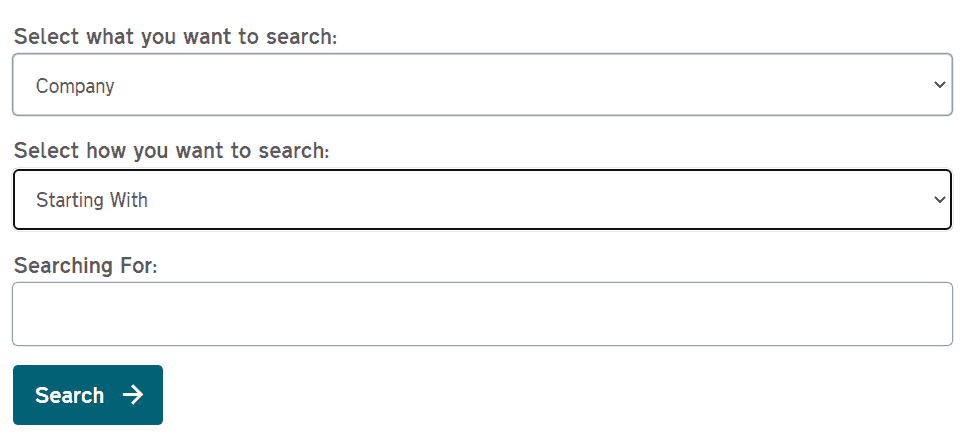

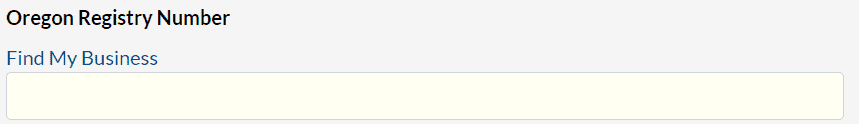

In Oregon, the annual report is filed with the Secretary of State, and filing is only available online. You can file by visiting Oregon’s Business Registry page and taking the following steps.

In Oregon, annual reports are due every year on the date you started your business. The penalty for filing late occurs after 45 days and results in your business being labeled “inactive” and liable to be dissolved. If you fail to file an annual report altogether, your business will be administratively dissolved within five years.

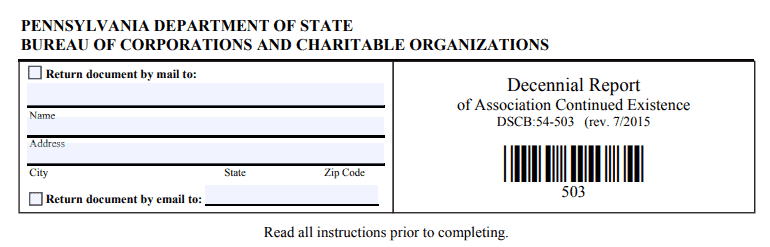

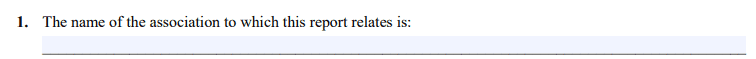

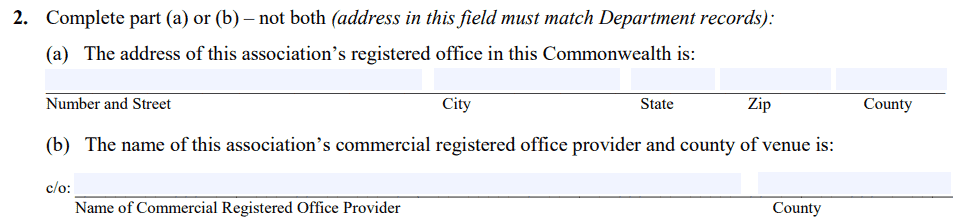

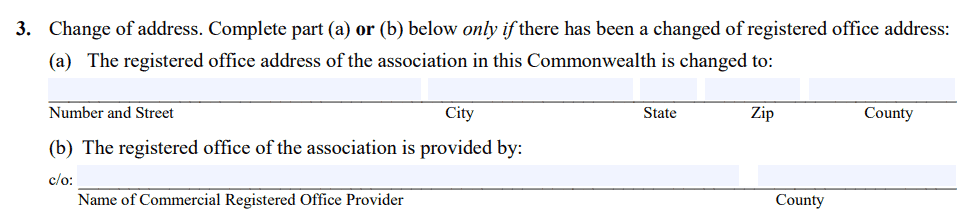

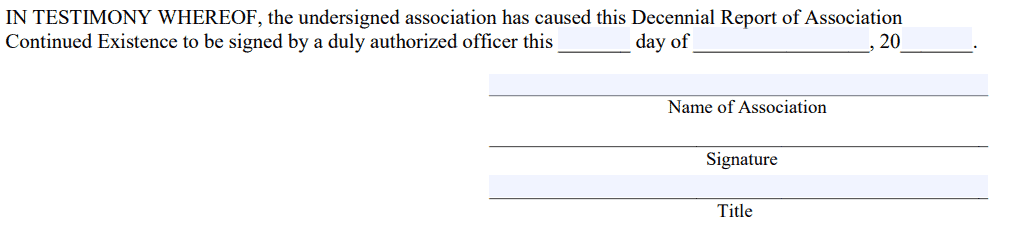

In Pennsylvania, the decennial report is filed with the Department of State’s Bureau of Corporations and Charitable Organizations. The state requires all decennial reports to be filed by mail, so these reports cannot be completed online or submitted via email.

Remember, your LLC only needs to file a decennial report with Pennsylvania if your business has not had any new or amended filings processed with Pennsylvania’s Bureau of Corporations and Charitable Organizations in the last ten-year stretch. Be sure to review your LLC’s filings within the relevant period to determine if your business needs to file a decennial report.

You can file by visiting Pennsylvania’s Department of State webpage and then taking the following steps.

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105

In Pennsylvania, decennial reports are due every ten years when the year ends with the number one – such as 2011, 2021, and 2031. Decennial reports can be filed at any time during the corresponding year.

Businesses in Pennsylvania that file their report late or even fail to file a decennial report altogether face the same penalties and risks. Pennsylvania won’t fine or formally close your LLC, but your business’s exclusive rights to its name will be suspended. This means another company could register itself under your LLC’s name, even though your business would still exist.

When a business does file a late decennial report, it will regain exclusivity of its registered name– as long as a different business did not claim the name during the associated suspension period.

In Rhode Island, the annual report is filed with the Secretary of State. You can file online by visiting the business services online website and taking the following steps.

If you choose to file by mail, you can download the form and mail it, along with the $50 fee, to:

Division of Business Services

148 W. River Street

Providence, Rhode Island 02904-2615

Phone: (401) 222-3040

In Rhode Island, annual reports are due every year by May 1st. The penalty for filing late is $25, while the penalty for failing to register a report altogether is the dissolution of the LLC.

In South Carolina, the annual report is filed with the Department of Revenue along with your state corporate tax return. The annual report is schedule D of the tax return form. To file online, you must use one of the following approved tax software options:

You must file and pay online using one of these services if you owe more than $15,000 in taxes.

If you are eligible and want to file by mail, you can download the form and mail it, along with your payment, as follows:

Mail Balance Due returns to:

SCDOR Corporate Taxable

PO Box 100151

Columbia, SC 29202

Mail Refund or Zero Tax returns to:

SCDOR Corporate Refund

PO Box 125

Columbia, SC 29214-0032

If you have filing questions, call 803-734-2158.

In South Carolina, corporate tax returns and annual reports are due on or before the 15th day of the fourth month after the close of the taxable year. If you file the return late, you will receive a penalty of 5% per month, not to exceed 25%.

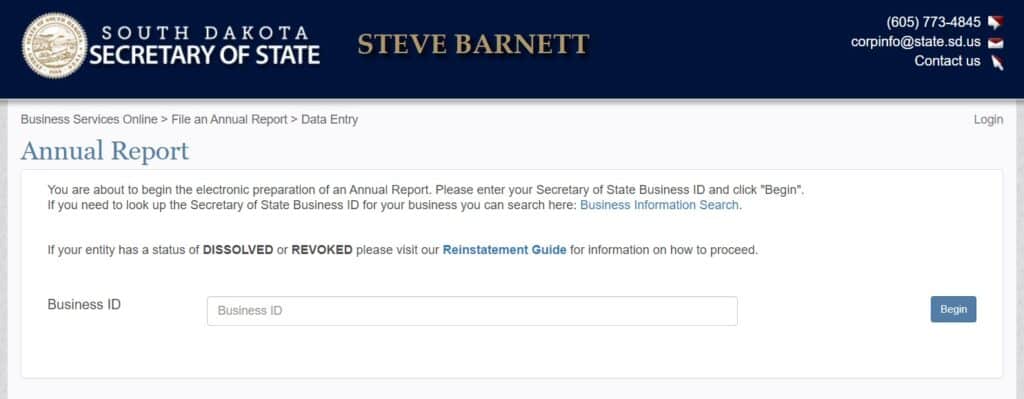

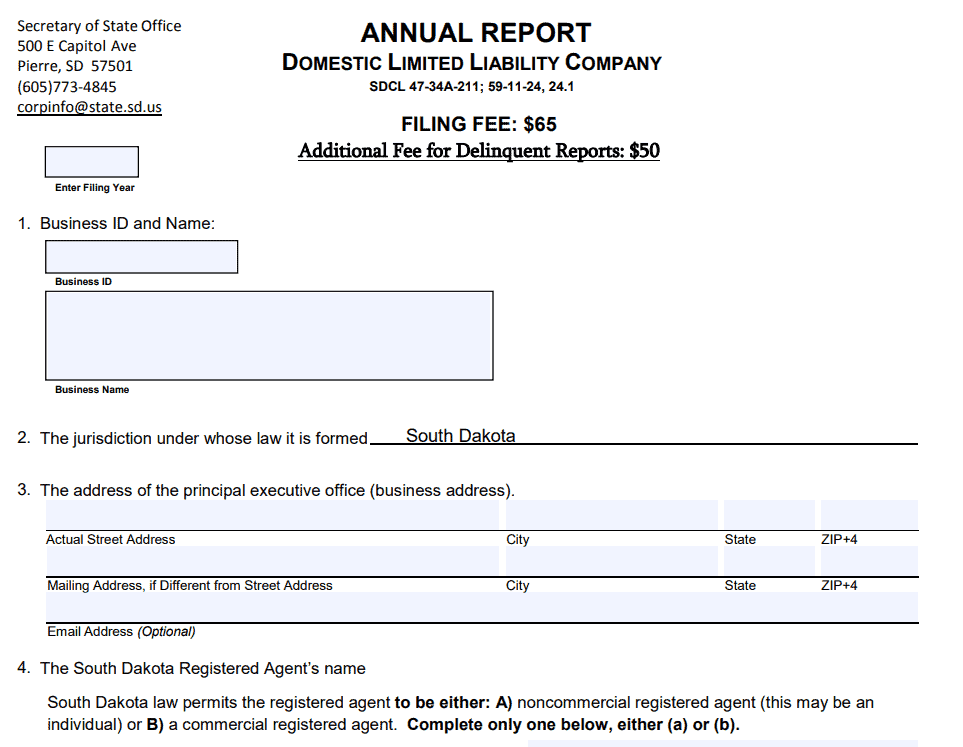

In South Dakota, the annual report is filed with the Secretary of State. You can file online by visiting the Secretary of State website and taking the following steps.

Alternatively, you can complete a paper form and file your annual report by mail. Note that the fee for paper filings is $65.

Send your completed form and fee to:

South Dakota Secretary of State Office

500 E Capitol Ave

Pierre, SD 57501

In South Dakota, annual reports are due on the first day of the anniversary month in which you started your business. For example, if you started your business on May 15th, your annual report will be due each year on May 1st.

The penalty for filing late is $50. If you don’t file your annual report within three months of your anniversary date, your business will be designated as delinquent. Failure to file within one year will result in dissolution of your LLC.

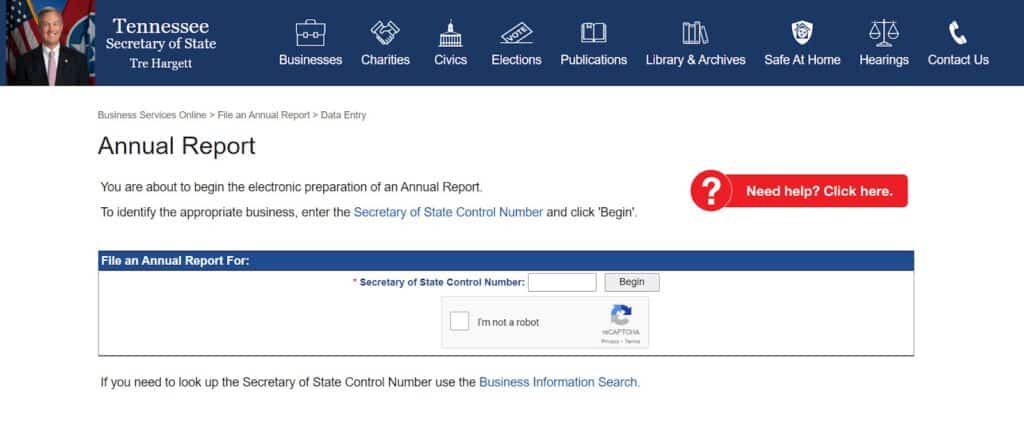

In Tennessee, the annual report is filed with the Secretary of State. You can file online by visiting the Secretary of State website and taking the following steps.

NOTE: In Tennessee, the annual report fee depends on the number of LLC members, or owners. There is a $300 minimum that, if you have more than six members, increases by $50 per member up to a maximum of $3,000.

Alternatively, you can submit your annual report by mail. Send your completed documentation and appropriate fee to:

Tennessee Secretary of State

Attn: Annual Report

6th Floor – Snodgrass Tower

312 Rosa L. Parks Avenue

Nashville, TN 37243

In Tennessee, annual reports are due every year by the first day of the fourth month after the end of your LLC’s fiscal year. For example, if your fiscal year ends on December 31st, your annual report will be due on April 1st.

There is no monetary penalty for filing your annual report late. However, if you fail to file your annual report on time, you will lose your good standing status and risk the state dissolving your LLC.

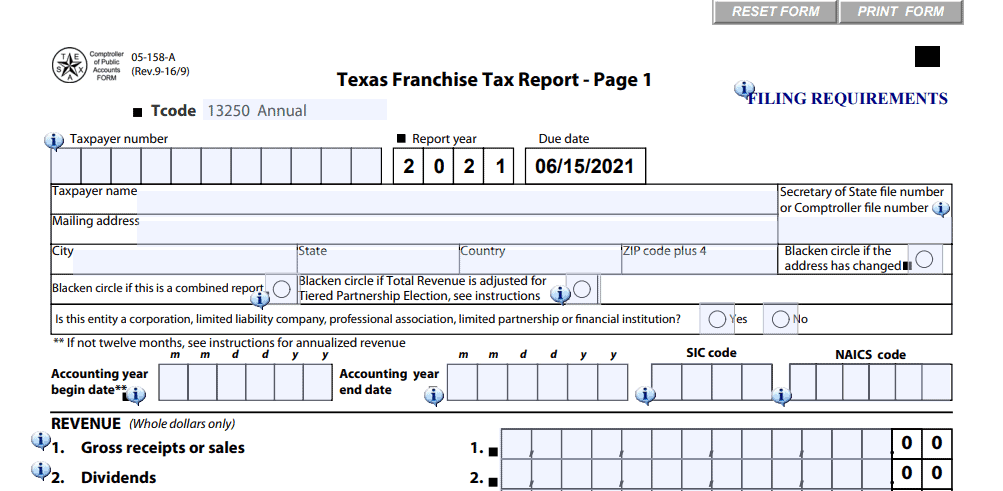

In Texas, the annual report is filed with the Comptroller. Annual reports consist of two filings: your annual public information report and annual franchise tax report.

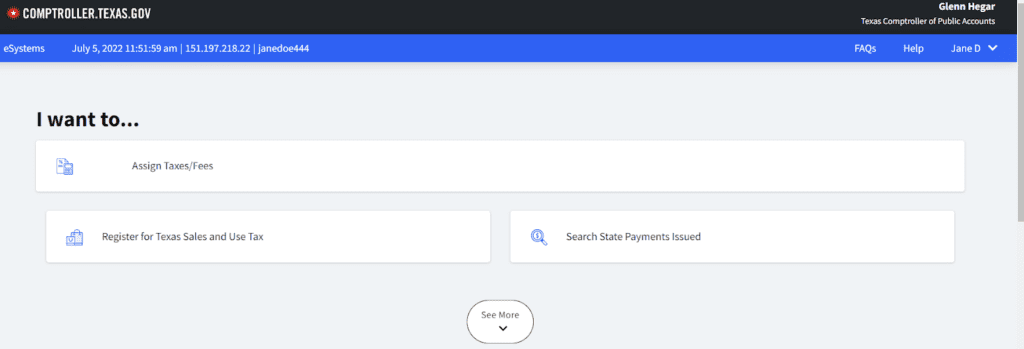

You can file online by visiting the Comptroller website and taking the following steps. If you don’t have an eSystems account, you’ll need to create one before filing online.

Alternatively, you can file by mail. Download the instructions and forms from the Comptroller website.

NOTE: If you do not owe franchise taxes, you still need to complete and file a No Tax Due Report.

Mail completed documentation and fees to:

Texas Comptroller of Public Accounts

P.O. Box 149348

Austin, TX 78714-9348

In Texas, annual reports are due every year on May 15th. The penalty for filing late is $50. Additionally, you will be charged a penalty of 5% of taxes due. If you do not file within 30 days of your due date, you will be charged an additional 5%. Late filings beyond 60 days will incur additional interest and risk administrative dissolution of the LLC.

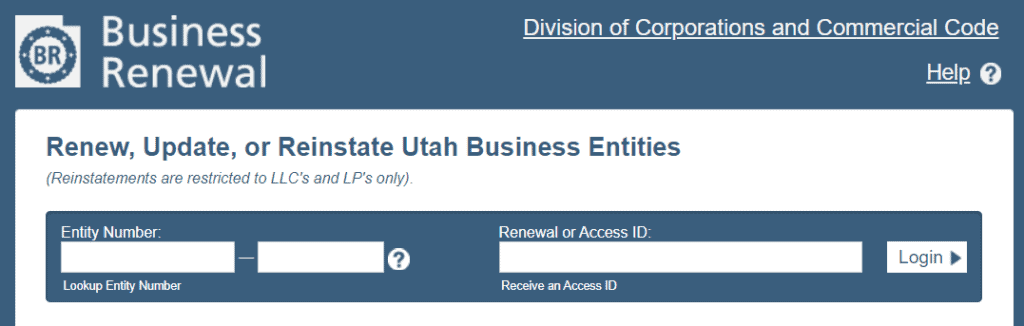

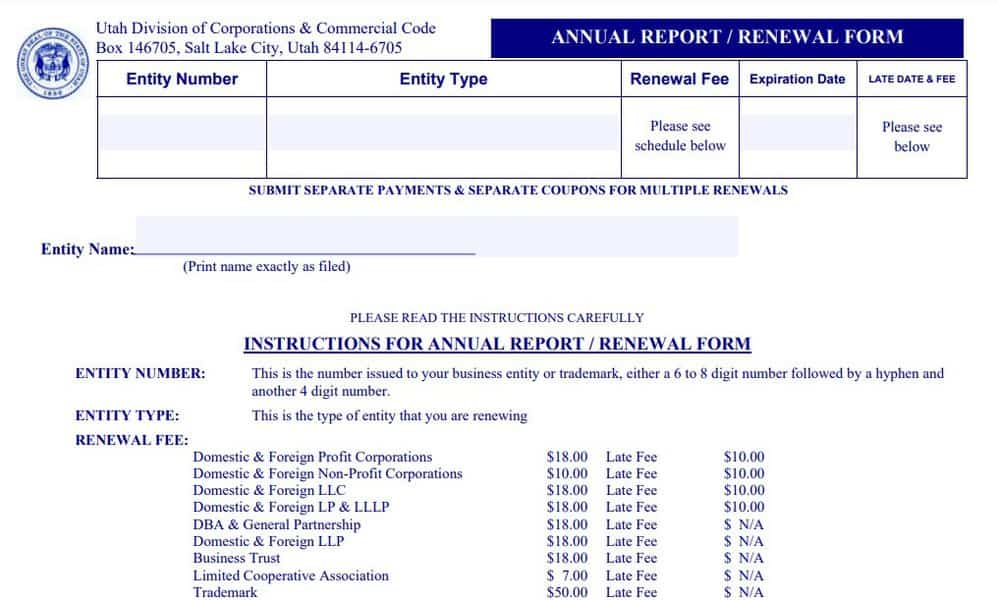

In Utah, the annual report is filed with the Department of Commerce. You can file online by visiting the Division of Corporations and Commercial Code website and taking the following steps.

Alternatively, you can download a paper form and submit a hard copy of your annual report.

Submit your completed paperwork and a check for your filing fee to:

Utah Division of Corporations & Commercial Code

PO Box 146705

Salt Lake City, Utah 84114-6705

In Utah, annual reports are due every year on the date on which you started your business. The penalty for filing late is $10, while the penalty for failing to register a report altogether is the potential dissolution of your LLC.

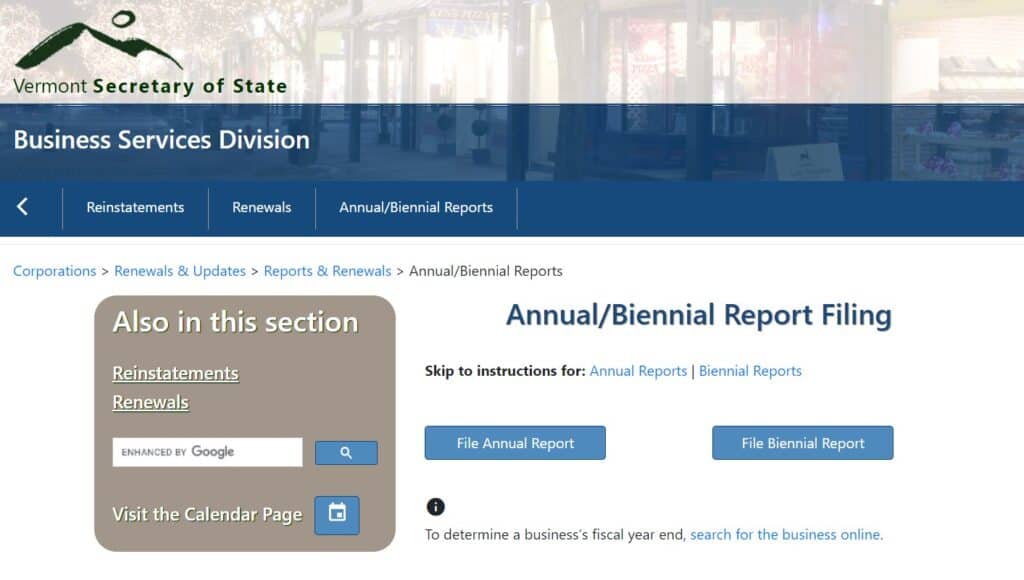

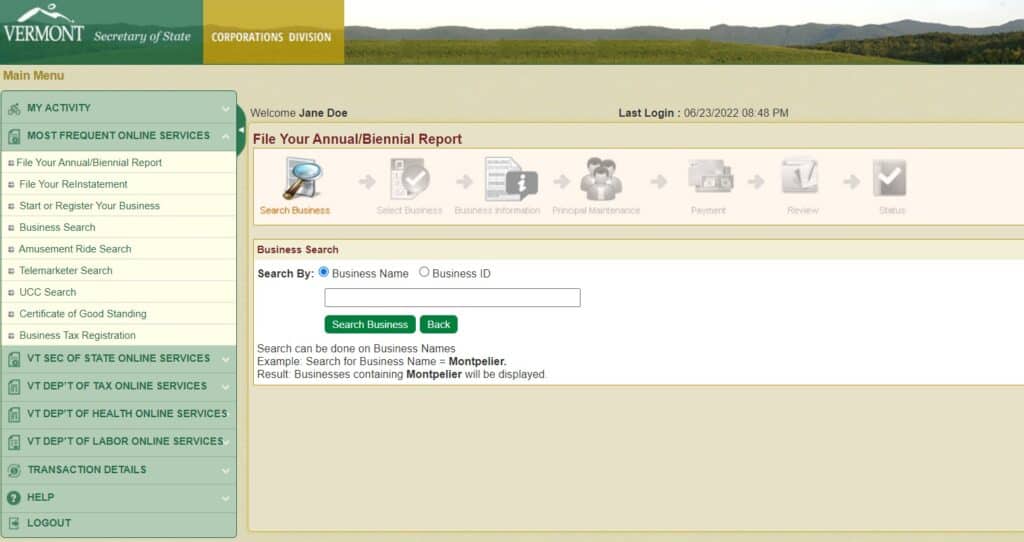

In Vermont, the annual report is filed with the Secretary of State. You can file online by visiting the Secretary of State website and taking the following steps. If you don’t already have an online account, you’ll need to create one before filing your annual report online.

If you wish to file by mail, send a paper copy along with a check for your filing fee to:

Vermont Secretary of State

Corporations Division

128 State Street

Montpelier, VT 05633-1104

In Vermont, annual reports are due within three months after the end of your business fiscal year as determined when you filed your articles of organization. For example, if your fiscal year ends on December 31st, you’ll need to file your annual report between January 1st and March 31st.

If you fail to file within your three-month window, the state may move your business into a terminated status. Should this happen, you’ll need to pay a $25 reinstatement fee and catch up on all late filings.

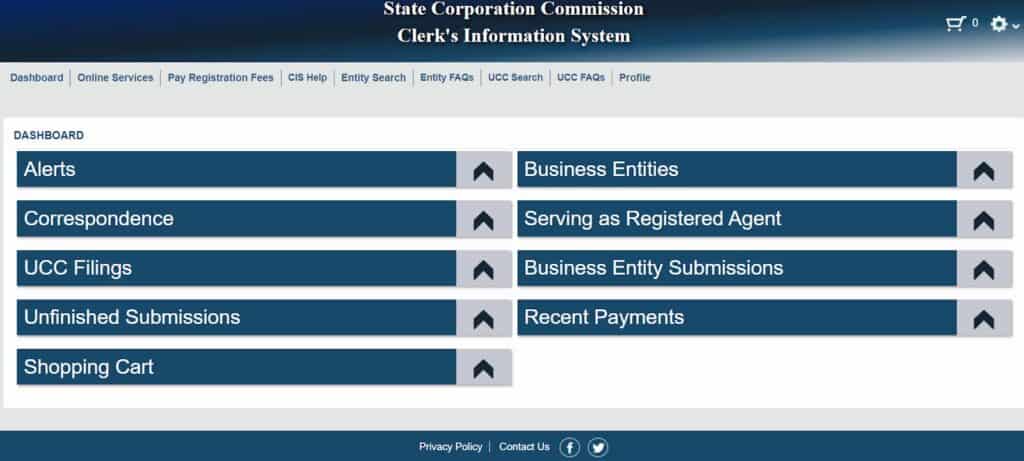

In Virginia, the annual report is filed with the State Corporate Commission. You can file online by visiting the Clerk’s Information System (CIS) website and taking the following steps. NOTE: If you don’t already have a CIS account, you will need to create one to file your annual report online.

If you prefer to file your annual report by mail, request a paper form through the State Corporate Commission website and mail a copy to:

Virginia State Corporation Commission

P.O. Box 1197

Richmond, VA 23218

In Virginia, annual reports and registration fees are due every year on the last business day of the month in which you started your business. For example, if your business anniversary is May 15th, your annual report will be due each year on May 31st.

The penalty for filing late is $25. If you fail to file your annual report by the fourth month following your due date, the state of Virginia will revoke your privilege to do business in the state.

In Washington, the annual report is filed with the Secretary of State’s Corporations and Charities Division. You can file online by visiting the CCFS portal and taking the following steps.

Alternatively, you can file an express report without logging in. Click on the Express Annual Report Link on the homepage.

If you wish to file by mail, print the PDF of your completed report and mail it along with a check for your filing fee to the address below. Make your check out to the Secretary of State.

Washington Secretary of State

Corporations and Charities Division

PO Box 40234

Olympia, WA 98504-0234

In Washington, annual reports are due every year on the last day of the month in which you started your business. For example, if your business anniversary is May 15th, your annual report will be due each year on May 31st.

The penalty for filing late is $25. If you fail to register a report altogether, you will receive a notice from the state with their intent to revoke your business’s status as a legal entity. This happens approximately 120 days from a past filing deadline.

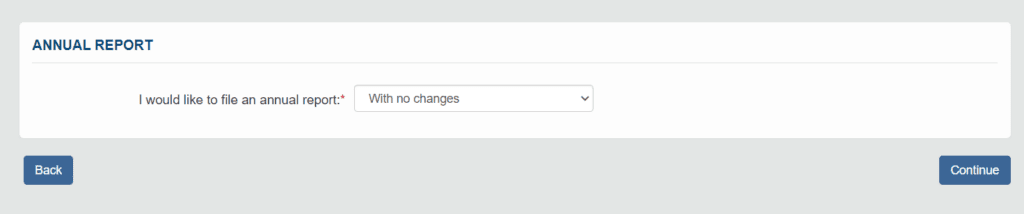

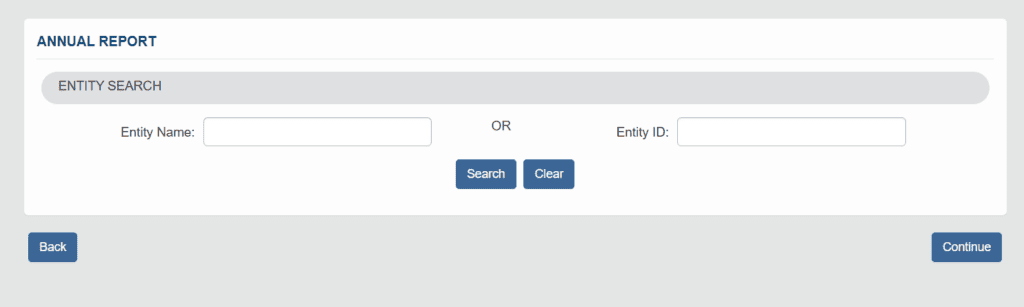

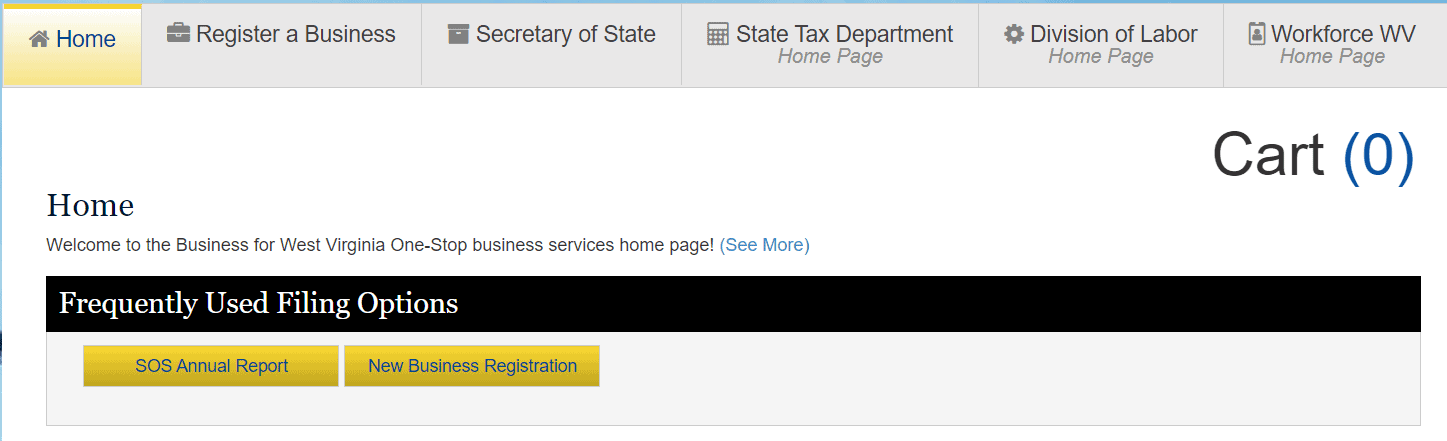

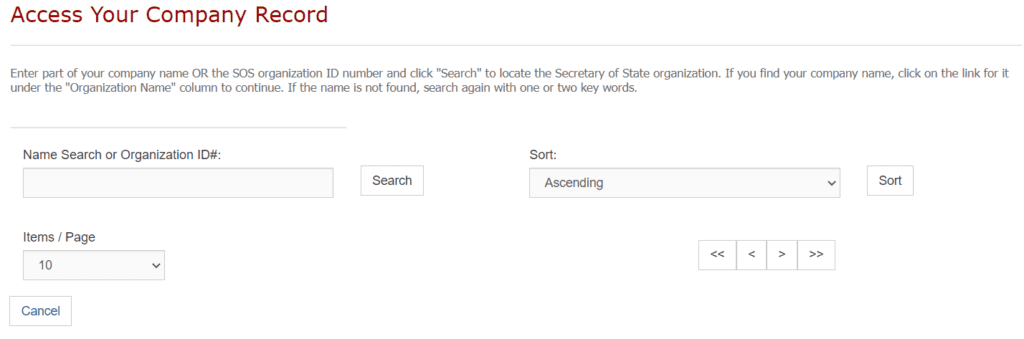

In West Virginia, the annual report is filed with the Secretary of State. You can file online by visiting the WV One Stop Business Portal and taking the following steps.

In West Virginia, annual reports must be filed and paid by July 1st each year, starting the first year after your business was registered. The penalty for filing late is $50, while the penalty for failing to register a report altogether is a potential revoking of your business privileges in West Virginia.

In Wisconsin, the annual report is filed with the Department of Financial Institutions. You can file online by visiting the One Stop Business Portal page and taking the following steps.

In Wisconsin, annual reports are due every year by the end of the quarter in which you started your business. The quarterly due dates are March 31, June 30, September 30, and December 31.

If you do not file your annual report on time, you don’t need to pay a fee, but you are jeopardizing your business status. Businesses can be administratively dissolved if filings are not filed within one year of their due date.

In Wyoming, the annual report is filed with the Secretary of State. You can file online by visiting the Wyoming Business Center through the Secretary of State website and taking the following steps.

Wyoming Secretary of State

Herschler Building East

122 W 25th Street, Suite 101

Cheyenne, WY 82002-0020

In Wyoming, annual reports are due on the first day of the month in which you initially formed your company. For example, if your business officially began on April 25th of this year, your first annual filing will be due on April 1st of next year.

There are no fees associated with late filings, but your business will be considered delinquent on the second day of the month following its due date. If you do not file your annual report within 60 days of the due date, the business entity will be administratively dissolved.

You can generally complete the annual report form online, though every state’s annual report form is different. Sometimes minimal information is required, while other states require more details, including member information.

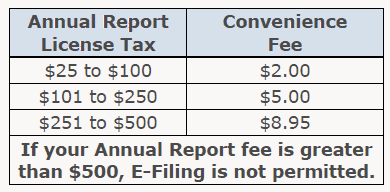

Again, state annual report fees vary and range from free to an $800 annual tax in California. You can usually pay the annual fee online by credit card and file the report electronically.

If you’re doing business in other states, you must be registered as a foreign LLC in those states and follow their reporting requirements as well.

After you file your report, you will receive a notification of any errors or omissions, or confirmation that your report has been filed. If you receive a notification, it’s crucial that you respond quickly and address any errors in order to avoid penalties.

Most states require an annual report, but it may be called something else in your state, such as an annual certificate, a biennial report, a periodic report, or a franchise tax report. Some states require that you also file a statement of information, which is just a form that lets the state know you’re still doing business. Fees and requirements vary by state. If you fail to follow your state’s rules regarding annual filings, your LLC may be dissolved by the state, so check with your secretary of state for requirements.

If you don’t file an annual report, you may incur additional fees and penalties, and your LLC could even be administratively dissolved.

Published on August 22, 2022

If you’re starting an LLC, the business entity formation process is one of the first and most important hurdles. This step can be terribly complex ...

Read Now

Published on December 30, 2021

If you’re starting a business, you may be considering forming a limited liability company (LLC) and have heard that you need to file articles ofor ...

Read Now

Published on July 20, 2021

Do some digging into the owners of industry and you will find the vast majority do not live in the state where they own theirbusinesses. ItR ...

Read Now

No thanks, I don't want to stay up to date on industry trends and news.

Comments