In this interview, David Pere, the founder of From Military to Millionaire, shares his inspiring journey from the Marine Corps to financial freedomt ...

How Smart Tax Planning Fuels Successful Businesses

Written by: Mark Stewart

Mark Stewart is the in-house Certified Public Accountant, an accomplished author and financial media specialist.

Published on April 1, 2024

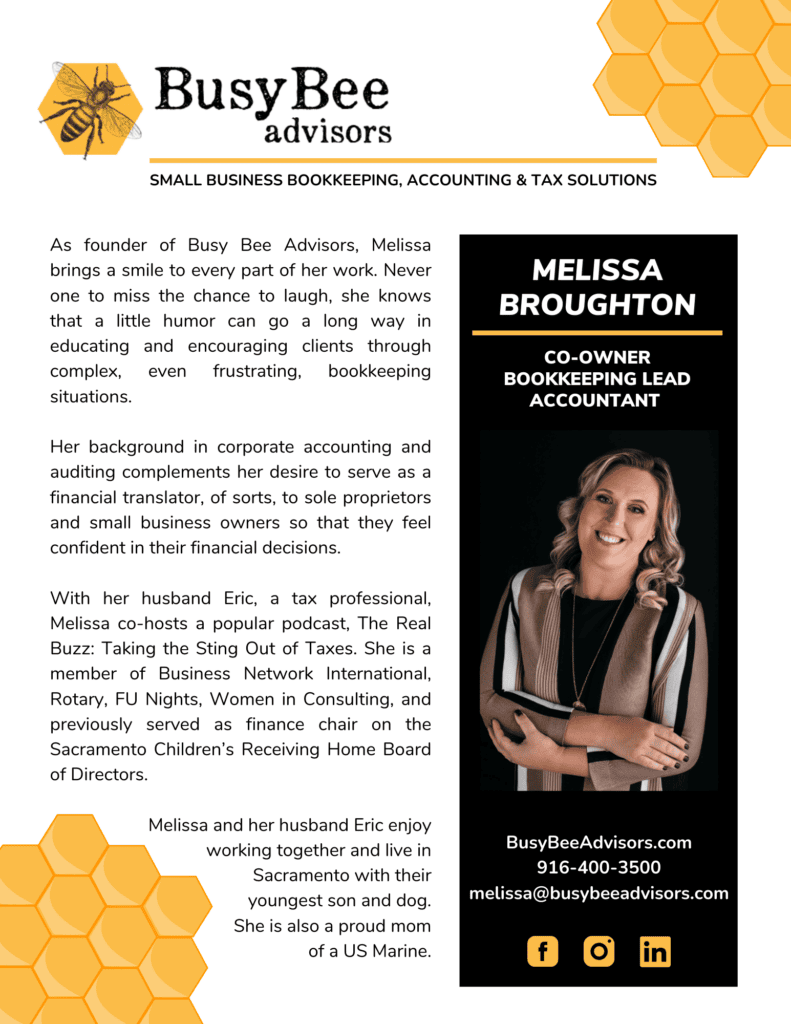

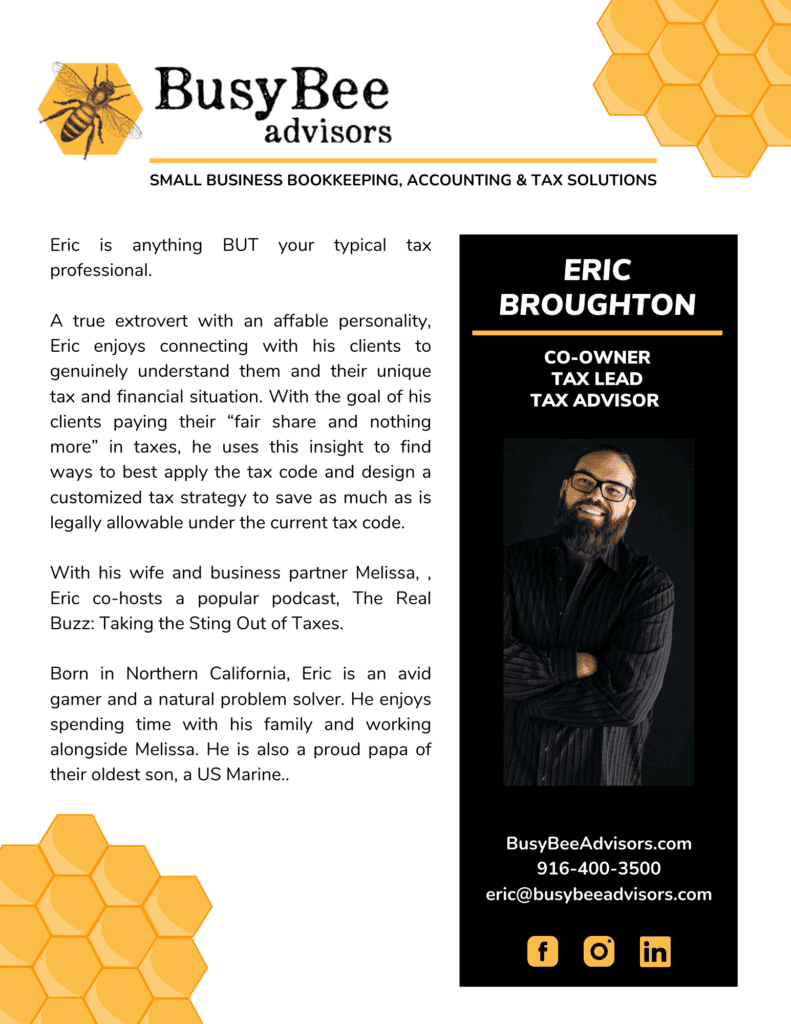

In this interview, we delve into the world of small business financial management with Melissa Broughton of Busy Bee Advisors. Based in Sacramento, Busy Bee Advisors has established itself as a key player in offering tailored bookkeeping, accounting, and tax services.

Melissa Broughton is the proud co-owner of Busy Bee Advisors, a California-based proactive tax and accounting firm. She works alongside her business partner & husband, Eric, to help their clients stay financially educated and profitable and pay as little in taxes as allowed under the current tax code. For more information about her, her company, or how they can help you, visit BusyBeeAdvisors.com, INeedBookkeeping.com, KickMyTaxBill.com, or check out their podcast The Real Buzz: Taking The Sting Out Of Taxes.

Origin and Mission

SBS – What inspired the inception of Busy Bee Advisors, and how does it address the specific needs of small businesses?

Melissa – Busy Bee Advisors was started in early 2017. After spending close to 20 years in corporate America, I felt that many small businesses had the need for reliable and accurate accounting services at a reasonable cost.

Tax Strategy Success

SBS – Can you describe a success story where your tax reduction strategies significantly benefited a client?

Melissa – There are so many success stories (not to brag) that it is difficult to pick a single one. The one that is standing out to me is a client we had several years ago who really believed he would have to close his business (and go back to being a W-2 employee) to afford what his previous preparer had quite unsympathetically told him he would owe on taxes.

After a little digging and reviewing with the client, we were able to come close to eliminating his would-be tax bill altogether.

In the tax industry, we have found that most preparers act as “order takers.” They simply “take” the information (aka numbers) that their clients provide them with and enter it into boxes on the applicable tax forms. The problem with this is that most clients may have little to no idea what an allowable business expense is (other than what they have heard or read on Google). They will almost always air on the side of caution, limiting or eliminating completely allowable business expenses.

Custom Solutions for Diverse Businesses

SBS – How do you personalize its services for diverse business types and sizes?

Melissa – We understand that every client’s tax or accounting situation is completely unique. By taking the time to dig deep, we gain a unique understanding of the challenges they may be facing then find the sections of the tax code that will be of the greatest benefit to them.

Navigating Financial Challenges

SBS – What are the most common financial challenges small businesses face, and how do you help overcome them?

Melissa – Lack of accurate financials. Most small businesses are not always consistent with their financial recordkeeping, or they put it off completely until the end of the year (for tax purposes). It’s a bit like cramming all night for a big test. Yes, you may pass, but there is so much valuable knowledge you miss out on.

By assisting our clients with maintaining accurate financial records throughout the year we are able to ensure that fewer deductions are missed. On the tax side, we require all of our clients (new & returning) to complete a tax organizer each year. Many of the questions included in the organizer are prompts for us indicating if they may benefit from certain tax strategies.

Adapting to Changing Tax Laws

SBS – How does your firm keep up with the constantly changing tax laws and accounting practices?

Melissa – Continuing education and networking with other professionals in our field help a lot. The internet has really done amazing things for our industry allowing us to be able to dig in and research specific topics and reach out to our peers to test our theories and play off of each other with ideas and information.

Leveraging Technology in Financial Services

SBS – What role does technology, specifically QuickBooks, play in your service delivery?

Melissa – QuickBooks, specifically QuickBooks Online, has been such an incredible game-changer in our industry. Financial professionals and clients can review data together in live time from anywhere with an internet connection. This has allowed us to have some great conversations with clients. From the tax perspective, it is easy to reclassify transactions into expense categories that will provide the most benefit to our clients. In all truth, the automatic bank feed features really have had the most impact. Once the client’s accounts are connected, all their financial transactions for designated accounts flow into QuickBooks Online, almost eliminating the need for time-consuming data entry. I could go on and on.

Bookkeeping Best Practices for Small Businesses

SBS – Could you share insights on how small businesses can better manage their bookkeeping to avoid common pitfalls?

Melissa – Consistency really is the key. First, make sure you have a dedicated account or accounts for your business. Second (depending upon the size of your business), set aside a block of time weekly (for smaller businesses) or daily (for larger businesses) to review financial transactions. If nothing else, we have seen this as a huge money saver, not only helping to avoid unnecessary overdraft fees but also helping to identify possible fraudulent transactions.

The other item that I recommend to all of our clients is to create a budget for your business. The purpose is not to reduce or limit spending but to be more mindful of it. Think of a business budget as more of a road map than a diet.

Strategies for Financial Health and Growth

SBS – What strategies do you suggest for small businesses to improve their financial health and growth prospects?

Melissa – According to the US Bureau of Labor Statistics (BLS), this isn’t necessarily true. Data from the BLS shows that approximately 20% of new businesses fail during the first two years of being open, 45% during their first five years, and 65% during their first 10 years. Only 25% of new businesses make it to 15 years or more. The most common cause of a business failing is a lack of understanding of a company’s financial picture.

Streamlining Business Incorporation for Entrepreneurs

SBS – How does your business incorporation service streamline the process for new entrepreneurs?

Melissa – While there can be some incredible tax advantages to becoming a Corporation (S Corp or C Corp) it may not be the best decision for every business. We make sure our clients understand potential cost and reporting requirements associated with starting a corporation, along with other pros & cons, to help each client make the best possible decision based on their unique situation.

Key Financial Indicators for Business Success

SBS – What are some key indicators a small business should monitor regularly for financial success?

Melissa – The first is budget. The budget will help a business owner as a roadmap of where they would like to go. Historical financial data will help a business owner to see the trends in their business. Timely (not waiting until the end of the year) and accurate financials will help the client “pivot” or change course when things do not go as planned. Specific KPIs really vary greatly from industry to industry. For example, the KPIs for a real estate agent are going to be incredibly different than those of a general contractor.

Ensuring Data Security in Financial Management

SBS – How do you ensure confidentiality and security in handling sensitive financial data?

Melissa – A paperless office has really been an amazing transformation for our firm. It ensures that our client’s information will not inadvertently fall into the wrong hands.

All staff undergo annual background checks and receive training on an ongoing basis on best practices.

All company files are password and multifactor authentication protected.

The Importance of Proactive Tax Planning

SBS – Can you discuss the importance of proactive tax planning for small businesses?

Melissa – There is only so much even the best tax professionals can do for their clients after the year has come to a close. By meeting with our tax strategy clients a minimum of four times per year, we are able to act quickly to implement the most beneficial strategies almost in real time. The most exciting scenario for us is when a client treats us as a trusted advisor in their business and allows us to act as their “coach” in advising them on the best way to accomplish the goal they set out to attain.

Future Developments

SBS – Finally, what future plans or developments can clients expect from Busy Bee Advisors?

Melissa – We really do wake up every day so excited about this firm. I have released my second book this year – The 4-Hour Bookkeeper (available soon at INeedBookkeeping.com), dedicated to helping small business owners who may not need a bookkeeper understand best practices for keeping timely and accurate financial records. Collectively, Eric & I have a book on the top 10 tax strategies coming out midyear to help small business owners take a more proactive approach to their own tax planning. Aside from that, you’ll have to stay tuned.

Subscribe to Our Newsletter

and gain insider access to cutting-edge business insights and trends.

Featured Resources

How David Pere Helps Veterans Achieve Financial Freedom

Published on April 3, 2025

Read Now

Empowering Entrepreneurs with a Consultative Banking Model

Published on January 23, 2025

When it comes to business banking, a one-size-fits-all approach doesn’t cut it — just ask Endeavor Bank. Since its founding in 2017, EndeavorBan ...

Read Now

How Click A Tree Makes Sustainability Simple for Businesses

Published on January 20, 2025

In this interview, Chris Kaiser, the founder and CEO of Click A Tree, shares his journey of creating a company dedicated to making sustainabilityacc ...

Read Now

Comments