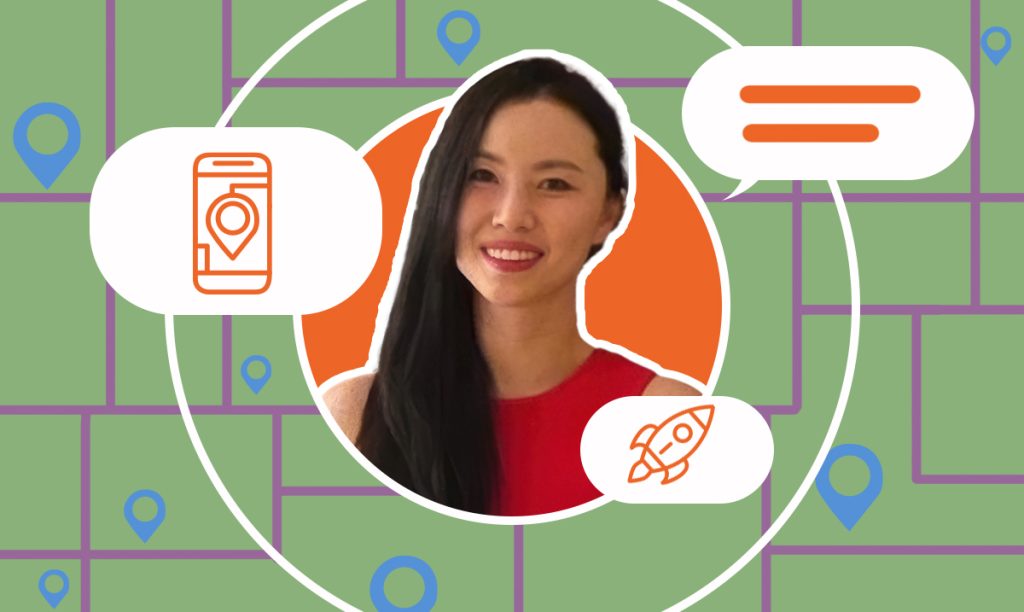

In this interview, we sit down with Nan Zhou, co-founder of No Code Map App, to discuss how she and her team transformed a trip-planning mapinterfac ...

Carl Gärdsell on Mastering Cryptocurrency Taxation with Divly

Written by: Mark Stewart

Mark Stewart is the in-house Certified Public Accountant, an accomplished author and financial media specialist.

Published on December 20, 2023

In an interview with Carl Gärdsell, CEO and founder of Divly, we take a peak into the world of cryptocurrency taxation. Gärdsell shares the unique inspiration behind Divly, a niche startup navigating a complex market. He discusses the challenges of starting such a specialized venture, the strategies for engaging a diverse audience, and the nuances of building a team skilled in both tax law and programming. Gärdsell also touches on Divly’s differentiation in a competitive landscape, the impact of customer feedback, and the challenges of scaling and navigating regulatory landscapes.

This interview is a treasure trove of wisdom for anyone interested in the intersection of technology, finance, and entrepreneurship. So, let’s dive in!

Starting a Niche Business

SBS – What inspired you to start Divly in such a specialized niche as cryptocurrency taxation, and how did you identify this specific market need?

Carl – In 2017, I eagerly stepped into the world of cryptocurrency, only to discover the following year the complexities and confusion surrounding tax declarations on my crypto earnings. At that time, I was deeply involved as a co-founder in a crypto startup, focusing on development tools. When that startup didn’t succeed, I found myself searching for a new challenge.

It was then that I remembered the struggles I faced with crypto taxes. I noticed that the solutions available were mostly tailored for the US, which didn’t quite fit the varied tax laws and requirements of other countries. My background in financial software has given me a good understanding of the work needed in this area. I teamed up with a skilled technical co-founder. Together, we embarked on creating Divly, aiming to simplify the crypto tax declaration process.

In early 2021 it was not evident that this niche market would be large enough to build a business that would satisfy us. The prevailing opinion was that crypto was mostly traded by people who wanted to avoid taxes. The statistics also showed at the time that less than 5% declared taxes on crypto. Our hypothesis was that crypto would eventually become large enough that tax authorities would start enforcing taxation more seriously. In December 2022, this hypothesis was proven right when the EU came out with the directive called DAC8, which requires all crypto exchanges to share information on customers who are EU citizens to the relevant tax authorities. This is to be enforced starting January 1, 2026, which we hope will be the year Divly takes off for real.

Challenges and Solutions

SBS – What were the most significant challenges you faced when starting Divly, and how did you overcome them?

Carl – To calculate people’s crypto taxes correctly, you first need to help them gather their full transaction history in one place. In crypto, it’s common to have multiple exchanges and wallets and send crypto between them, which makes this a tedious task. The customer needs to download files or use their APIs to fetch the transaction data from all their different crypto wallets. Many of these services are quite new and have terrible exports that make it difficult to import data in a practical manner for the customer. They often change their exports with little warning, which breaks the integrations several times a year.

To deal with this challenge, we had to spend about half of our resources in our first year on building a system that solved this task. Furthermore, we had to build monitoring systems to observe when exchanges added new transaction types or changed their exports completely. Although it was grueling work to do at the start, it has become a competitive moat. We now have 100–200 active integrations and are adding more every year.

The second challenge is dealing with your own cash flow when you work in a market that is not only cyclical because of tax deadlines but also cyclical due to the volatile booms and busts in the crypto market. The amount of people that trade affects how many people will declare taxes. The way we dealt with this was to create detailed cash flow forecasts and raise capital from investors to have a cushion.

Target Audience Engagement

SBS – How do you effectively communicate and engage with your target audience, given the complex nature of cryptocurrency taxation?

Carl – You want to simplify as much as possible for the customer so that they don’t need to be both a tax expert and programmer to declare their crypto taxes. We’ve tried to abstract as much of the complex terminology and processes by creating a simple UX that feels approachable. Furthermore, we’ve designed custom tax report outputs that clearly guide the user step by step on how to use the numbers we generate to fill in their tax forms. We’ve come far, but I think we can do more.

In some cases, a user’s tax history is too complicated to simplify in an automated fashion. In these cases, manual help is required. We work with accountants or tax lawyers to provide that help.

Team Building

SBS – Can you describe the process of building your team, particularly in the context of finding individuals with the right mix of expertise in tax law and programming?

Carl – Fortunately, the founding team had a mix of financial and programming backgrounds which allowed us to build the MVP without any external help. Without that expertise, I don’t think it would have been worth attempting to start Divly. At least not for me.

We realized quite quickly that it did not make sense to internally hire professional tax lawyers. We could do most of the initial research ourselves and then complement it with feedback from both the tax authorities (free) and tax lawyers (consulting fees). This was much more affordable for us and has allowed us to provide specialized support for 16 countries!

We now have some of the most comprehensive crypto tax guides ever written. See, for example, our recently published US crypto tax guide and UK crypto tax guide.

Competitive Landscape

SBS – How does Divly differentiate itself in the competitive landscape, especially against larger, more established companies?

Carl – Great question — how do you stand out when you are smaller, have less money, fewer employees, and less time in the market? We believe one way is to build a challenger brand. There are great brands that have allowed much smaller companies to stand out in the market. We’re hoping to do the same with Divly by taking a playful approach and using a cute mascot. If you pass by a crypto event soon, you may see a bluebird handing out tax forms! The costume is in production!

Secondly, we are focused on underserved markets to which other companies have not tailored their offerings. This has worked well for us in the Nordics.

Customer Feedback and Product Development

SBS – How has customer feedback influenced the evolution of Divly’s services?

Carl – Everyone on our team is assigned customer support days, including the founders. This helps us stay close to the customer and build stuff that matters. Because of this, most of our features have been developed alongside customer feedback. It’s seldom that we develop features that people have not already asked for, and we are quite reluctant to invest time in developing random ideas. Maybe that’s a bad thing if we want to stand out more, but it seems to work.

Scaling the Business

SBS – As Divly expands, what strategies are you employing to scale the business sustainably, especially in different international markets?

Carl – Automate as much as possible and set up processes to follow for each market. Otherwise, it becomes a mess! This is especially true for our marketing efforts. We’ve also seen that it helps to avoid overcomplicating the product features and keeping things simple. Most features in software products don’t serve most users anyways.

We’ve started taking a step-by-step approach for each market where we invest more time into it when the local user base grows. We made mistakes before where we invested too much time into a specific market based on a hunch. This cost significant resources that we never recouped.

Regulatory Challenges

SBS – How do you navigate the constantly changing landscape of cryptocurrency taxation laws and regulations across different countries?

Carl – There are a few good things that simplify this process. The first is that tax authorities rarely change the process of how to declare your taxes, even if they make changes to how crypto taxes should be calculated. Secondly, the tax deadline is once a year, so it’s often enough to do one thorough review per year.

Nonetheless, changing regulations require us to update our logic in the system and the guides we write. The difficult part is not necessarily making the edits but rather keeping track of the changes in all 16+ countries that we support. Outside of the annual review before each tax season, we do our best to build and maintain relationships with tax authorities and/or tax lawyers who can help us stay up to date on the latest changes.

Funding and Investment

SBS – Could you share your experience and advice regarding securing funding and attracting investors for a niche startup like Divly?

Carl – Most people are surprised when they find out that multiple competitors in our niche market raised 100M+ USD during the craze in 2021. This put our industry on the radar and helped us raise some capital. I do think that was more about the crypto craze and tech company craze in 2021 rather than sound logic.

My experience overall is that if you are in a niche market it’s easier to raise from angels and smaller funds whose expectations differ from a traditional VC. You don’t want to have an investor with expectations of you becoming a unicorn when that’s simply not feasible in smaller markets. Set a reasonable prospect of what a good outcome is and focus on maximizing the chance of success. If your market is niche and the product requires specific expertise to build, it is possible that your chance of success will be much higher than in a large market with low barriers to entry.

Marketing Strategies

SBS – What marketing strategies have proven most effective for Divly in reaching potential customers who might be unaware of their need for crypto tax services?

Carl – That’s a good question. Most of our users find us via Google search. Yet they are typically somewhat aware that taxes need to be paid because they would likely have used keywords that relate to taxes.

We find that unaware potential customers are best reached through partnerships such as with crypto exchanges. They have a much better reach of crypto traders and can communicate the importance of declaring your crypto taxes and services such as Divly. We recently held an internal competition in regard to building partnerships where one of my colleagues decided to take it to the next level and promised to shave his head and sell his furniture to win.

Maintaining Company Culture

SBS – As your team grows, how do you maintain the company culture and values that you started with?

Carl – Working in an office makes this much easier, especially when you start out. Hang out together, set milestones and rewards, create your own memes, and just try to have fun together. We had remote colleagues and found it was much harder to integrate them into the culture. Nowadays, we all work together in one office. We try to avoid growing the team too quickly and instead opt to automate as many tasks as possible. Hence, I have limited experience in building a culture in a fast-growing team and probably should not give advice on this matter!

Advice for Aspiring Entrepreneurs

SBS – Finally, what key piece of advice would you give to aspiring entrepreneurs who are looking to start a business in a highly specialized and technical field?

Carl – It helps to have an unfair advantage by starting your journey with a team that has most of the required specialized and technical expertise. It improves your odds of succeeding in a market that has higher barriers to entry. I already have five years of experience with crypto (which is a lot when it comes to crypto) and a few years working with financial software at a large international corporation. My co-founder had all the technical knowledge needed to build a financial platform. I’d question starting such a business if you don’t have that unfair advantage from the start.

As with any business, even highly specialized ones, be practical and try to get as far as possible with minimal resources. We built our MVP and had paying customers before we raised capital. Try to do the same or better than us in that regard. The first money you raise is typically the most expensive.

Subscribe to Our Newsletter

and gain insider access to cutting-edge business insights and trends.

Featured Resources

How No Code Map App Delivers Custom Maps Without Coding

Published on April 3, 2025

Read Now

How LifterLMS Simplifies Online Course Creation for Educators

Published on February 27, 2025

Online education is booming, but creating and scaling a successful course can be challenging without the right tools. That’s where LifterLMS comes ...

Read Now

How Jinxbot Leads Zero-Waste 3D Printing

Published on January 14, 2025

Jason Reynolds, founder of Jinxbot and co-founder of the zero-waste nonprofit PrintCycle, is leading the charge. With a passion for innovation anden ...

Read Now

Comments