In New York, as in most states, the primary step in creating a limited liability company (LLC) is to file articles of organization with the state.Th ...

Cost to Start an LLC in New York

Written by: Coralee Bechteler

Coralee is a business writer with experience in administrative services, education, and software testing.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on August 7, 2022

Updated on April 3, 2024

If you’re thinking of starting a limited liability company (LLC) in New York, you’ll want to know in advance how much it’s going to cost. LLC formation fees vary by state, so it’s wise to do a bit of research and prepare yourself, and your new business, for the necessary steps.

LLC Costs in New York

| Requirement | Cost/Fee |

|---|---|

| Articles of Organization | $200 |

| Certified Copy – Articles of Organization | $10 |

| Certified Copy – Certificate of Status | $10 |

| Name Reservation | $20 |

| Registered Agent Service | $50 – $300 |

| Operating Agreement | $0 – $2500 |

| Annual Report | $9 |

| Franchise Tax | (see previous table) |

| Business Licenses and Renewals | varies – check with state and local government |

New York Articles of Organization Cost

In New York, you form an LLC by New York filing articles of organization, which requires a $200 fee. It’s a simple process you can do online by logging into the On-Line Filing service provided by the Department of State.

If you need a certified copy of the Articles of Organization, there is a $10 fee. If you need a Certificate of Status, there is a $25 fee. If you’d like the state to hold your LLC name before you register, you can fill out the form here for $20 to reserve it for 60 days.

Completed paper forms and their accompanying fees should be sent to:

New York Department of State

Division of Corporations

One Commerce Plaza, 99 Washington Ave

Albany, NY 12231-0001

New York Registered Agent Cost

In New York, your business is required to have a New York registered agent, also known as an agent of service in process. A registered agent is a person or business authorized to accept and respond to legal, tax, and financial documents on behalf of your business.

In New York, you can be your own registered agent, or it can be another member of the LLC. An individual who is not a member or a professional agency can also serve as the registered agent for your LLC.

Costs for a registered agent service range from $50 a year up to $300 or more. Several online firms, such as ZenBusiness and Northwest Registered Agent, provide quality services at reasonable rates.

New York Business Licenses and Permits Cost

Starting an LLC in New York requires obtaining the required licenses and permits from local, state, and federal governments. Fees for these vary, but most costs are minimal.

Federal regulations, licenses, and permits associated with starting your business include doing business as, health licenses and permits from the Occupational Safety and Health Administration (OSHA), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific permits.

You may also need state-level and local county or city-based licenses. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments to learn more.

Business license fees depend on the type of business and the agency issuing the license or permit. On average, business licenses cost between $100 and $300+, plus renewal fees.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package ($149 + state fees). They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

New York Operating Agreement Cost

In New York, your LLC is required to have an operating agreement in place. Even though an operating agreement isn’t filed with the state of New York, the document persists to be an effective way to help avoid disputes and lawsuits that could threaten the stability of your business.

An LLC operating agreement is an important legal document that details who owns the business and provides essential information pertaining to member duties. An LLC operating agreement establishes the financial relationship between members and the basics of the working relationships between those members and the managers who oversee daily operations.

Again, the operating agreement is not filed with the state. Instead, it remains a private internal company document. It’s advisable to hire an attorney to ensure your operating agreement is thorough and legally binding.

Creating an operating agreement is free if you just draw it up yourself (here you can find free New York LLC Operating Agreement template). Alternatively, you can pay around $100 for guidance from an online business advisory.

This is an extremely important document, so it’s recommended that you use the services of a specialist or legal firm. If you choose to hire an attorney, the price will be around $500 for a single-member LLC and $2,500 for a multi-member LLC.

New York LLC Formation Service Cost (Optional)

Forming an LLC in New York tends to involve a lot of red tape and paperwork, so for many entrepreneurs just starting out it’s a good idea to hire an experienced service provider.

Some of the best services for forming an LLC in New York are ZenBusiness and Northwest Registered Agent. LLC Formation service will take care of all the key steps, keeping you updated while allowing you to focus on launching and growing your business.

The cost of professional services depends on your requirements and LLC formation plan. Most LLC service providers offer different plans/packages and there are many LLC services that offer free LLC formation.

Ongoing New York LLC Costs

Every state has a different fee structure and timelines for LLC documents and licenses. It’s important to stay up-to-date or your business could face significant penalties. The fees and timelines for New York are detailed below.

Annual Fees

In New York, you’ll need to file a New York LLC biennial statement to keep your LLC in good standing. In other states, this is called an annual report or a statement of information. The fee is $9, and you can file online using the state’s E-Statement Filing System.

Franchise Tax Reports

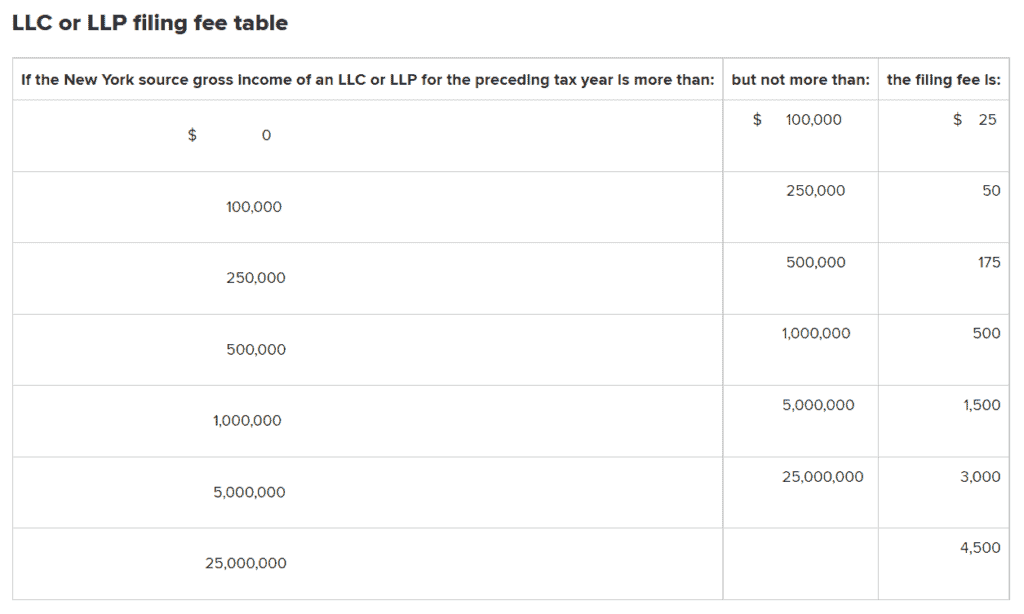

A franchise tax is not a tax on a franchise business. It is a fee that the state imposes on registered business entities for the right to operate. New York charges an annual franchise tax on a sliding scale. See the table below to identify which bracket your business falls in.

You can visit the state’s Department of Taxation and Finance LLC annual filing fee webpage for more information about the state’s franchise taxes.

Business License Renewal Fees

Some business licenses and permits must be renewed periodically, which may have a small associated fee. In New York renewal fees vary. For example, a food service permit can cost $280 or even $400 to renew.

In contrast, New York liquor licenses are valid for three years. Licensed businesses will be sent a Renewal Advisory three months before the license expiration, specifying the total renewal fees.

It’s best to create calendar reminders to monitor when expirations are coming up to ensure you have time to determine the necessary fees and apply for license renewals. This way, you can run your business without interruption.

Cost to Start an LLC in New York

- LLC Costs in New York

- New York Articles of Organization Cost

- New York Registered Agent Cost

- New York Business Licenses and Permits Cost

- New York Operating Agreement Cost

- New York LLC Formation Service Cost (Optional)

- Ongoing New York LLC Costs

Subscribe to Our Newsletter

and gain insider access to cutting-edge business insights and trends.

Featured Resources

How to File Articles of Organization in New York

Published on June 26, 2022

Read Now

How to Start an LLC in New York

Published on March 16, 2022

A limited liability company (LLC) is an increasingly popular business structure for startups in the US, offering liability protection for ownershipa ...

Read Now

How to Start a Business in New York

Published on October 27, 2021

If you live in New York, you are in one of the world’s great business capitals. Many top investors and multinationals make their home in New YorkC ...

Read Now

Comments